Strong plans to raise billions to pay off Nissan's debt .

It appears that the famous Nissan car company is facing a severe debt crisis.

According to reports, the company is planning to raise more than $7 billion

to repay its debts due over the next year.

The company is currently planning to issue bonds and sell assets

in an attempt to save the company. The company plans to

issue convertible bonds, including bonds in dollars and euros.

The company also plans to sell a portion of its stake in Renault.

The company also expects to obtain a loan exceeding $1 billion

from the British Export Credit Agency.

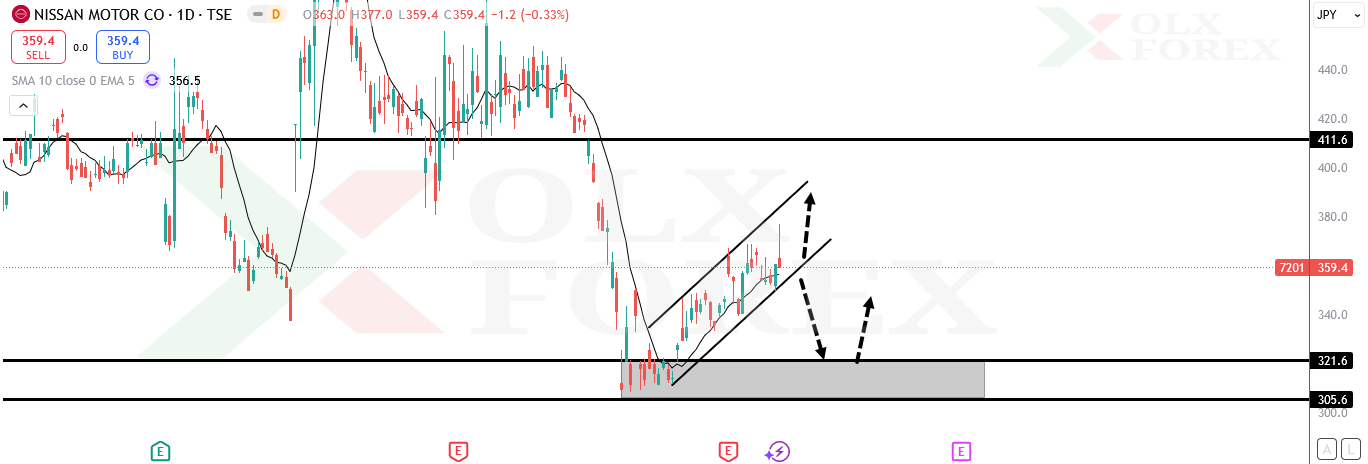

As for the technical analysis:

It appears that the stock is still facing a strong downward trend.

After the previous sharp decline, the stock is currently moving

within an ascending price channel,

indicating a negative pattern that supports the continued decline

in the event of a breakout of the ascending channel,

which will push the stock to decline sharply again

reaching the demand areas below, near the 321 level.

If the current upward trend continues, we may see a rise

to the upper limit of the descending price channel shown on the chart.