Currency Floatation: Types and How to Navigate It

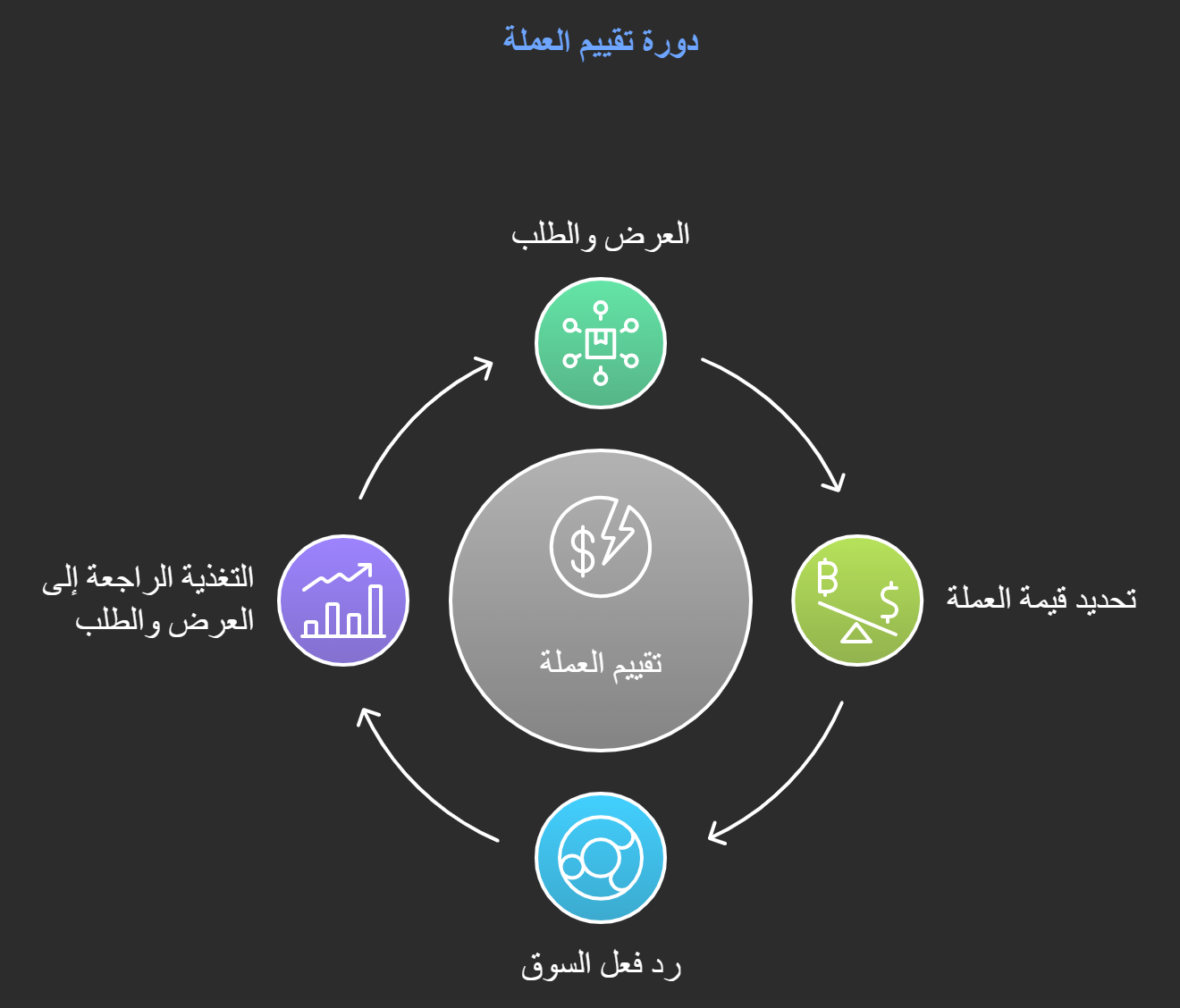

*Floatation* refers to the process of determining a country’s currency value without direct intervention from the government or central bank, based on supply and demand in the foreign exchange market.

