The difference between trading and investing

Some people believe that trading and investing are the same, but there is a fundamental difference between them: the time frame for each.

Investing is a long-term strategy where the investor holds assets, such as bonds or stocks, for years or even decades, waiting for their value to increase. In contrast, a trader operates on shorter time frames, buying and selling assets repeatedly to profit from price fluctuations in the short term.

Let’s explore what investing and trading are, as well as the differences between them.

What is Investing:

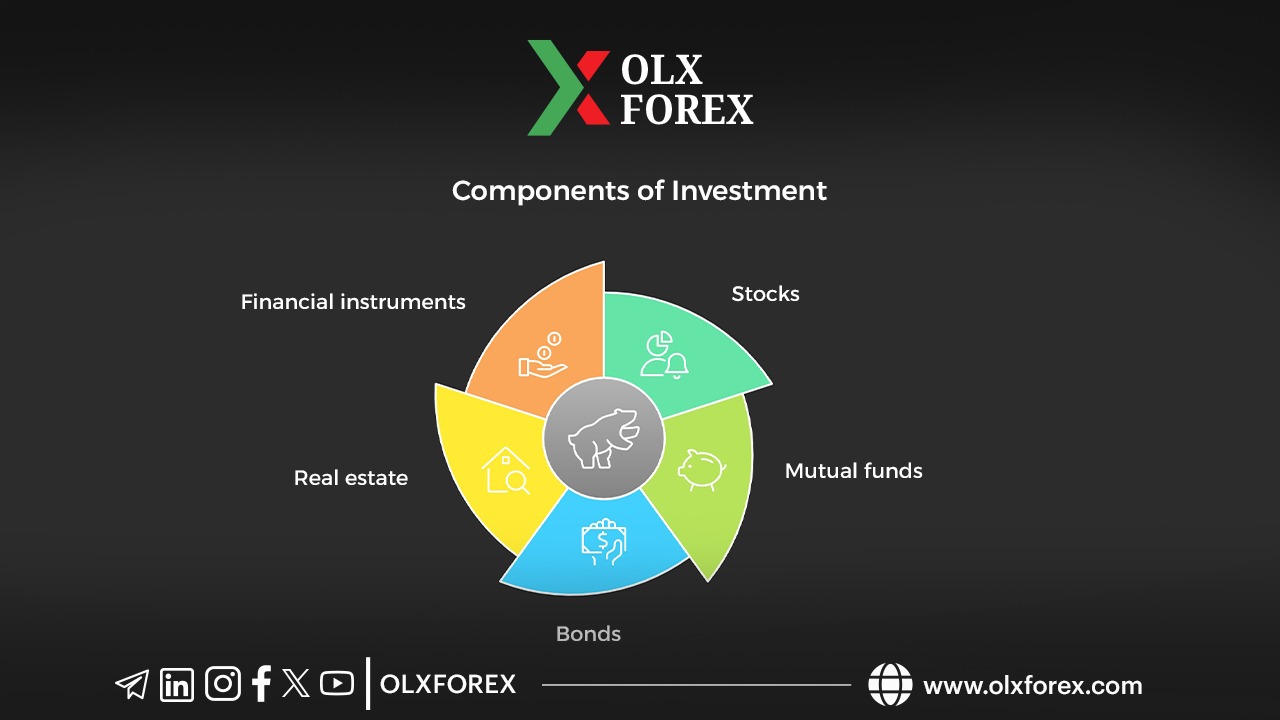

Investing is a means of gradually accumulating wealth over a long period. Investors acquire a diversified portfolio that includes various asset classes, such as stocks, mutual funds, bonds, real estate, and other financial instruments. These investments are typically held for years or even decades to benefit from earnings like interest, dividends, and capital appreciation. The essence of investing lies in the investor's long-term perspective, focusing on patience, strategic planning, and a steadfast commitment to achieving financial goals over extended time frames, which may last for decades.

