Withdrawal and deposit methods in XM

Discover all deposit and withdrawal methods available at XM in 2025, including bank cards, e-wallets, bank transfers, and digital currencies such as USDT. This complete guide explains speed, fees, and the best options to give traders maximum convenience.

In the trading world, the ease of depositing and withdrawing funds is a key factor that determines the success of an investment experience. Traders always need a secure, fast, and flexible method to manage their money without complications. For this reason, XM provides a wide range of payment options, including bank cards, e-wallets, local transfers, and digital currencies such as USDT, to meet the needs of clients worldwide. In this article, you will learn about all available deposit and withdrawal methods for 2025, including their advantages, processing speed, and expected fees, helping you easily choose the method that suits you best.

1) Credit/Debit Cards (Visa / Mastercard)

Speed: Instant deposit (a few minutes).

Withdrawal: From hours up to 3 business days (depending on issuing bank).

Security: Supports protection technologies such as 3D Secure in many countries.

Fees: XM does not charge extra fees, but the bank may apply a commission.

Important Notes:

• Deposit amounts are first refunded to the card used before any other method.

• Best suited for quick and medium-sized deposits Open your account now from here and enjoy flexible and smooth deposits.

2) E-Wallets (Skrill / Neteller / SticPay)

Speed: Instant deposit, withdrawal takes from minutes up to 24 hours.

Fees: No fees from XM, but the wallet provider may charge commissions.

Preference: The fastest option for most traders.

Conditions:

• The wallet must be in your personal name (third-party accounts not accepted).

• Ideal for traders who need fast and frequent liquidity.

Open your account now from here and enjoy flexible and smooth deposits.

3) Bank Transfer (International / Local)

• Deposits: from hours up to 3 business days.

• Withdrawals: from 2 to 7 business days.

Cost: Fees may apply from the sending bank or intermediary banks.

Best Use:

• Suitable for large amounts.

• A good option for those who prefer direct transfer to their bank account.

Note: XM may cover certain fees depending on the amount and regulatory entity.

Learn more about the types of accounts offered by XM and the advantages of each here.

4) Local Payment Methods (Depending on Country)

Availability: Shown inside the Members Area depending on country of residence.

Speed: Instant to a few hours for deposits, hours to days for withdrawals.

Flexibility: Supports local currencies and makes internal transfers easier.

Learn about bonus offers and their features here.

5) Digital Currencies (USDT – Tether)

Availability: Not fixed available only for some clients inside the Members Area.

Deposit:

• Time: Minutes up to 1 hour (depending on blockchain).

• Networks: TRC20 (lower fees) or ERC20.

Withdrawal: Usually within hours up to 24 hours (if available).

Fees: Depend on blockchain congestion and network fees.

Security Tips

1. Verify the required network before sending (wrong network = loss of funds).

2. Start with a small test transfer.

3. Keep your TxID and transfer proof.

Open your account now from here and enjoy flexible and smooth deposits.

General Rules for Deposits and Withdrawals at XM

1. Funds are always returned to the same deposit method first (especially cards).

2. The payment method must be in your own name.

3. KYC verification is required to activate all withdrawal methods.

4. Currency conversion may apply if the payment currency differs from the account currency.

Reference Processing Times

• E-wallets: Minutes – 24 hours.

• Bank cards: Hours – 3 business days.

• Bank transfers: 2 – 7 business days.

