The head of the Federal Reserve Bank of New York, John Williams, pointed to further interest rate cuts after the last cut, supporting growth while monitoring inflation rates with great anticipation, as Williams suggested that further interest rate cuts would be appropriate over time, in line with Bank Chairman Jerome Powell's forecast of gradual cuts.

He also said that the incoming inflation data are encouraging, but stressed that we have not yet reached the return of inflation to the Fed's 2% target on a sustainable basis.

After cutting interest rates by 50 basis points in September, which was more than usual by the US Federal Reserve, it seems that the Fed is ready to take a more conservative approach in the coming months as economic data continue to support growth and moderate inflation.

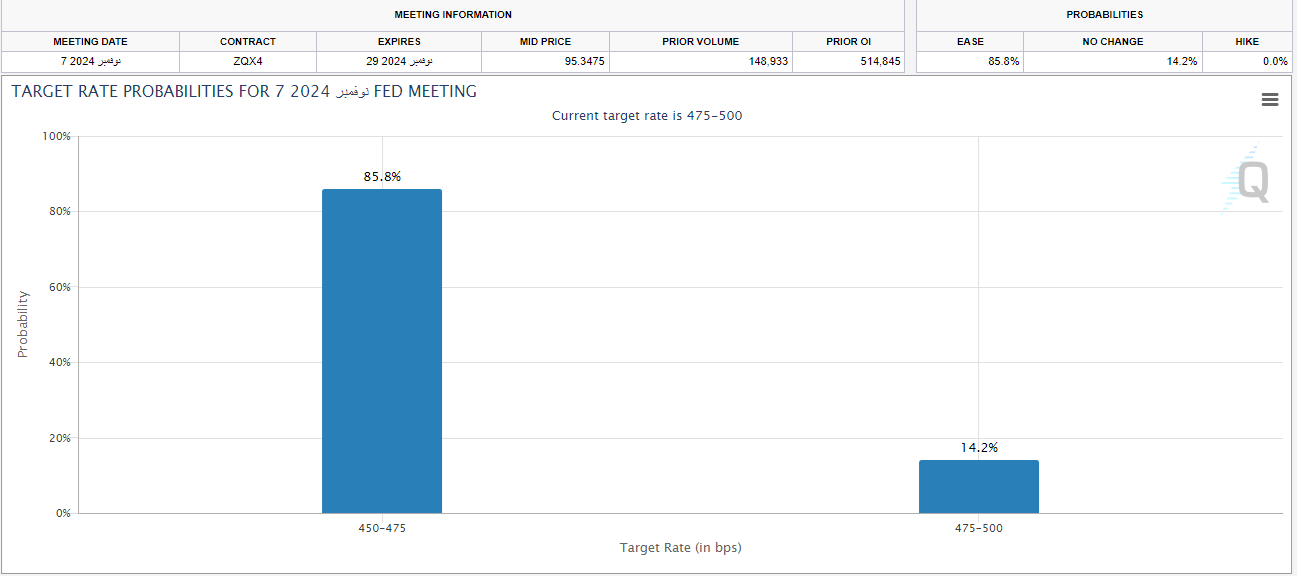

The jobs data released at the end of last week also reinforced expectations of a 25 basis point cut in interest rates next November.

The Fed is trying to support the economy while making sure that interest rates are not cut too quickly and inflation rises again.