Trading Strategies with Fundamental Analysis

Fundamental analysis

is a method for analyzing financial markets to predict prices. In forex, it focuses on the overall economic situation and examines various economic factors of a country, including interest rates, employment figures, GDP, international trade, and manufacturing indicators, as well as their impact on the value of the national currency.

Types of Trading Strategies Using Fundamental Analysis:

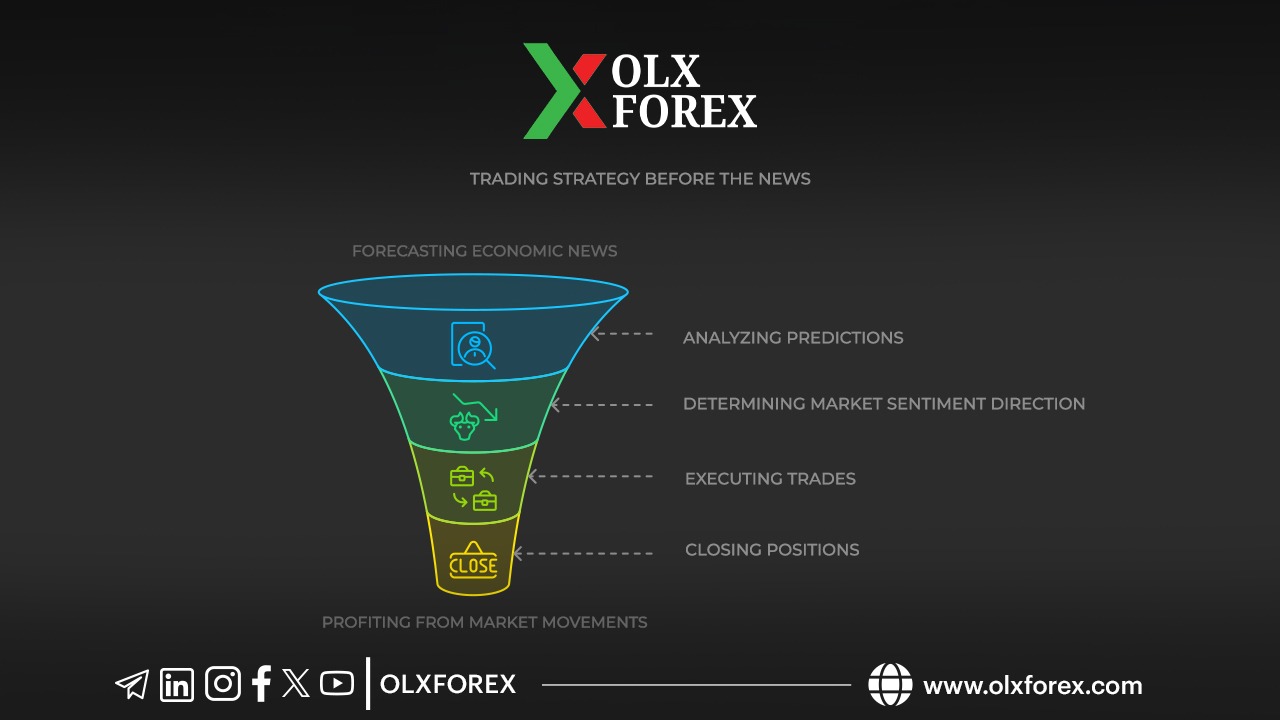

1. Trading Before the News Release:

This strategy relies on the strength of the news, using anticipated events—such as central bank meetings to set interest rates or inflation reports—to make trades. For instance, if inflation expectations are negative, a trader might consider it an opportunity to sell the U.S. dollar or buy gold, as they typically have an inverse relationship. Markets often start pricing in significant news one or two days in advance, allowing traders to take advantage of negative market movements before closing their positions prior to the news release.

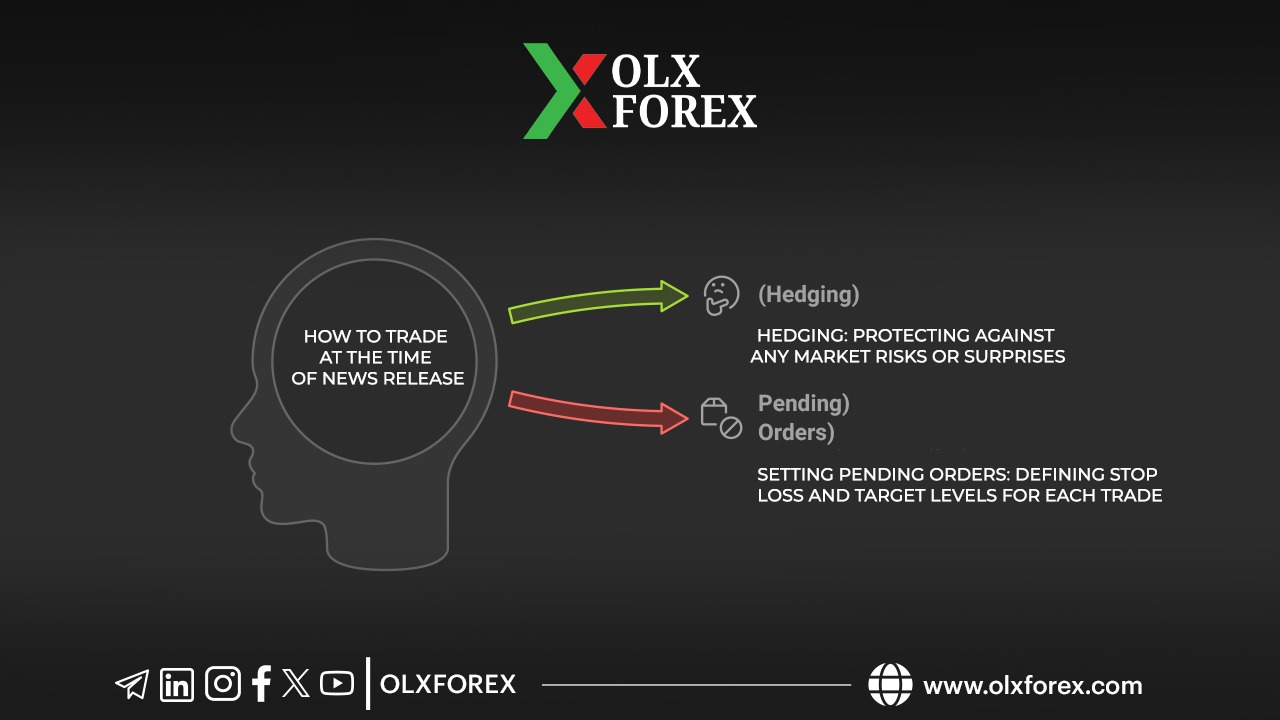

2. Trading at the Time of the News Release:

This approach involves hedging by placing opposing orders around the time the news is released, as the news could turn out contrary to expectations. Traders might set pending buy and sell orders at a specific number of points from the current price of a currency pair. For example, a trader could place a buy and sell order for gold or any dollar pair with a set distance of 30 points from the current price, also determining stop-loss and take-profit levels for each trade.

3. Trading After the News Release:

This strategy focuses on waiting for market reactions following the news release and the subsequent stabilization of prices. Traders analyze market trends after the news to gauge how the pairs affected react. Continuing with the previous example, a trader might wait for the interest rate news, and after the market absorbs the news shock—regardless of whether it aligns with expectations or not—they can then determine their trading positions on dollar and gold pairs based on the anticipated market direction following the news.