Emerging market trends and new opportunities to trade in them

Emerging markets are developing country economies that are gradually becoming more integrated into global markets, where they are likely to develop in the near future in addition to those developed in the past.

Emerging markets generally exhibit most of the characteristics of developed countries, which are essentially countries that move and move from traditional low-income and less developed economies to industrialized and modern economies capable of maintaining higher standards of living as well as mixed markets or free markets where emerging markets are generally characterized by high growth rates, but this rapid economic growth also comes with inherent risks.

However, emerging markets have played an important role in stimulating the global economy since the term was coined in the early eighties, with emerging markets estimated to make up about 80% of the global economy. This is because large countries, such as China and India, are also referred to as emerging markets because of their over-reliance on exports as well as the availability of cheap labor.

The currency crisis of 1997 saw major steps taken by major financial institutions, such as the International Monetary Fund, to help emerging markets have more developed economies and financial systems.

At the turn of the millennium, the term BRICS was used to refer to the largest emerging markets that are set to have a significant impact on the global economy by 2050.

BRICS represents the countries of Brazil, Russia, India, China and South Africa as the founding countries of this new economic entity and then joined by some other countries, led by Egypt, there is also the term MINT, which refers to the countries of Mexico, Indonesia, Nigeria and Turkey.

These terms are usually coined to distinguish countries that share the unique investment opportunities available to foreign investors.

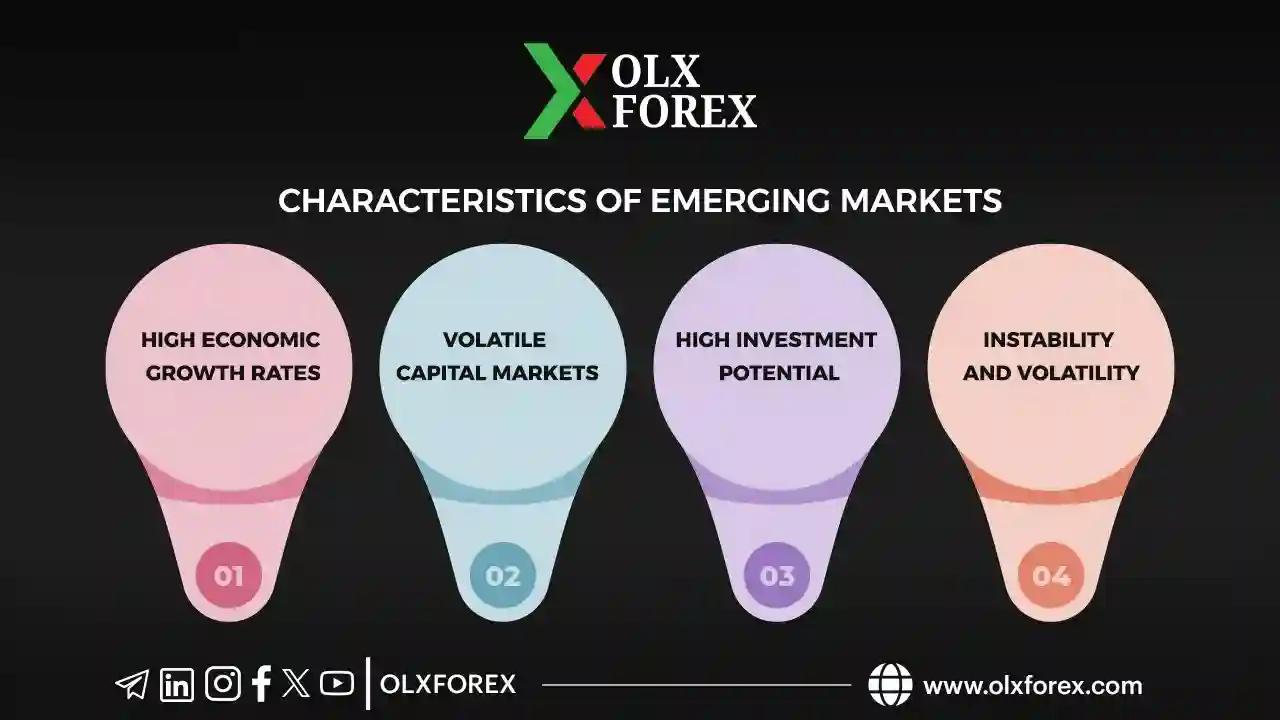

Characteristics of emerging markets:

1- High economic growth rates

Emerging markets typically see their economies grow by about 6% to 7% per year.It is not uncommon for economies to record double-digit growth rates, while developed countries record economic growth rates of less than 3%.

This means that emerging-market GDP growth rates will consistently outperform those of advanced countries.

2 - Turbulent Capital Markets

Emerging markets usually have liquid domestic bond and equity markets, however (unlike developed countries) their capital markets are still so immature that it can be difficult to obtain reliable and relevant information on the companies they trade on their exchanges.

It can also be difficult to sell debt products such as bonds or treasury bills.

3 - High investment potential

Emerging markets have high investment potential, with particularly attractive opportunities as they move from closed economies that rely mostly on mining and agriculture to more open economies that facilitate international trade.Compared to developed countries, emerging markets offer the potential for higher returns despite the inherent risks.

4 - Instability and volatility

Emerging markets are characterized by instability and volatility, as these countries are vulnerable to fluctuations in the values of commodities such as oil and food products as well as major currencies such as the US dollar (USD) and the euro (EUR), and domestically they are also strongly affected by changes in inflation levels as well as interest rates.

Trading opportunities on the currencies of the main emerging markets

Brazilian Real (BRL)

The BRL is Brazil's official currency and ranks 20th among the most traded currencies in global forex markets as of September 2021. It was introduced in July 1994 to address the country’s rampant hyperinflation and stabilize its economy. Brazil boasts a well-diversified economy, being a major exporter of both hard and soft commodities and having a thriving services sector.

Currently, the USD/BRL chart indicates a strong upward trend, presenting a promising long-term buying opportunity.

Russian Ruble (RUB)

The Russian Ruble is the official currency of the Russian Federation and ranked 17th among the most traded currencies in global forex markets as of September 2021. The modern ruble was introduced in 1991 after the Soviet Union’s collapse. Russia’s economy relies heavily on oil and natural gas exports, primarily to EU nations.

The ruble is highly volatile, often considered one of the world’s most unstable currencies. The USD/RUB pair has fluctuated between 55.00 and 80.00 in recent years, with significant depreciation driven by U.S. sanctions and fluctuating oil prices following the Ukraine crisis. Currently, the currency has resumed an upward trend, offering strong buying opportunities as seen on the chart.

Chinese Yuan CNH or CNY

The CNH yuan is the official currency of the People's Republic of China and ranks eighth among the most traded currencies in the global forex markets as of September 2021. In terms of nominal GDP, China is the second largest economy in the world, only after the United States. This makes the economy by far the most influential emerging market! USDCNY has traded between 6.0000 and 7.2000 in recent years, and the source of volatility has been China's monetary policies as well as the international debt market.