How to Start Trading Without Large Capital

How to Use Small Accounts or Leverage Strategies

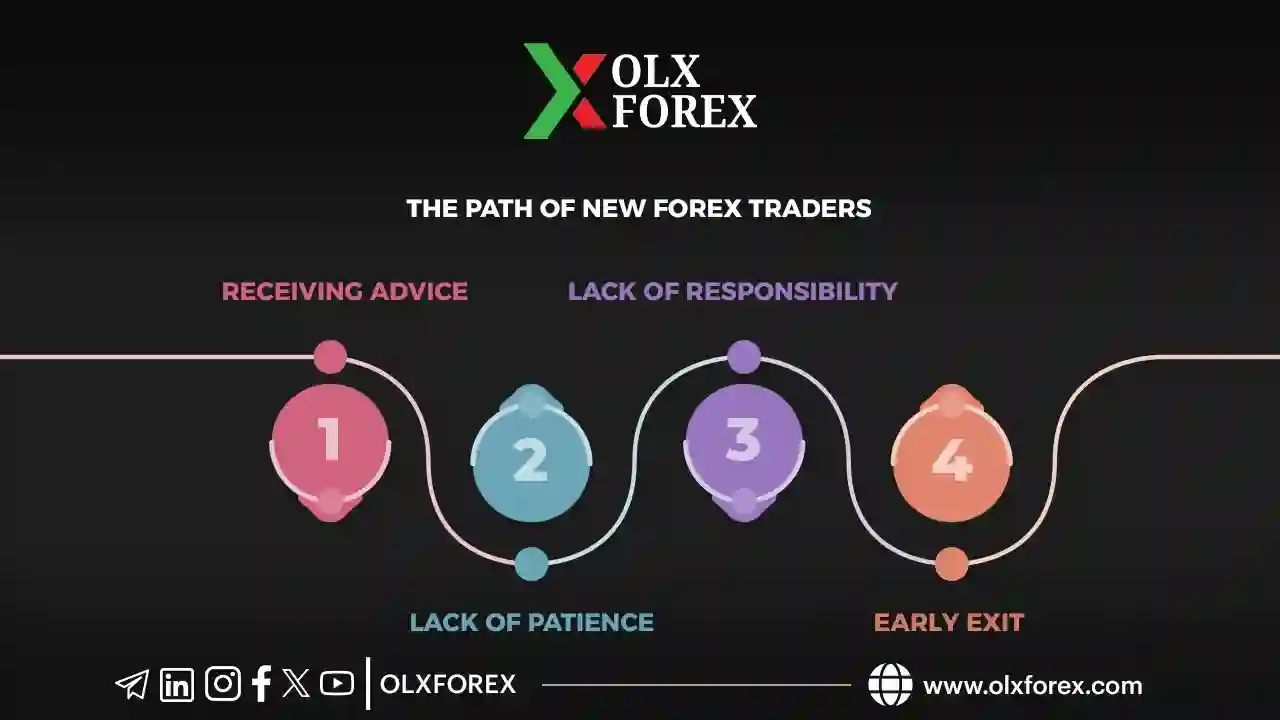

Many professional traders often advise their beginner counterparts that they cannot achieve impressive results in the foreign exchange market if they start their journey with small capital. However, in reality, this advice is not directed at everyone. It’s crucial to understand its true meaning, as these words are primarily meant for traders who lack patience and responsibility. Unfortunately, these traits are common among many new traders trying their luck for the first time in the forex market. It goes without saying that most forex traders leave the market after a short period.

What Are the Risks of Using a Small Account in Forex Trading?

If you start your journey with a balance of just a few hundred dollars or less, you are likely to feel the pressure of growing your account quickly. This pressure often leads traders to open many trades without focusing on those that offer the best chances of success, thus risking a significant portion of their capital. The inevitable result is the accumulation of losses sooner or later, which causes the account balance to evaporate in a short period. Most of these traders are forced to leave the market because they cannot return after losing their money.

How to Manage Small Accounts Effectively:

Given that the smallest trade size in forex is 0.01, which corresponds to 1,000 units of the base currency, it’s not difficult to do the math and calculate the minimum amount needed to start trading. To do so, consider the leverage you will use, the percentage of capital you're willing to risk in a single trade, and the number of open trades you want to handle at once.

If you're unsure about the calculations, you can always make risk-free trades on a demo account or get a welcome bonus account from a brokerage firm. These options allow you to test the trading mechanics as well as the company's service quality.

Once you've completed this step, it’s important to choose the appropriate leverage size for your account. You should understand that the higher the leverage, the greater the risk for each trade you open. Therefore, we recommend choosing moderate leverage ratios, such as (1:100) or (1:200), especially if your balance is under $1,000. Avoid using a lot size greater than 0.01 and don’t trade more than two positions at once. Stick to stop-loss levels, and avoid high-risk trades.

The final step you need to understand is how effective your risk management is and how accurate your trading strategy is. This can be done by using various technical analysis tools, or by learning them if you're still a beginner. Alternatively, you can follow expert analysts and consult them for market trends and the best available opportunities. All these services are available on our official website, OLX Forex, whether through the educational library, special recommendation services, or private advisors.

You can always contact the OLX Forex team to get free advice on everything related to Forex companies➡️ from here before starting to deposit your money so as not to lose it with one of the unreliable companies.