Monetary Policy and Its Types

Monetary policy is a primary tool in economic policy, used to manage a country's economic conditions. Central banks or monetary authorities are responsible for formulating and implementing national monetary policy, aiming to achieve a balance between supply, demand, and interest rates. This is intended to reach economic goals such as price stability, avoiding inflation or recession, supporting economic growth, and achieving full employment.

Monetary policy differs from fiscal policy, which is managed by the government through the Ministry of Finance. Fiscal policy includes decisions on government spending and taxation, while monetary policy is conducted by central banks, like the Federal Reserve in the United States, which controls the money supply and interest rates. Although their scopes differ, both monetary and fiscal policies influence a country’s economic performance.

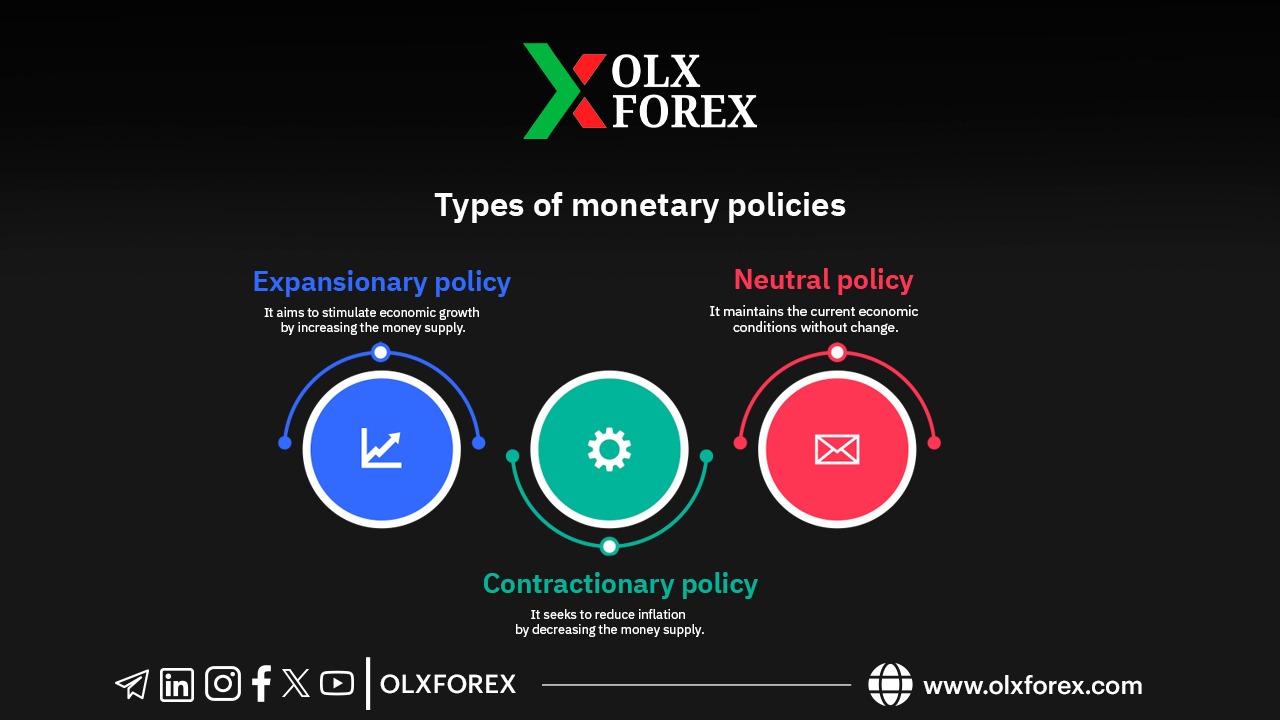

Types of Monetary Policies

Monetary policies can be divided into three main types: expansionary, contractionary, and neutral.

Expansionary Monetary Policy

Expansionary monetary policy aims to stimulate local economic growth during periods of recession by increasing the money supply and lowering interest rates to boost demand. This policy often leads to a depreciation of the currency, thereby reducing the exchange rate. It relies on injecting more money into the markets.

