Bank of America is optimistic about Netflix's continued growth.

According to recent reports from Bank of America, the bank's analysts confirmed

their high optimism about Netflix. The stock target has been raised

to 1,490,000, and the company's rating has been changed to "buy."

The bank stated that they still see the company as very strong.

The company's shares have risen 33% since the beginning of the year.

The company's current performance is considered strong compared to its competitors.

The number of active users has reached more than 90 million.

It has also begun targeting more users in the age group

between 18 and 34, which is currently the most popular age group.

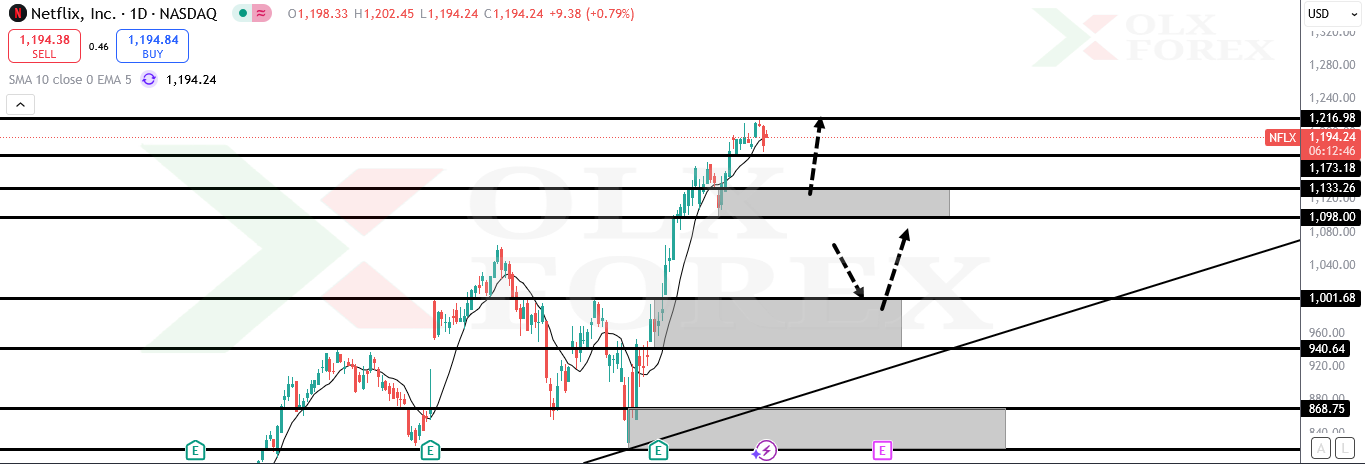

Regarding technical analysis:

The stock is still moving in a strong uptrend so far,

and the outlook remains positive regarding the continued upward trend over the long term.

The first demand areas at 1133 are considered good buying areas.

Targeting levels 1173 and 1216, respectively.

If the first demand areas are broken and a full candle closes below them,

the correction may continue to the next demand areas at 1001.

From there, the stock is expected to rebound.