The statements of Neel Kashkari, a member of the Federal Reserve Board, were as follows:-

- This reflects the progress in inflation and the easing of the labor market.

- The balance of risks has shifted towards the risk of further easing of the labor market.

- It is too early to declare victory in the face of inflation, but the process of deflation of inflation is on the right track.

- The policy remains tight, although it is uncertain how tight it will be.

- The course of federal interest rates will depend on the totality of the data received.

- The signals about economic strength have been confusing, with consumer spending surprisingly resilient.

- There is little evidence that recessionary forces are accumulating or that inflation may surprise the uptrend.

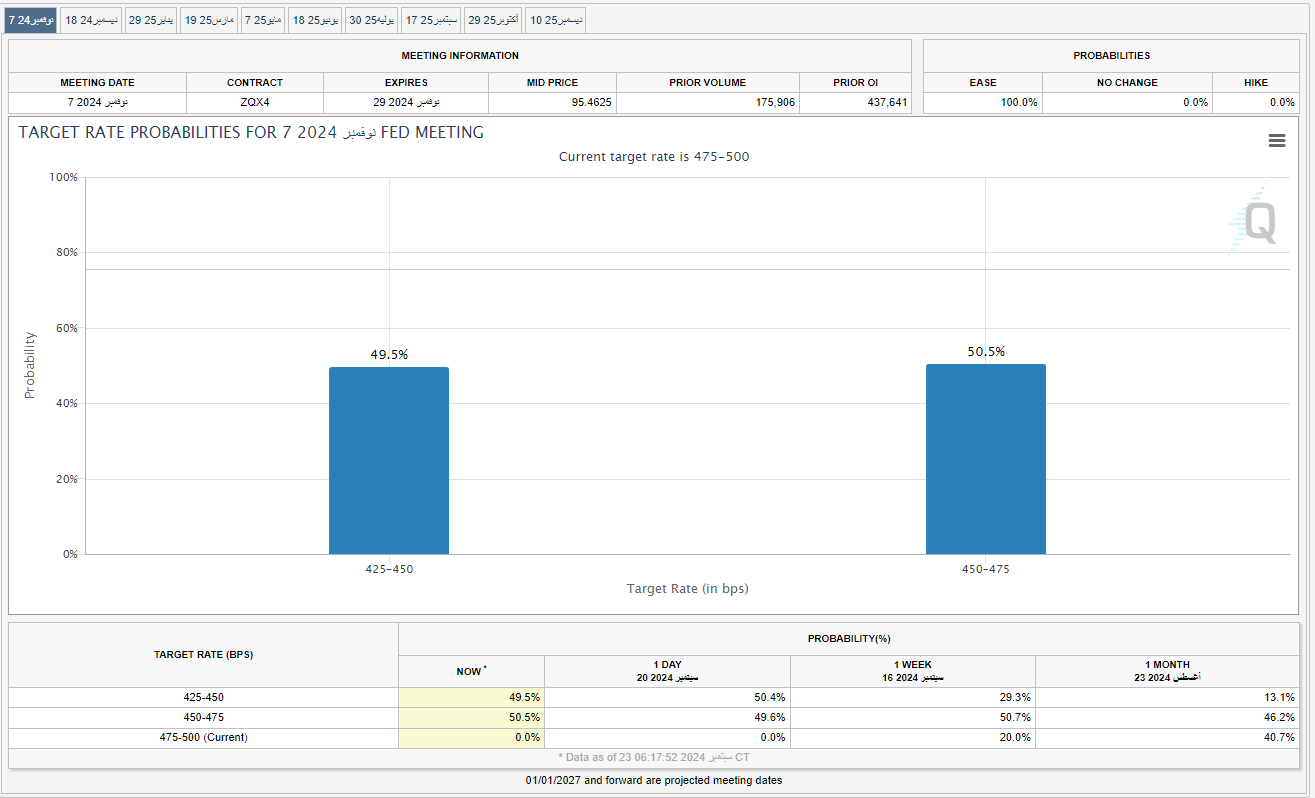

Traders now expect that the probability of another 50 basis point interest rate cut next November will reach about 50.5%.