Bank of Japan keeps interest rates steady

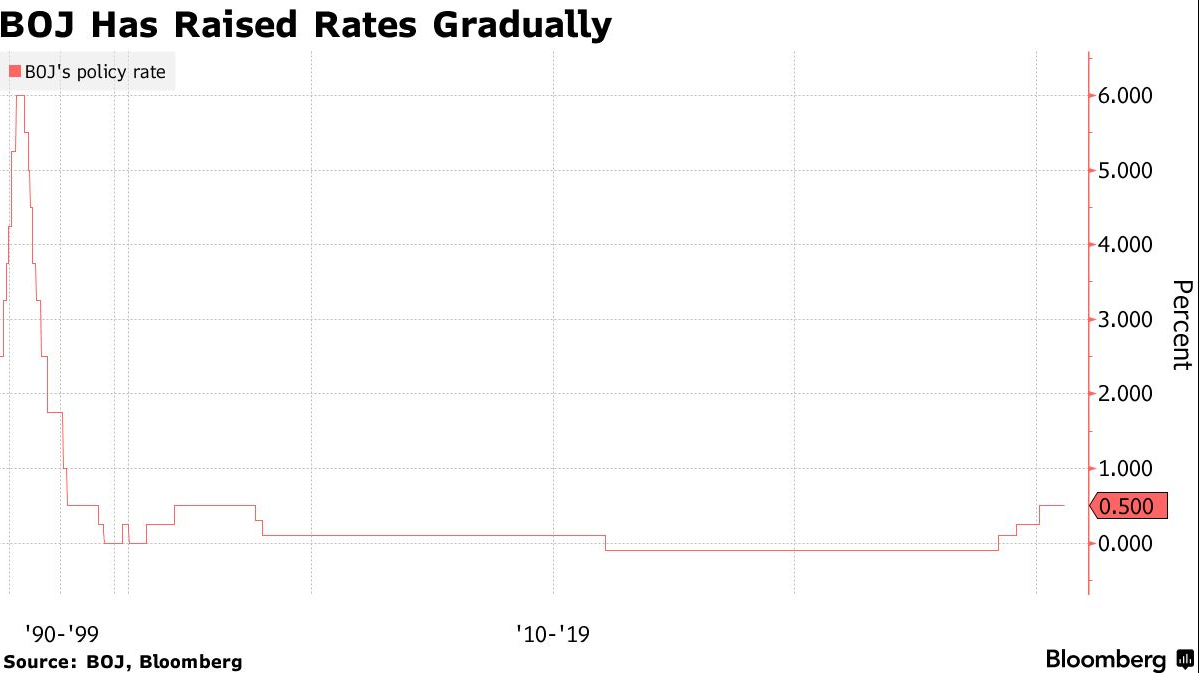

The Central Bank of Japan on Thursday kept interest rates steady at 0.5% by a unanimous vote, according to a statement released on Thursday.

All 56 economists surveyed also predicted this decision.

The bank also raised its inflation forecast for the current fiscal year, indicating cautious optimism that the Japan-US Trade Agreement will help the economy avoid a sharp slowdown.

The nine-member council raised its average inflation forecast for the current fiscal year from 2.2% to 2.7% in its quarterly economic outlook report, reflecting the continued rise in food prices.

The council also raised its forecasts for the fiscal years 2026 and 2027 slightly, steps that economists had not expected.

Here are excerpts from the statements of the governor of the Central Bank of Japan, Kazuo Ueda, at his press conference following the meeting:

The path of interest rates

- If the economy and prices move in line with our expectations, we expect to continue raising interest rates and adjusting the level of monetary support in accordance with the improvement in economic developments and prices.

Note that we will not wait until core inflation reaches 2%, our decision (on raising interest rates) depends on how likely it is that core inflation will reach this level.

- Given the trade agreement between Japan and the United States, and the agreements that Washington seems to be concluding with other countries, we can say that the uncertainty surrounding the forecast has subsided compared to April. We can also say that the probability of core inflation reaching 2% has increased.

- When we think about the negative risks to the economy and their implications for monetary policy, we have to keep in mind that our official interest rate is still low at 0.5%.

Inflation expectations

- The uncertainty surrounding the Japanese economy has subsided thanks to the Japan-US Trade Agreement, but there is no change in our basic forecast that core inflation will remain stagnant for some time due to slowing growth.

- As for core inflation, we will study various data, including people's opinions about prices, long-term inflation expectations, and we will conduct a comprehensive assessment of the economy and prices.

- Core inflation is still below our 2% target, but it is expected to rise moderately and the cycle of rising wages and inflation continues.

- If macro-inflation remains high for a long time, we must take into account the risk of its impact on core inflation.

- Rising food prices may negatively affect consumer confidence, worsen household spending, or may prolong inflation, I would always like to monitor whether rising food costs will affect inflation expectations and core inflation.

The impact of tariffs

- The uncertainty about the tariff rate may have subsided, but the impact of significantly higher US tariffs on the economy is still unclear.

- I don't think that we are lagging behind, or that the risk of being late is great.

The wage cycle

- We see that higher wages push up prices for services, higher prices push up wages, but we do not think that they are accelerating sharply.

That's why we think we're not far behind. However, we should be aware that macro-inflation may affect core inflation and inflation expectations more than before, because core inflation is now approaching 2%.

Recent yen movements

Currency movements have not deviated much from the levels that we assumed when making our price forecasts.

Thus, I do not think that recent currency movements will have an immediate significant impact on our inflation forecasts.