Opportunity to buy US stocks.

HSBC analysts raised their rating on US stocks

from "neutral" to "overweight" on Wednesday.

The bank noted optimism about artificial intelligence

and the expected support from a weaker US dollar

with a high probability of increased business activity.

The bank stated that looking at previous stock price increases

in the face of uncertainty, we find that risk assets were mostly

recovering rather than suffering.

The bank added that in the short term, we may see a strong rally in stocks

due to the possibility of a US tax cut, which could stimulate

stocks to rise in the coming period.

The bank indicated that it sees the decline in the second quarter of the year

as a good opportunity to reposition and buy US stocks.

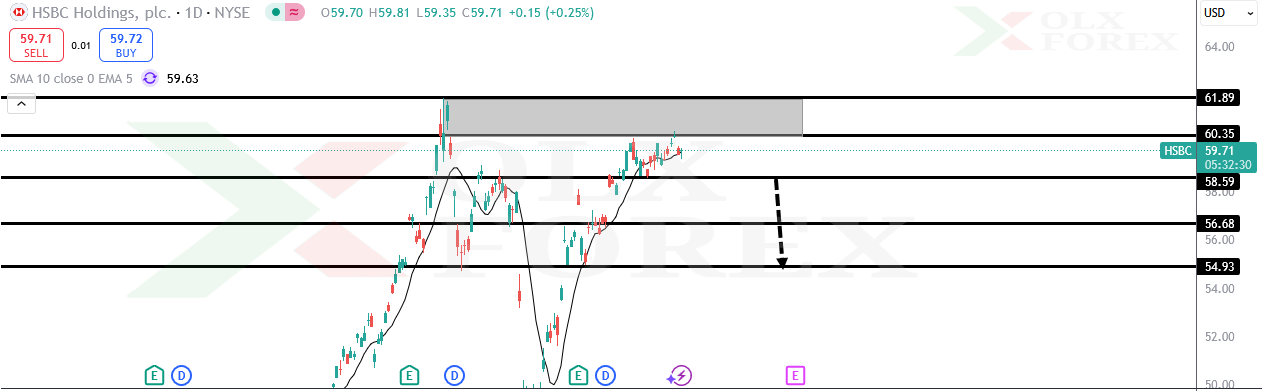

Technically, HSBC shares:

The stock has reached strong oversold supply zones.

The stock has already begun to rebound and is currently moving in a sideways direction.

We are only expected to see a decline in the stock if it closes

below the support levels, specifically below the 58.59 level.

This could push the stock further down to the targets specified on the chart,

which are located at the 56.68 and 54.93 levels, respectively.

If the oversold zones are breached and the stock closes above them,

specifically, a full candle close above the 61.89 level,

the stock may continue to rise in the short and medium term.