Safe Havens and How to Diversify Your Investment Portfolio

Traders and investors always seek safe havens, especially during financial and economic crises, to preserve their money and even achieve good profits during such times.

What are Safe Havens?

Safe havens are investments aimed at preserving the value of money and even generating profits during times of war, financial crises, or natural disasters like pandemics.

Characteristics of a Safe Haven:

- Liquidity: Should be easy to use and convert into cash at any time.

- Durability: Should not deteriorate over time.

- Growth Potential: Should have the potential to rise during inflation.

- Supply and Demand: The supply should not exceed demand.

Naturally, no safe haven possesses all these characteristics, so it is essential to diversify your investment portfolio with various options.

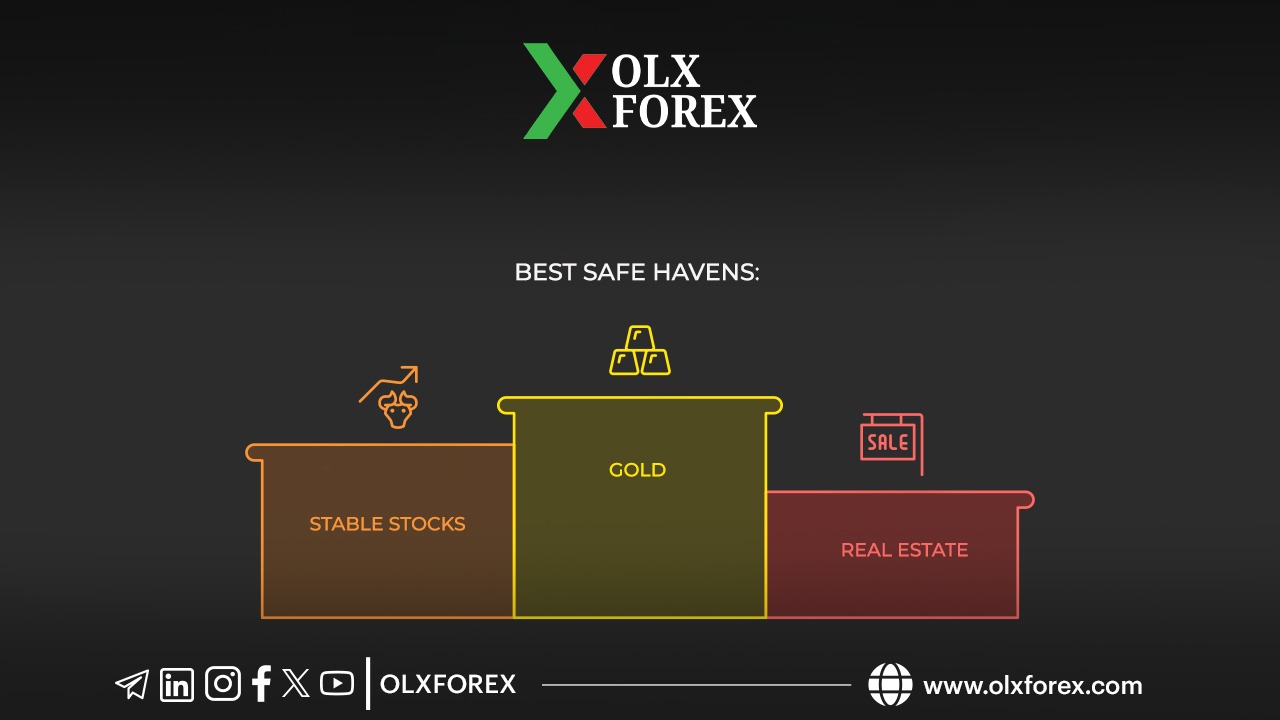

Best Safe Havens and Investment Diversification:

There are many safe havens in the markets, both in trading and elsewhere. However, the most reliable safe haven is gold.