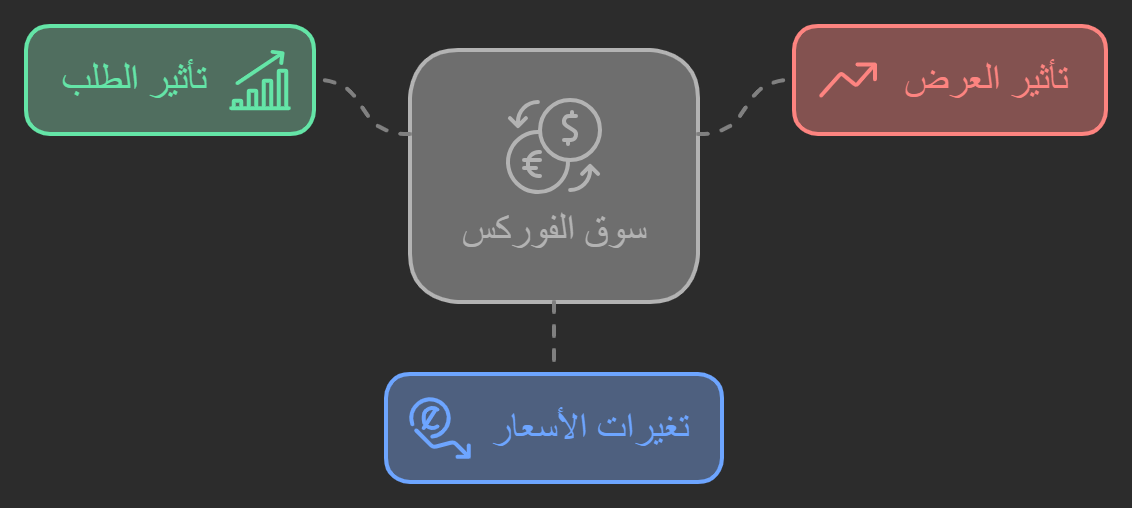

Forex Market

If demand increases, the currency's value rises; if selling increases, its value drops. Prices can fluctuate multiple times a day.

In this context, central banks do not target a specific exchange rate compared to other currencies when implementing a *full float*; rather, they allow it to fluctuate similarly to commodity prices like gold or silver, which change frequently.

The history of floatation dates back to the early 1960s when political and economic developments prompted a search for alternatives to the Bretton Woods Agreement, which had established fixed exchange rates tied to the US dollar. Eventually, it became impossible to manage the continuous fluctuations among the currencies of the signatory countries.

The system began to collapse, leading to thoughts of floating currencies. The *Smithsonian Agreement* of 1971 supported this shift by allowing countries to adjust their exchange rates by up to 2.25%. However, this agreement faced numerous issues, prompting Japan and some industrialized nations to float their currencies in 1973. Following their success, other industrialized countries adopted similar policies, which evolved into one of the preferred methods for supporting national economies and achieving economic goals.

Additionally, the *IMF Agreement* in 1976 confirmed that currency floatation contributes to the International Monetary Fund's reforms, representing an effort to adapt to new global economic developments.

Types of Floatation

There are different forms of currency floatation, classified based on the central bank’s approach in managing the currency’s stability:

1. *Free or Absolute Float*:

In this pure float system, supply and demand primarily determine the currency exchange rate, with minimal state intervention. Countries with developed capitalist economies, such as the USA, the UK, and Switzerland, typically adopt this approach.

2. *Managed or Directed Float*:

In this type, the exchange rate is primarily determined by supply and demand, but the government or central bank can intervene to guide the currency value up or down as necessary. This is often a response to significant discrepancies between supply and demand or changes in global economic conditions that affect currency values. Governments use this method to adjust their currency exchange rates in line with economic fluctuations.

This managed float is now used in many capitalist countries as well as in numerous developing nations, where currency values are often linked to the Euro, British Pound, or US Dollar, which continue to dominate the global foreign exchange market.

Avoiding Negative Effects of Floatation

To mitigate the adverse effects of floatation and preserve the value of your assets, consider investing in stable value assets, such as gold, which serves as a safe haven, or purchasing real estate, which tends to appreciate over time. This approach helps reduce the amount of liquid cash held in banks, protecting against currency value fluctuations.