Trading Gold and Commodities as Popular Investment Tools During Economic Crises

During economic crises, investors and traders often seek safe havens to protect their wealth from inflation and capitalize on the situation to earn substantial profits. The search for such investment tools intensifies during challenging economic times, with certain assets emerging as key options to grow wealth and diversify investment portfolios. In this report, we will explore some of these tools that offer both security and potential for strong returns.

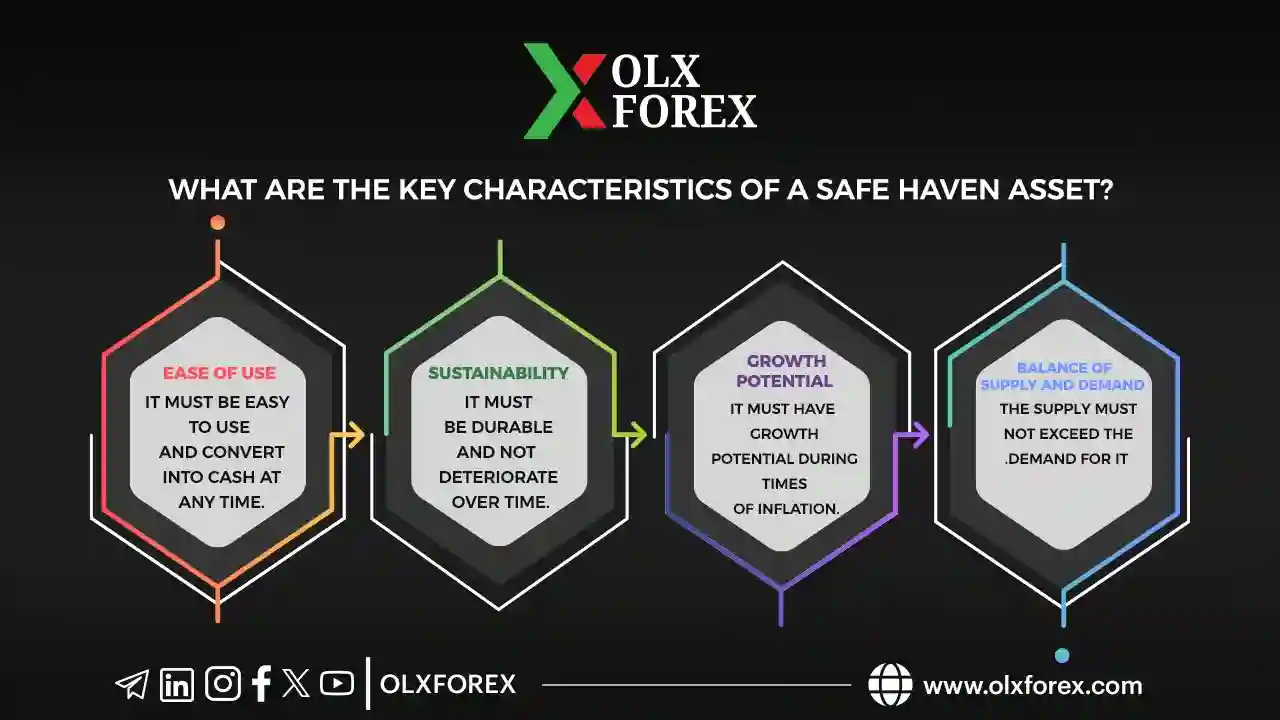

What Are the Characteristics of a Safe Haven?

A safe haven is an investment tool with specific characteristics that make it the ideal choice in difficult times. Key traits include:

Ease of Conversion to Cash: It should be easy to sell and convert into cash at any time.

Stability: The asset should remain resilient and not deteriorate over time.

Growth During Inflationary Periods: It should have the ability to appreciate in value during inflation.

Limited Supply with High Demand: The supply of the asset should be restricted, ensuring sustained demand.

Best Safe Havens and Investment Diversification

1. Gold:

Gold is considered one of the strongest and most reliable safe havens that investors turn to during economic crises. It has a proven track record of preserving wealth and generating strong returns. Over the past few years, from the COVID-19 pandemic to the ongoing war in Ukraine and the current instability in the Middle East, gold has seen a consistent upward trend, reaching new record highs.

Since the outbreak of the COVID-19 pandemic, gold prices have surged, and this upward trajectory has continued, making it one of the top choices for investors seeking security in times of crisis. Gold has proven itself as one of the best, if not the best, investment options during such challenging times.

2. Investment Funds:

Investment funds are a favorite investment tool for many due to their diversified nature. These funds combine investments in currencies, stocks, bonds, gold, and even cryptocurrencies like Bitcoin. This diversification allows investors to earn returns even during periods of economic downturn.

3. Government Bonds:

Government bonds are among the safest and most stable investment tools during crises. The bonds of countries like Japan, the United States, and Switzerland are considered some of the best in the world. These bonds are considered the most secure and stable investments in times of economic uncertainty.

4. Defensive Stocks:

Defensive stocks, which are often linked to sectors like energy and pharmaceuticals, are another strong investment choice during economic downturns. These stocks are typically less volatile during recessions and provide steady dividends, even in times of economic slowdown.

5. Currencies:

Certain currencies are considered good investment tools during economic crises. Notable examples include the Swiss Franc, the US Dollar, and the Japanese Yen:

Swiss Franc:

The Swiss Franc is one of the strongest currencies due to Switzerland's stable economy, its political neutrality, and the strength of its banking sector.

US Dollar:

The US Dollar is one of the most important currencies globally and is considered a global reserve currency. It has high liquidity and is closely tied to gold, making it a reliable choice for investors.

Japanese Yen:

As the currency of the third-largest economy in the world, the Yen is also a safe haven during market volatility, especially when US bonds and stocks are fluctuating. Its liquidity, along with the country’s economic stability and low interest rates, make it a solid investment during times of uncertainty.

Important Considerations Before Investing

Before diving into any investment, it is essential to be aware of key economic events and understand the type of market you are entering. Additionally,

consider the following:

Return on Investment:

What is the expected return from this investment?

Risk Level:

What is the level of risk associated with this investment?

Naturally, the return on investment should ideally be at least double the level of risk, and in many cases, it is advisable to aim for returns that are three times the risk. It is crucial to thoroughly assess these factors before committing to any investment strategy.