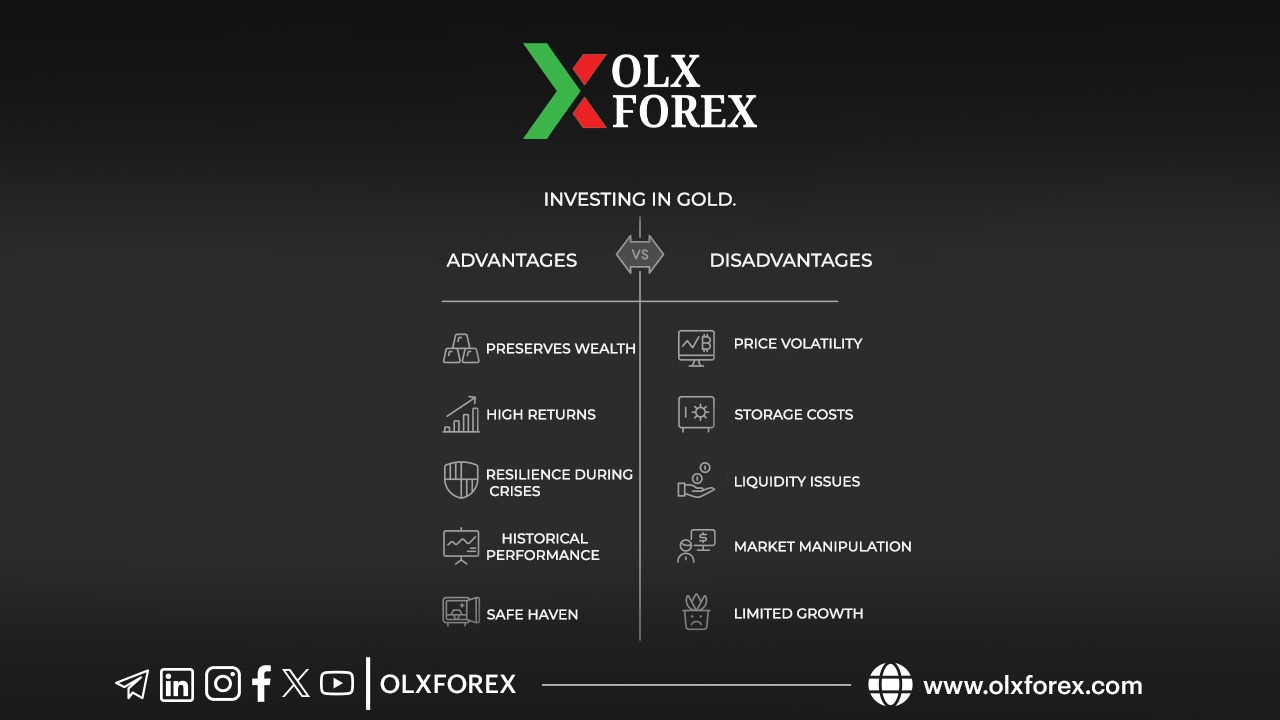

Gold:

Gold is known for its ability to preserve wealth and provide strong returns on investment, particularly during economic crises and wars. A clear example is the significant rise in gold prices during the COVID-19 pandemic, as well as its increase at the onset of the Russia-Ukraine war and currently between Israel and Palestine. These events have driven gold to new historical highs, solidifying its status as the top safe haven.

Swiss Franc:

The Swiss franc is considered a safe haven currency for several reasons:

- The strength of the Swiss economy and its government's neutrality.

- The robustness of the country's banking sector, which leads many investors to buy the currency during crises, wars, and pandemics alongside gold.