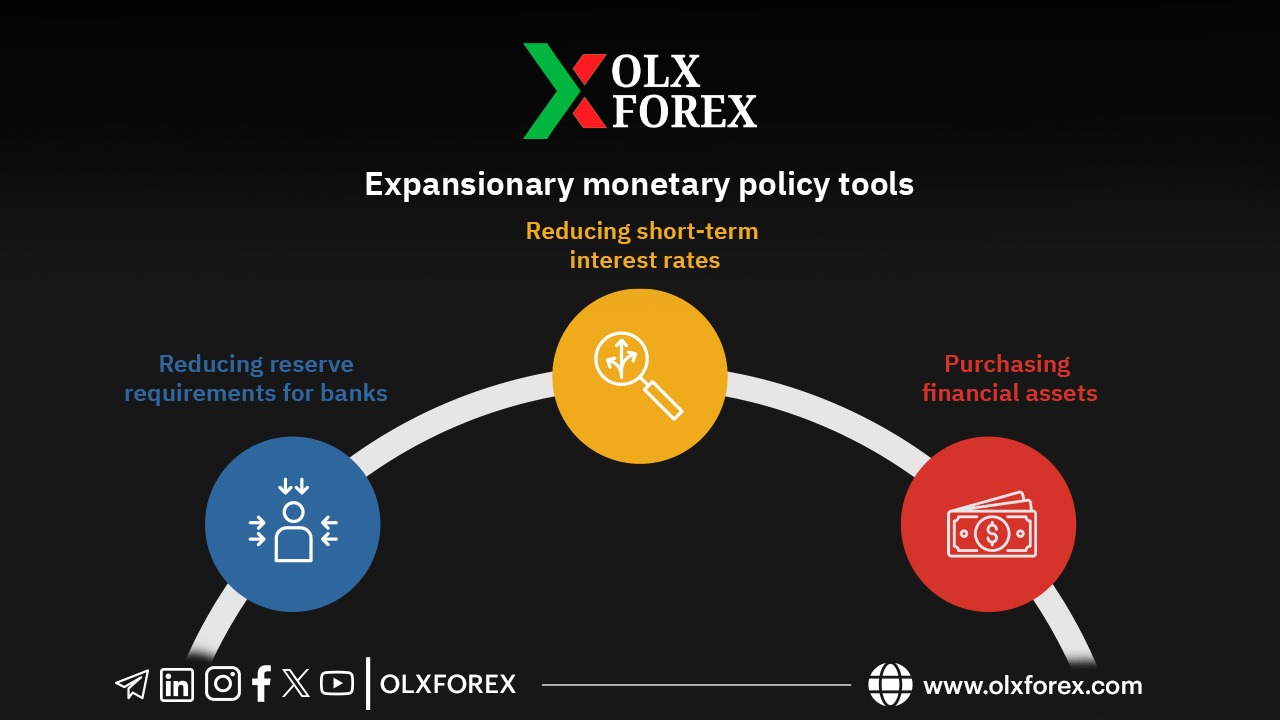

Tools of Expansionary Monetary Policy:

Lowering Short-Term Interest Rates: When commercial banks apply for short-term loans from the central bank due to liquidity shortages, the central bank reduces interest rates on these loans, which lowers borrowing costs and enhances demand.

Reducing Reserve Requirements for Banks: The central bank lowers reserve requirements, allowing commercial banks to lend more money to customers.

Purchasing Financial Assets: Such as buying government bonds, where the central bank injects liquidity through open market operations to enhance liquidity in local markets.

