Fed meeting: stable outlook, stable interest rates

This is likely to be one of the least exciting FOMC meetings in a while.

At this week's meeting, the Fed seeks to continue to wait until things become clearer on key economic and political developments.

So, there may not be much worth checking out by the end of the day. But we'll see if there are any surprises.

At the very least, the interest rate decision will be very clear and direct that the Fed will not cut interest rates today.

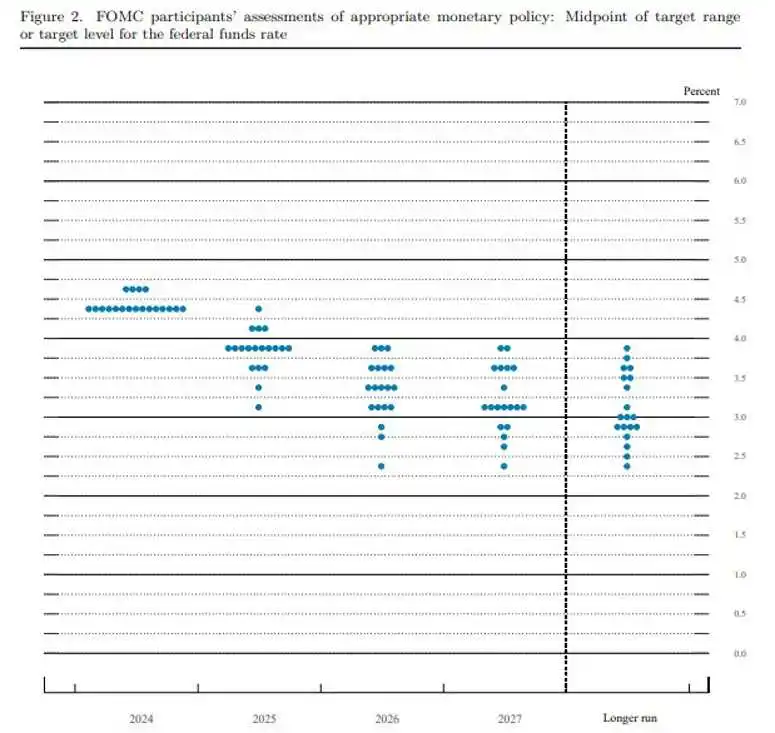

Since this is a quarterly meeting, then there will be a forecast of the points chart, which will be more interesting, however, we may not see much change compared to December.

Here's what we had last time:

The average forecast for the federal funds rate in 2025 was 3.9%, then 3.4% in 2026, then 3.1% in 2027, and 3.0% in the long term.

Now that we have the opportunity to get an idea about tariffs, will the Fed feel more confident in changing these forecasts?

It's a difficult question, but they may be comfortable keeping things the same for now.

There is still a lot of uncertainty about Trump's reciprocal tariffs, they will be applied only in early April, how this will affect inflation and the economy, so it is wiser to take a more patient approach.

On the other hand, we have seen a decline in US data in general, and the latest non-farm payrolls report also included some worrying details, the headline figure was strong, but the unemployment rate rose slightly, while wages were slightly lower.

As for inflation itself, it is slightly above the level of 3%, and when delving deeper into the reading of the basic personal consumption expenditures index.