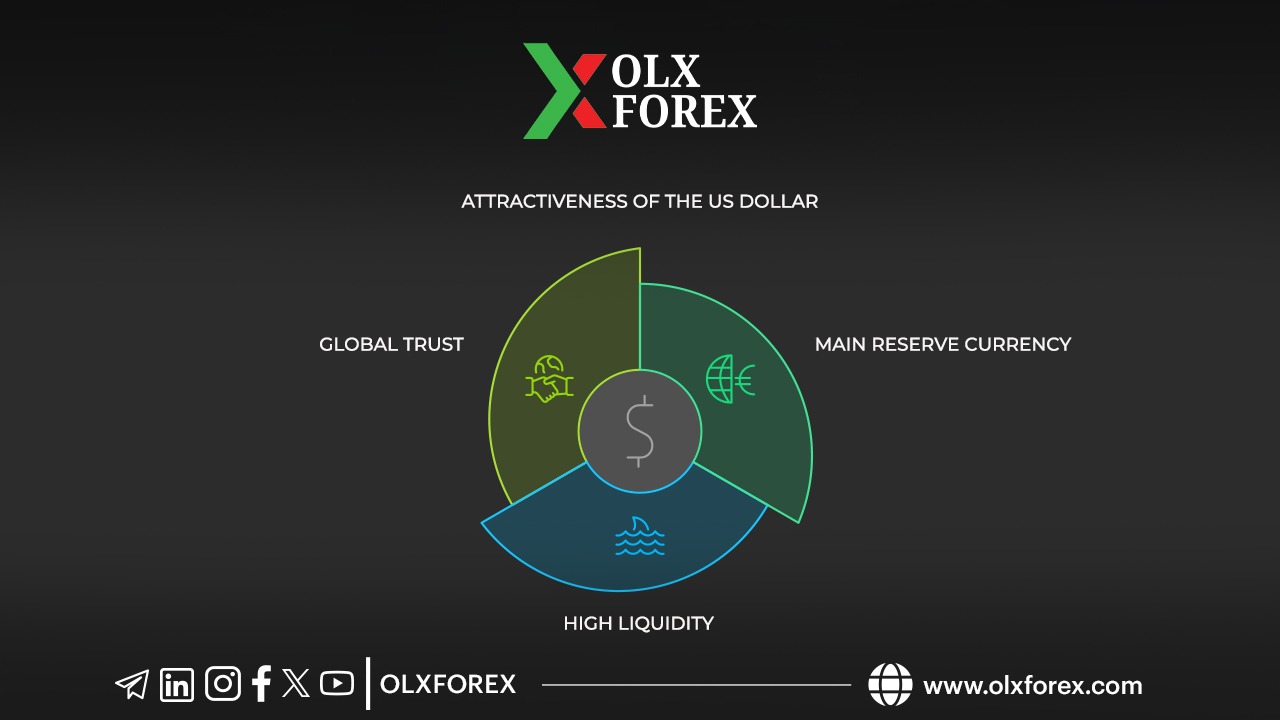

US Dollar:

The US dollar is also a strong safe haven currency, primarily because it is the world's leading reserve currency and has high liquidity at all times.

Government Bonds:

Government bonds are one of the options investors turn to during crises, with maturities that can extend for several years. Short-term bonds are preferred because they are less sensitive to market fluctuations.

Safe Haven Stocks:

These are stocks with stable prices that are not significantly affected by surrounding conditions, often supported by the government due to their strategic importance. They are favored during crises or for long-term investment.

Investment Funds:

Investment funds diversify investments across various fields, making them reliable during crises, though they may not be the best choice for all investors.

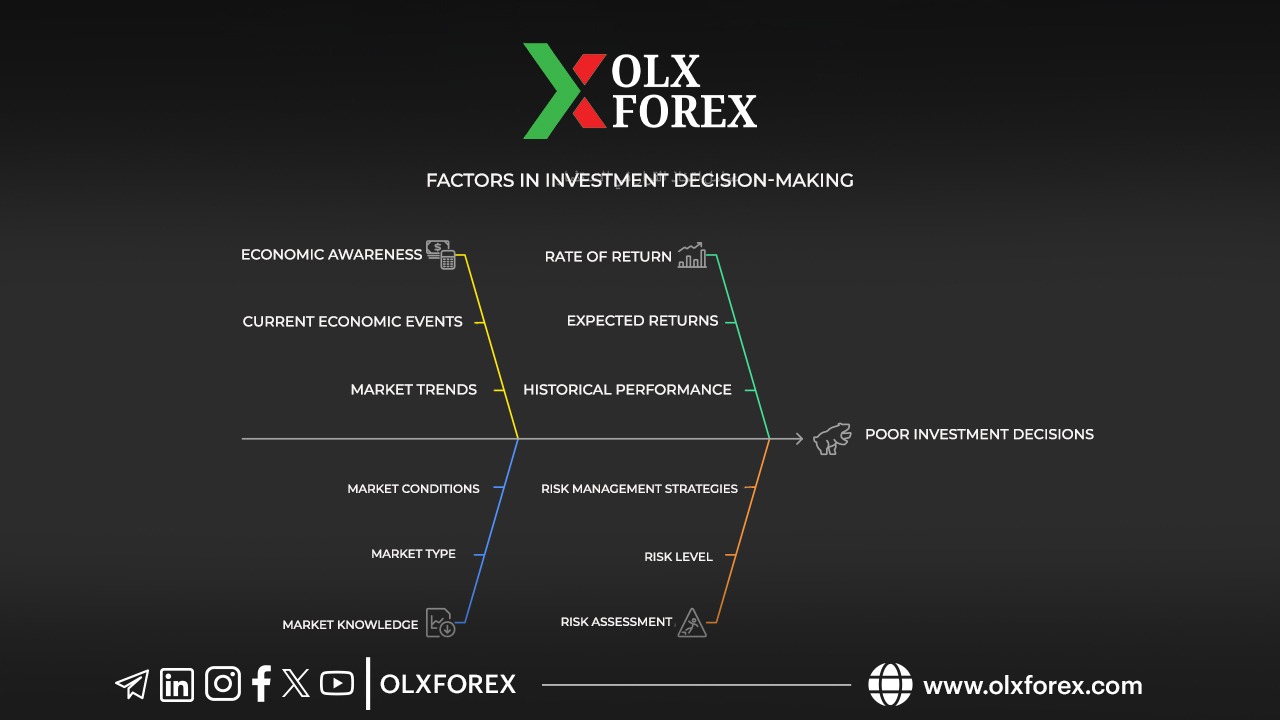

Important Conditions Before Investing:

- Stay informed about economic events.

- Be aware of the type of market you are investing in.

Before investing, consider the following:

- What is the expected return on this investment?

- What is the risk level associated with this investment?

The return should ideally be at least double the risk, preferably three times, so careful analysis is crucial before entering any field.

You can read more articles to learn the difference between trading and investing from here

And follow the global economic news from here

And more about knowing the flotation and its types and how to survive it and is there a flotation coming and when? Right this way

And more about the impact of the US elections on the financial markets 2024? Right this way