Cryptocurrency Trading: The Growing Influence on the Forex Market

Cryptocurrency trading has become one of the most popular topics in financial markets in recent years, and it has had a clear impact on the traditional forex market.

What is the Cryptocurrency Trading Market?

The cryptocurrency trading market is a financial market where digital currencies like Bitcoin, Ethereum, Litecoin, Dogecoin, and others are traded. The cryptocurrency market operates without any time or geographic restrictions, and it is open 24 hours a day, seven days a week. The daily trading volume exceeds $1 trillion.

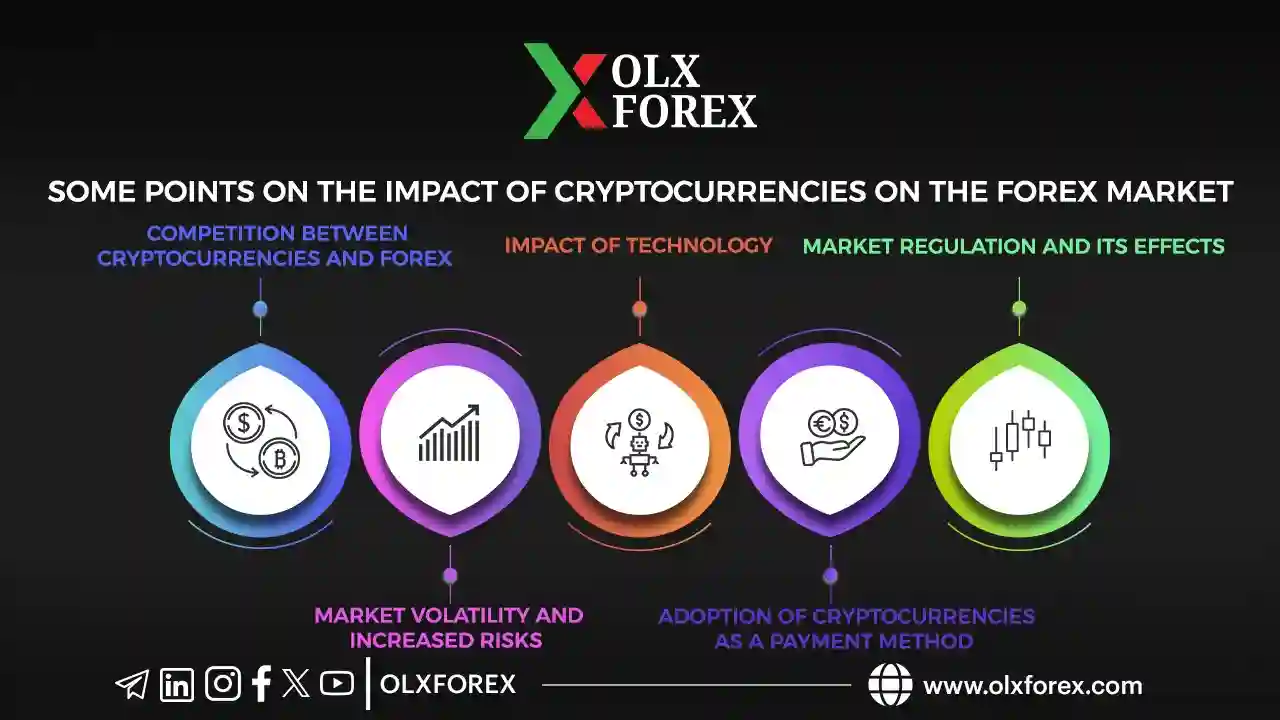

Here, we will explore some of the impacts of cryptocurrencies on the forex market:

Cryptocurrencies and their impact on the Forex market in 2025:

Competition between Cryptocurrencies and Forex:

- Cryptocurrencies such as Bitcoin and Ethereum have become strong competitors to traditional currencies. Investors are seeking assets with high returns, which has drawn many of them to cryptocurrencies, thereby decreasing the interest of some in the traditional forex market.

- Market Volatility and Increased Risks:

Cryptocurrencies are known for their sharp volatility, which provides significant profit opportunities but also increases the risks to your capital. In contrast, the forex market is relatively more stable due to its connection to major economies and monetary policies.

- Impact of Technology:

The use of technologies like blockchain in cryptocurrency trading adds a new layer of security and transparency, which can influence how traditional currencies are traded.

- Changes in Market Liquidity:

Cryptocurrencies have attracted huge amounts of capital from traditional markets, sometimes resulting in decreased liquidity in certain forex currency pairs. Cryptocurrencies can also provide additional liquidity during times of economic stagnation.

- Adoption of Cryptocurrencies as a Payment Method:

Many companies have started accepting cryptocurrencies as a payment method, increasing their legitimacy. However, fiat currencies still maintain their dominant position in international trade.

- Market Regulation and Its Effects:

The forex market is subject to strict rules and regulations from central banks, while the cryptocurrency market operates with more freedom. This freedom has attracted many new traders to cryptocurrencies but has also led to greater volatility and higher risks.

Conclusion: With the growing popularity of cryptocurrencies, there is an increasing overlap between the forex market and the cryptocurrency market. This overlap creates new opportunities for traders and investors, as they can diversify between forex and cryptocurrencies to achieve better returns. Cryptocurrencies are not a replacement for the forex market, but rather complement it.

You can contact the OLX Forex team to get a free consultation on everything related to digital currencies and Forex➡️ from here before you start depositing your money so as not to lose it in one of the unreliable currencies.