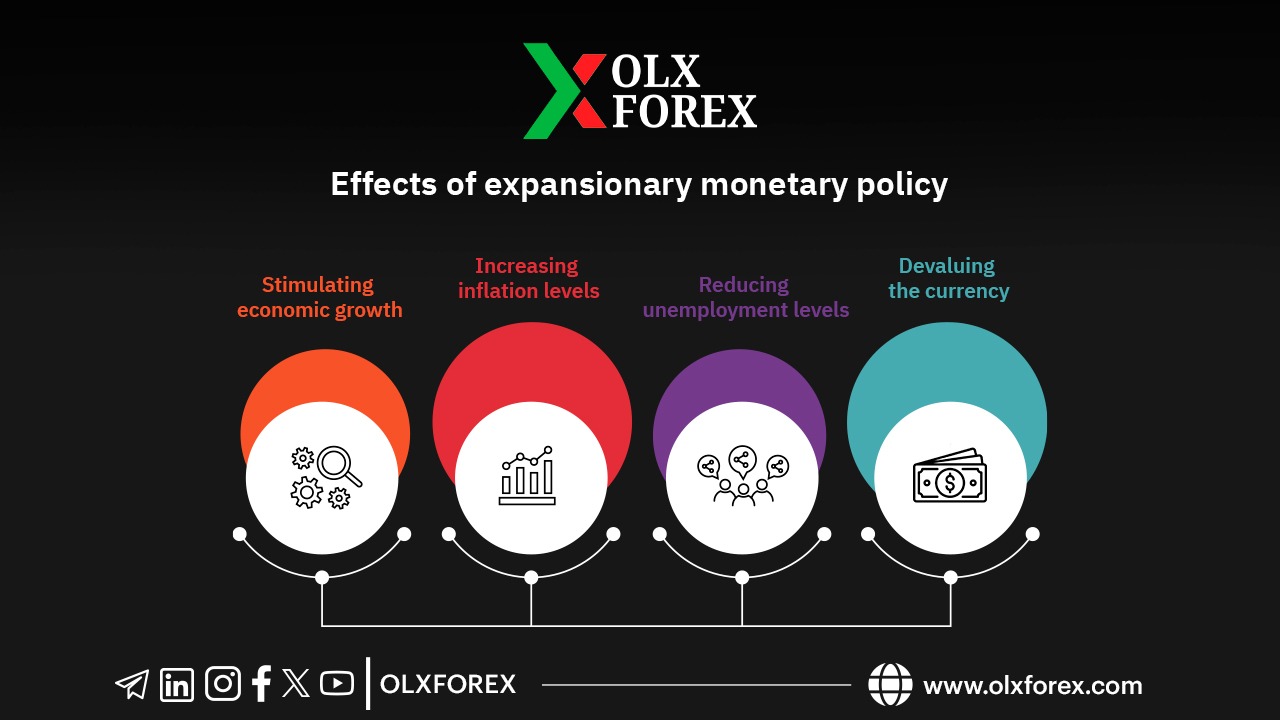

Effects of Expansionary Monetary Policy:

Stimulating Economic Growth:

Encouraging consumption and investment, as lower borrowing costs lead to increased spending by consumers and more investment from businesses.

Rising Inflation Levels: Due to the increased money supply.

Currency Depreciation: Enhancing the competitiveness of exports, making them cheaper and more attractive to foreign markets.

Lowering Unemployment Rates: Resulting from increased investments and the creation of more job opportunities.

Contractionary Monetary Policy

Contractionary monetary policy is used to combat high inflation and aims to reduce money supply by tightening monetary policy.

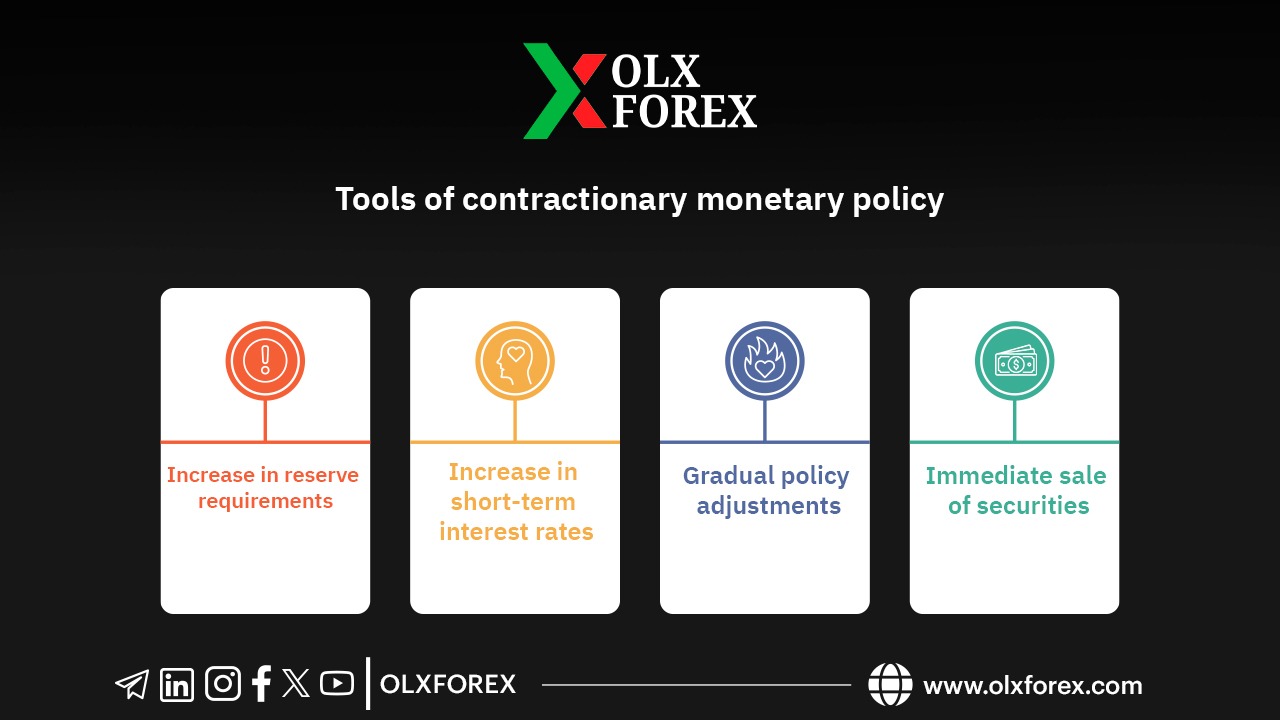

Tools of Contractionary Monetary Policy:

Raising Short-Term Interest Rates: The central bank increases the cost of short-term loans for commercial banks, resulting in higher interest rates and reduced demand for loans.

