The US dollar index is trading on Monday at 103 levels, approaching two-month highs amid expectations that the Fed will not provide further massive interest rate cuts at its remaining meetings until the end of the year.

These expectations increased especially after the release of some US data, the most important of which was the jobs report and consumer inflation, where the results came stronger than expected, despite the rise in weekly unemployment claims and the slowdown in inflation among producers who provided a counterargument.

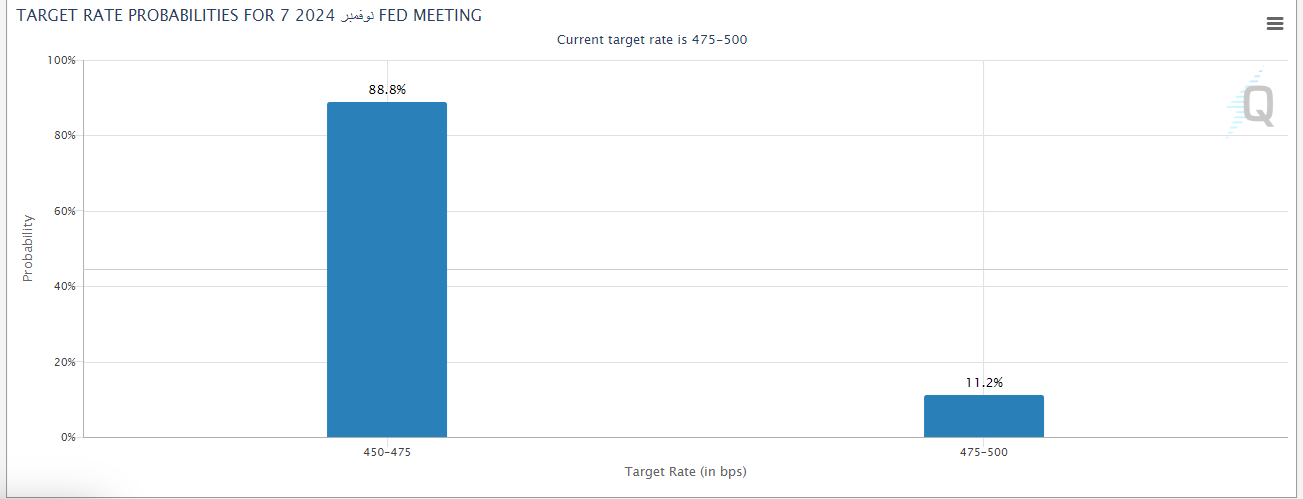

However, the markets are currently pricing in a probability of more than 88% for a 25 basis point interest rate cut in November, while ruling out any chances of another half a percentage point cut.

Investors are now looking forward to new retail sales and unemployment claims data this week, as well as Fed Governor Christopher Waller's statements later in the day.

It also rose against most currencies, especially the Chinese yuan after disappointing stimulus announcements from China over the weekend.