What is Trading:

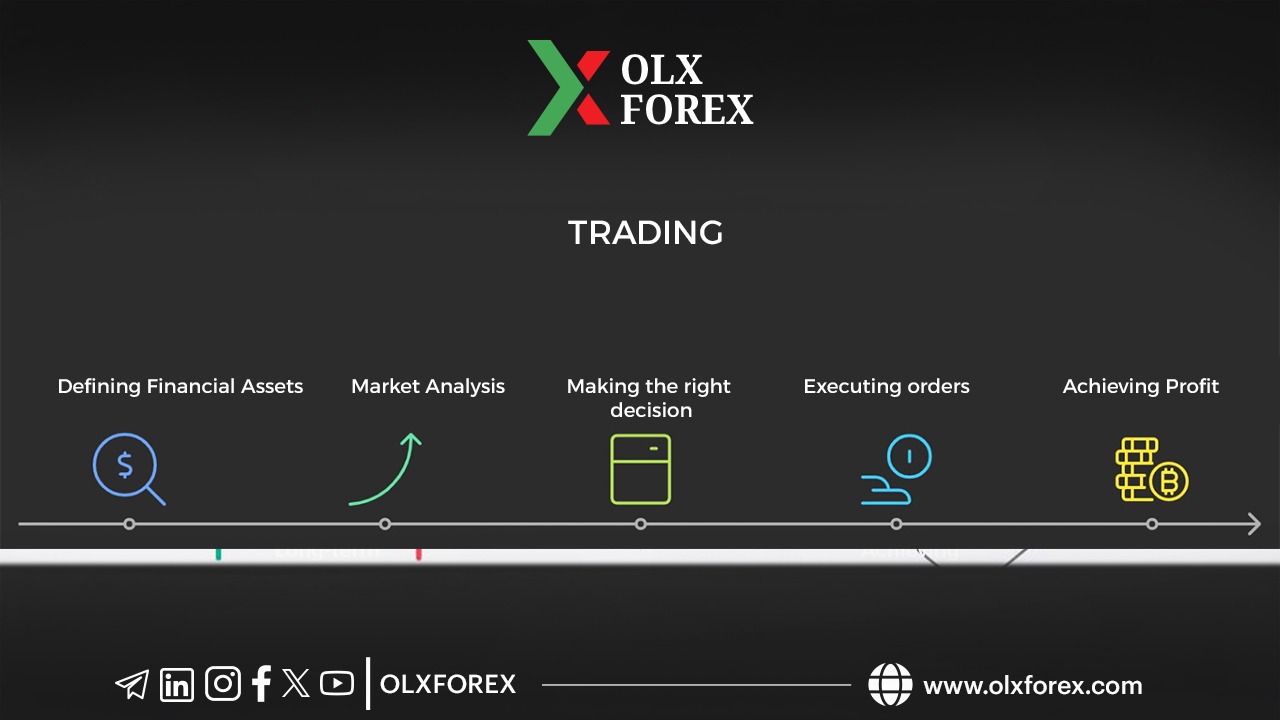

Trading involves the buying and selling of financial instruments like stocks, bonds, currencies, commodities, and derivatives with the goal of making profits within a short time frame. Traders capitalize on short-term market fluctuations, driven by speculation, whereas investing prioritizes long-term wealth accumulation. One prominent market primarily focused on trading is the forex market. In forex trading, positions are often held for short periods, appealing to day traders, although some traders may hold long-term positions, typically executed by companies or financial institutions.

