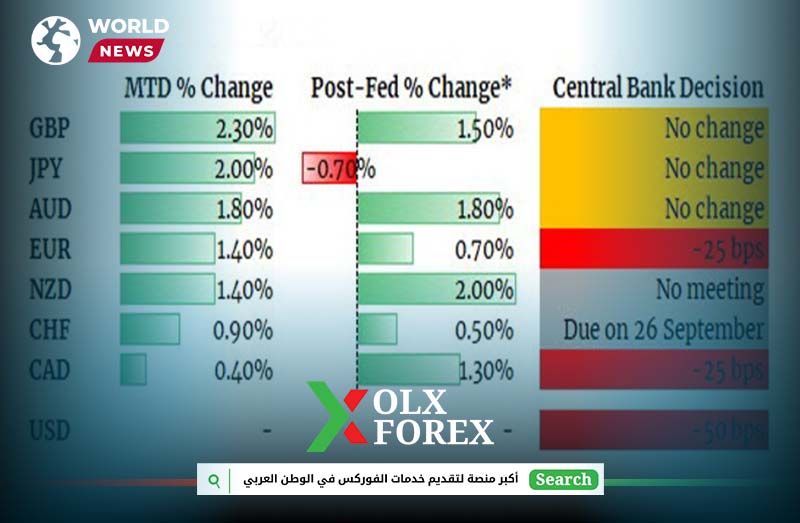

This illustration shows how things went after the Fed's decision last week to cut interest rates by 50 basis points, along with what other major central banks have done this month.

With the exception of the yen, the dollar weakened significantly against all major currencies, the Australian dollar, the pound sterling, and also the New Zealand dollar were the most positive, as the Reserve Bank of Australia and the Bank of England continue to maintain a more restrained policy stance.

The thing that the Fed showed us this month is that it can be pushed into a decision by the markets, and the main variable that drives the pace of interest rate cuts now will be how economic developments will develop.

According to the current situation, Fed Funds futures show a 59% probability of lowering interest rates by 50 basis points for November already.

The decline in two-year Treasury yields to 3.52%, which is a two-year low, also does not help support dollar sentiment at the moment, even with 10-year Treasury yields holding steady at 3.74%.

Forecasts now suggest that the Fed may cut interest rates faster and reach the final interest rate faster than any other bank, It is possible that US interest rates will stabilize at about 3%.

The rest of the central banks that are cutting interest rates more slowly will therefore have to catch up with the Fed in cutting interest rates faster in the future.

So, then it is possible that the dollar will return to its strength again. But for now, the market's focus remains on how quickly the Fed will cut interest rates and not on where interest rates may end at the end of the cycle yet.

Until this focus changes, the dollar may find itself in a more vulnerable position during the current period.