Common Mistakes to Avoid

1. Sending USDT on the wrong blockchain network.

2. Attempting to withdraw profits before the original deposit is refunded to the card.

3. Using an account or wallet not in your name.

4. Failing to provide documents when changing the withdrawal method.

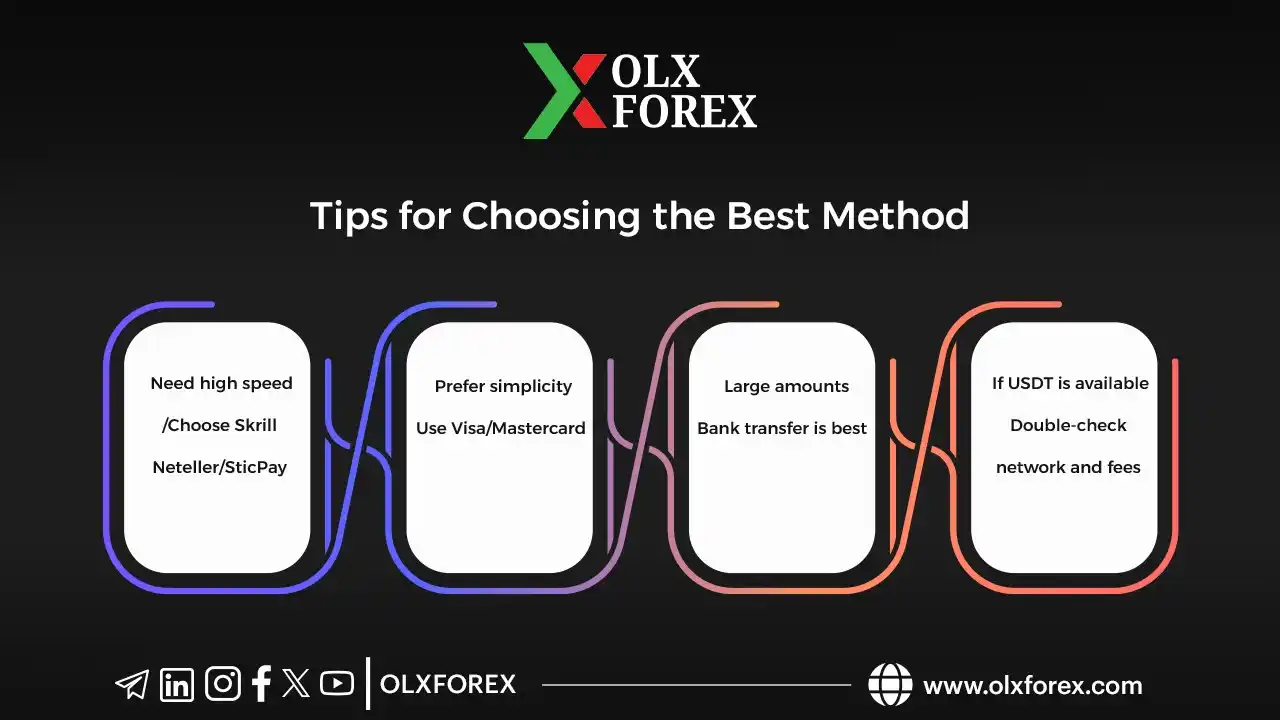

Tips for Choosing the Best Method

1. Need high speed ⇒ Choose Skrill/Neteller/SticPay.

2. Prefer simplicity ⇒ Use Visa/Mastercard.

3. Large amounts ⇒ Bank transfer is best.

4. If USDT is available ⇒ Double-check network and fees.

Conclusion

Managing your funds in the trading world is just as important as making buy and sell decisions. With XM, deposits and withdrawals are easier and more flexible thanks to a wide variety of options, from bank cards and e-wallets to local transfers and digital currencies such as USDT. These choices ensure a secure, fast, and convenient experience wherever you are.

If you are looking for a broker that combines trust, professionalism, and financial flexibility, XM offers the ideal solution so you can fully focus on developing your strategy and achieving your investment goals.

FAQ

1. What is the fastest deposit method at XM?

The fastest methods are bank cards and e-wallets such as Skrill and Neteller, with nearly instant processing.

2. Does XM charge fees on deposits or withdrawals?

XM does not charge any fees, but banks or payment providers may apply additional charges.

3. Can I deposit or withdraw using digital currencies like USDT?

Yes, in some countries XM supports USDT deposits, but availability depends on your location. Check your Members Area to confirm.

4. How long does a bank transfer withdrawal take?

Usually 2 to 5 business days, depending on intermediary and local banks.

5. What is the minimum deposit at XM?

The minimum deposit usually starts at 5 USD, but may vary depending on the payment method and account type.

6. Do I have to withdraw using the same deposit method?

Yes, according to XM policies, withdrawals are always processed first to the same deposit method (especially bank cards) to ensure security and comply with anti–money laundering rules.

7. Are local transfers available in all countries?

No, local transfers are only available in countries where XM cooperates with local banks or payment providers.