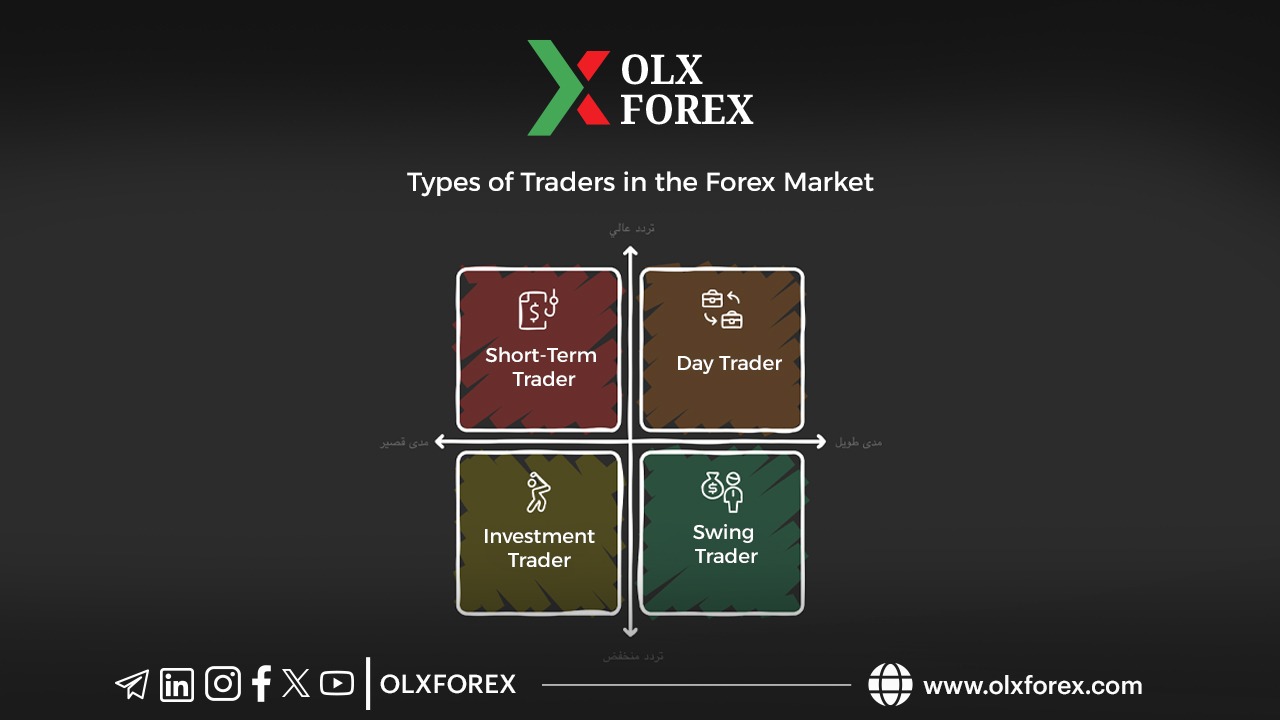

Types of Traders in the Forex Market:

1. Scalpers:

These traders capitalize on small price fluctuations for quick profits, using very short time frames from one minute to five minutes. They aim for small price moves with large contract sizes, relying on rapid entry and exit from trades.

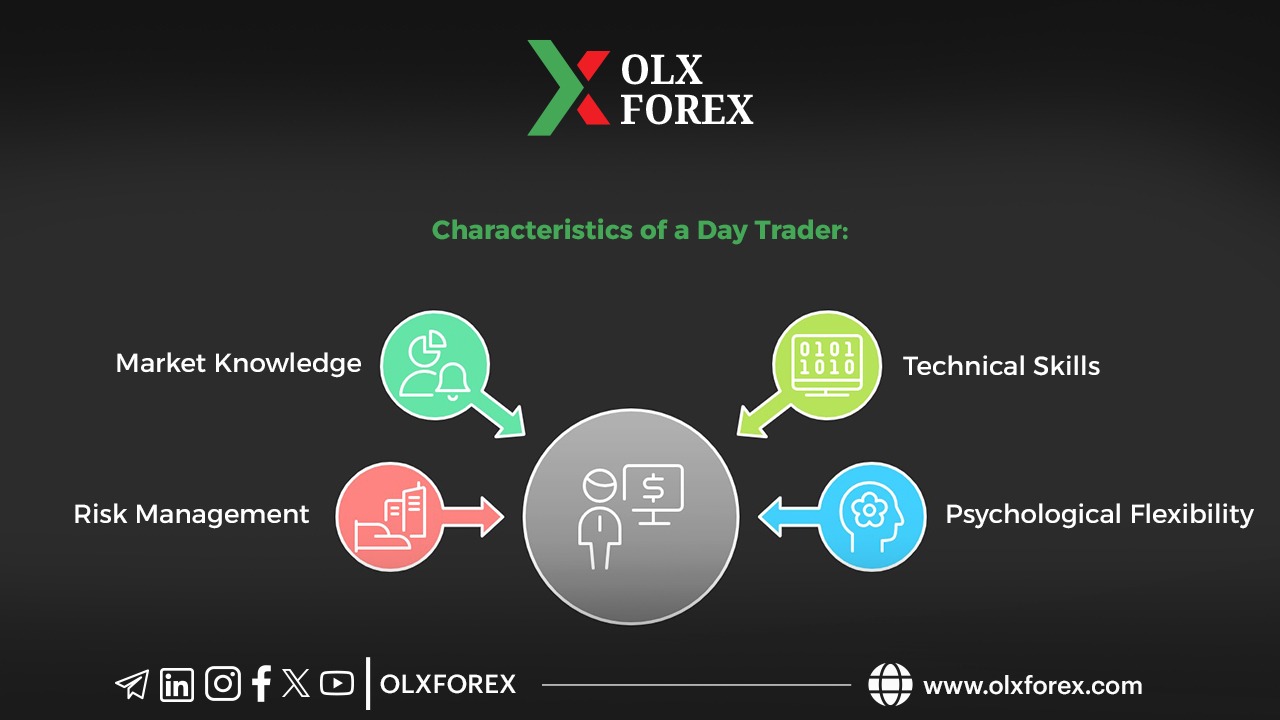

2. Day Traders:

Day traders open and close their positions within the same day. They use larger time frames, ranging from 15 minutes to one hour, and do not leave positions open overnight to avoid news and volatility that may impact prices before market close. They typically focus more on technical analysis than fundamental analysis.