Increasing Reserve Requirements for Banks: The central bank raises the required reserve ratio, limiting banks' ability to offer new loans.

Selling Securities: The central bank sells government bonds to investors, thereby reducing liquidity in the markets.

Effects of Contractionary Monetary Policy:

Slowing Economic Growth:

Individuals and businesses typically halt major investments, and companies slow down production.

Decreasing Inflation Levels: Achieved by reducing the money supply and stabilizing prices in the economy.

Increasing Unemployment Rates: Due to the economic slowdown and decreased production, leading companies to hire fewer employees.

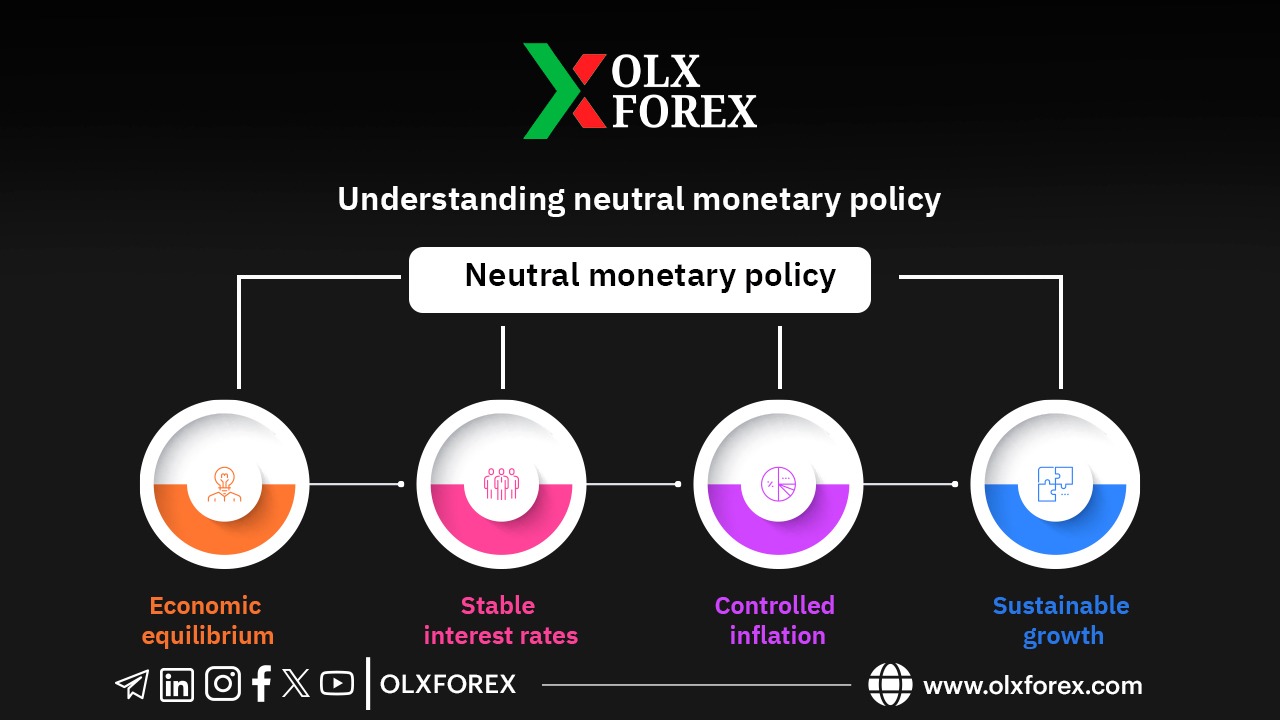

Neutral Monetary Policy

Neutral monetary policy is a third, less commonly used type, applied by central banks when the economy is in balance and does not require additional stimulus for growth or measures to curb inflation.

Under neutral policy, the central bank takes no significant action to expand or contract the money supply, focusing instead on maintaining interest rates and liquidity levels that ensure price stability and support sustainable growth without unnecessarily accelerating inflation or slowing the economy.

In summary, monetary policy plays a crucial role in managing economic conditions and achieving desired outcomes in financial markets. By adjusting the money supply and interest rates, central banks can influence economic activity, inflation, and employment levels, ultimately steering the economy toward stability and growth.