Tesla's stock rating has been downgraded.

Tesla's stock has fallen sharply due to the dispute between CEO Elon Musk and US President Donald Trump.

The company has lost more than $350 billion so far, recording its largest loss since the beginning of 2025.

Shares have fallen 29.3%, the largest decline of the year.

Separately, Bird analysts downgraded Tesla's rating to "Neutral" due to the current controversies and uncertainty,

as well as the stock's high expectations and strong competition.

Bird also stated that it expects these concerns regarding Tesla's brand to continue until evidence emerges to reflect this.

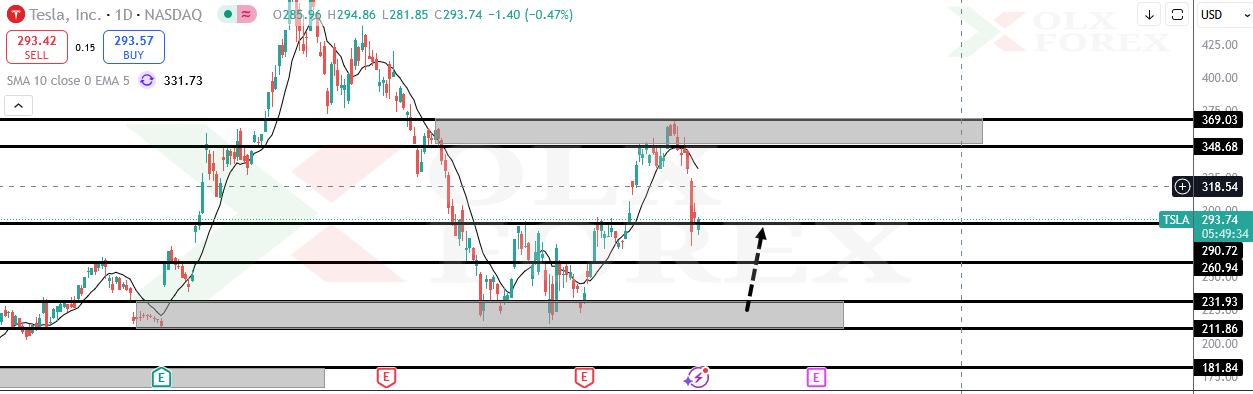

Technically, the stock:

Tesla's stock declined after reaching strong supply zones,

which were considered among the most important expected selling areas for the stock.

The stock is expected to continue its decline at the present time.

Buying is not recommended at this time due to the lack of strong buying zones.

However, if the stock continues to decline, the identified demand zones,

located at 231.93, are the best buying zones.

From these, a rise to targets of 260.94 and 293.62, respectively, is expected.

A buy view fails if the stock breaks and closes below the demand zones with a full candle.