Morgan Stanley expects the S&P 500 index to rise.

Morgan Stanley has upgraded US stocks to "overweight"

due to the weak dollar and current supportive monetary policy.

The bank also expects the S&P 500 index to rise to 6,500

during the second quarter of 2026.

The bank also stated that it favors US stocks over non-US stocks.

Earnings revisions are expected to reach their lowest levels in the near term.

The current weakness of the dollar is expected to play

a positive role in increasing the profits of multinational foreign companies.

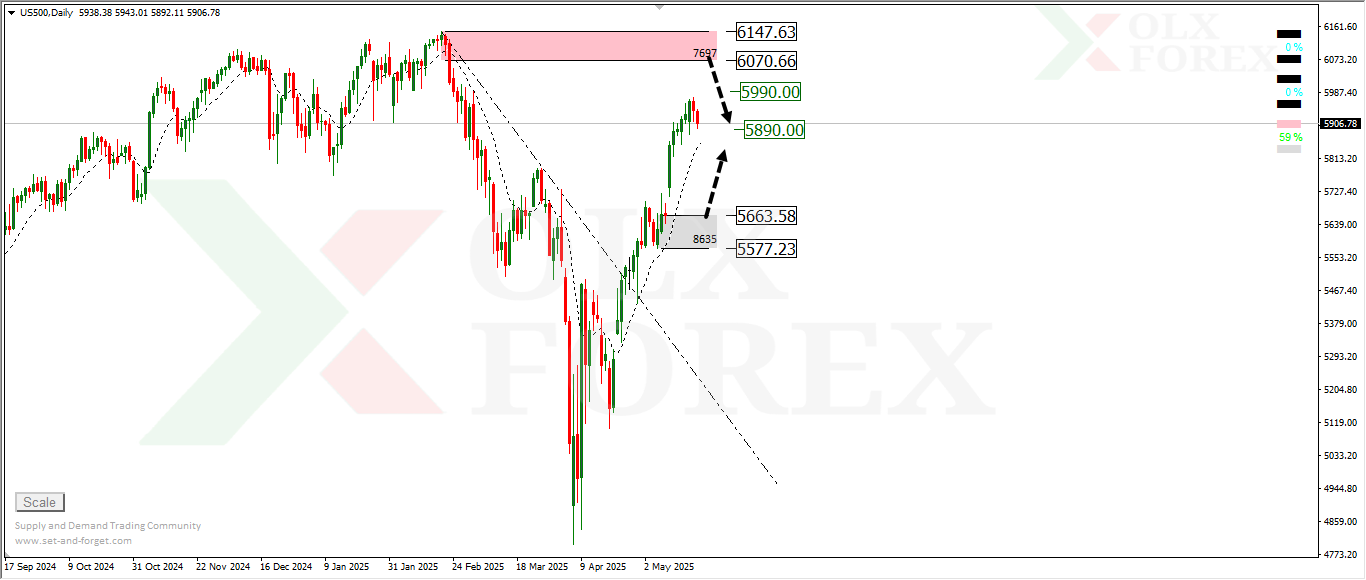

technical the S&P 500 index:

The index is still moving in a strong uptrend with current signs of weakness.

Therefore, we may see some corrections in the index soon.

Currently, the best buying areas are the demand zones at the 5663 level.

If the upward trend continues, the supply zones above

located near the 6070 level are the best selling areas on the index.