Social Trading and Copy Trading from Successful Investors

What is Social Trading?

In the world of financial markets, it allows for copying the trades executed by experienced traders, known as Copy Trading. Social trading is a method that allows traders to monitor and copy the trades of expert investors (signal providers), enabling beginners to follow, copy, and learn from the strategies and insights of top-performing traders.

Once a trader (provider) opens or closes a trade, the same action is automatically executed in your account with the same proportions.

If you're a beginner in forex and need some guidance, copy trading can be a great solution. However, this approach should be practiced carefully if you want to avoid common mistakes.

Steps to Start Copy Trading?

- Choose a reliable platform like these platforms you will find ➡️ from here

- Register and link your account.

- Open a trading account with a brokerage firm that supports copy trading.

- Choose the right trader: Analyze the performance of traders based on profits, risk ratios, and the number of followers.

- Set your capital: Choose the amount you want to invest in copy trading, considering the risks.

- Monitor and evaluate: Regularly check the trader's performance and switch traders if necessary.

Why is Copy Trading So Popular?

With the increasing popularity of cryptocurrencies and other financial tools recently, the number of people wanting to enter the trading world is also growing. Thus, a lack of experience is a significant obstacle, and this is where copy trading comes in.

Social trading is characterized by transparency, ease of use, and efficiency. Additionally, it allows users to collaborate and help each other. Famous traders can make profits, while beginners can take their first steps with fewer mistakes and losses. Professionals are happy to multiply their profits, while beginners borrow effective trading strategies from them.

Pros and Cons of Copy Trading

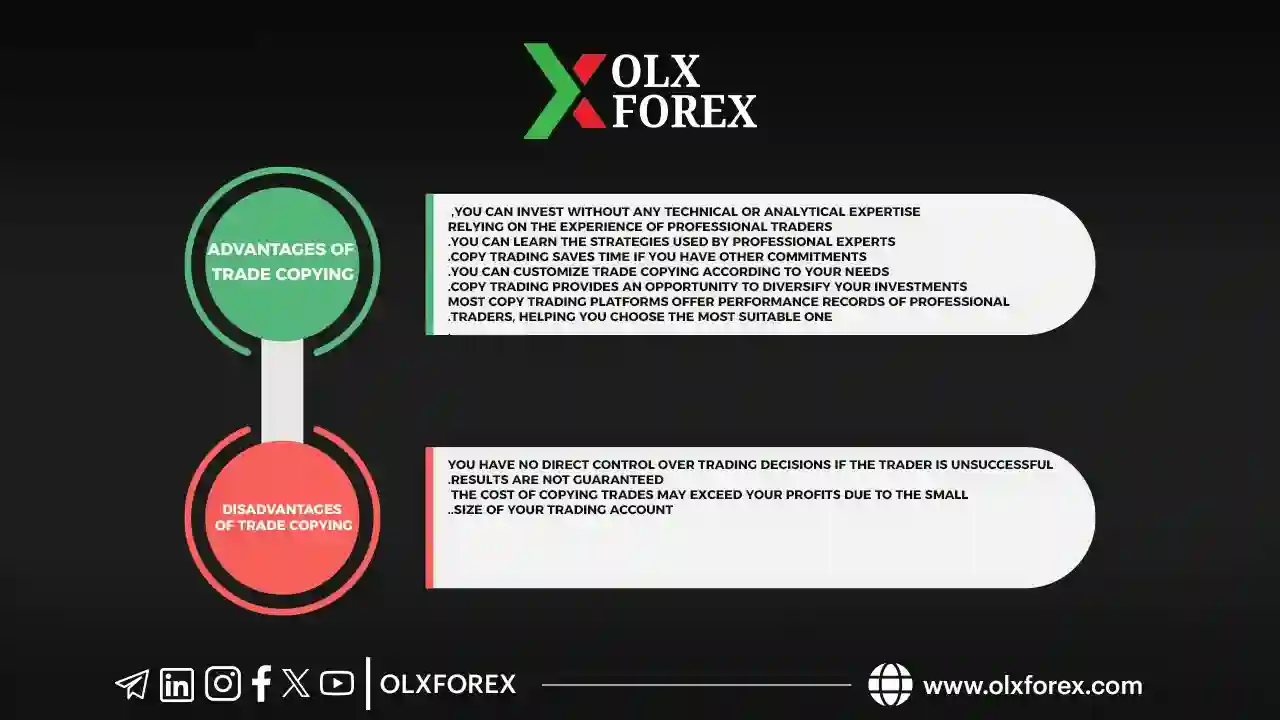

* Pros of Copy Trading

You can invest without any technical or analytical expertise, relying on the experience of professional traders.

You can learn how professional traders operate.

Copy trading saves time if you have another job.

You can customize copy trading based on your needs.

Copy trading offers an opportunity to diversify your investments.

Most copy trading platforms offer performance records of professional traders, helping you choose the best one.

* Cons of Copy Trading

You have no direct control over trading decisions if the trader is unsuccessful.

Results are not guaranteed.

The cost of copy trading can be higher than your profits if your trading account is small.

Consider the pros and cons of this service when determining if copy trading is right for you, so use it carefully with a clear strategy.

Soon, at OLX Forex, we will offer a copy trading account for our followers to link their accounts with us if they are interested in this type of trading and copy trading from the experts at OLX Forex Stay tuned You can ask about the start date of copying and how to join ➡️ from here