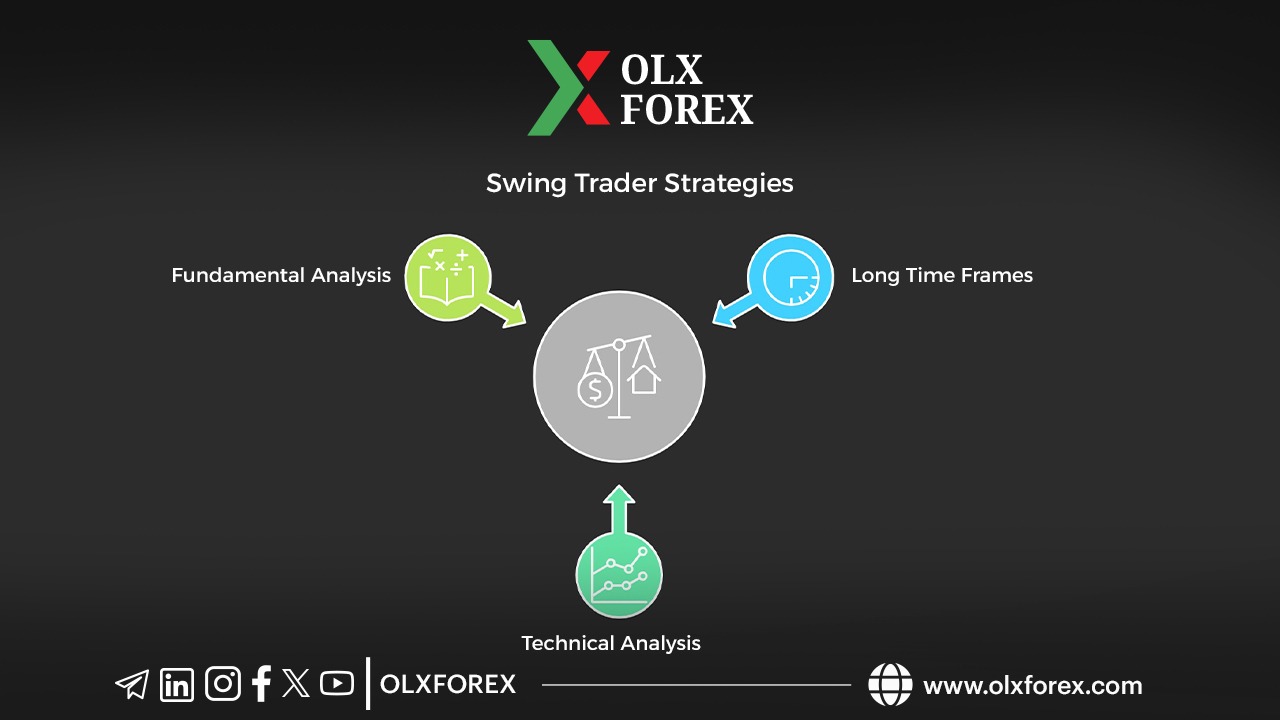

3. Swing Traders:

Swing traders hold their positions for longer periods, using time frames from one hour to four hours, and even daily. They often diversify their approaches, applying both technical and fundamental analysis.

4. Position Traders:

These traders focus on the long-term value of assets and their longer-term trends rather than short-term market fluctuations. They may hold positions for months or even years, relying heavily on fundamental analysis and studying the economy of the country.

Regardless of whether you are a scalper, day trader, swing trader, or position trader, it is essential to choose a reputable brokerage that offers low and stable spreads on all financial instruments, whether currencies, commodities, indices, metals, or stocks. This ensures that you can achieve your goals efficiently without facing difficulties in trading. Quick access to your funds through various deposit and withdrawal methods is also crucial. For a seamless trading experience, we recommend Exness as a top choice for our clients. You can learn more about the company by opening your account here.