تخفيض تصنيف الأسهم الأمريكية بشكل مفاجئ .

قام بنك يو بي أس في خطوة جديدة بتخفيض تصنيف

الأسهم الأمريكية حيث تم تخفيضها من جزاب إلى " محايد "

و ذلك بعد رفع التصنيف في بداية شهر أبريل الماضي .

و ذلك بعد إرتفاع مؤشر S&P500 بمقدار 11%

كما أنها ترى أن السوق حالياً يمر بحالة إنتعاش مؤقته

و ذلك نتيجة تعليق الرسوم الجمركية لمدة 90 يوم .

ذكر بنك يو بي أس أن التخفيض لا يعني نظرة سلبية

كما أنه لا يدعوا لبيع الأسهم بالوقت الحالي .

من الناحية الفنية لمؤشر S&P500

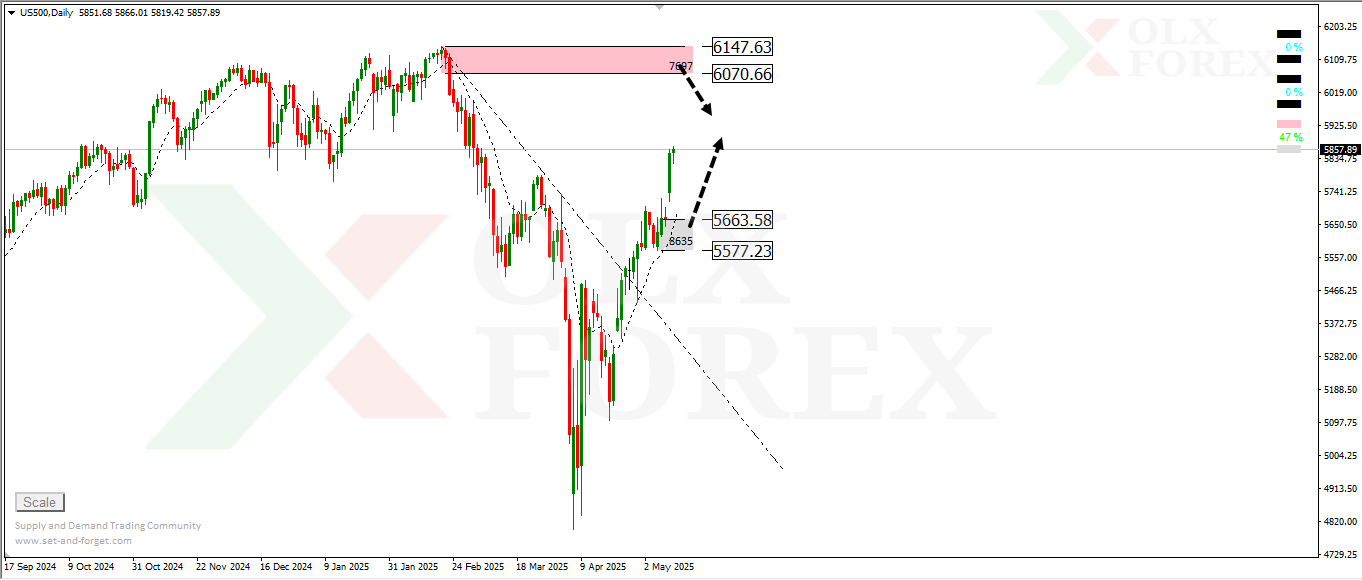

واصل مؤشر الأس اند بي 500 الصعود بقوة مكوناً مناطق طلب جديدة

عند مستويات 5663 , من المتوقع الصعود منها في حالة إختبارها .

أما في حالة إستمرار الصعود للمؤشر فقد نرى صعوداً

وصولاً لمناطق العرض بالأعلى و التي تعتبر مناطق بيع جيدة للمؤشر

و ذلك بالقرب من مستويات الـ 6070 .