Explanation of the Triple Top model

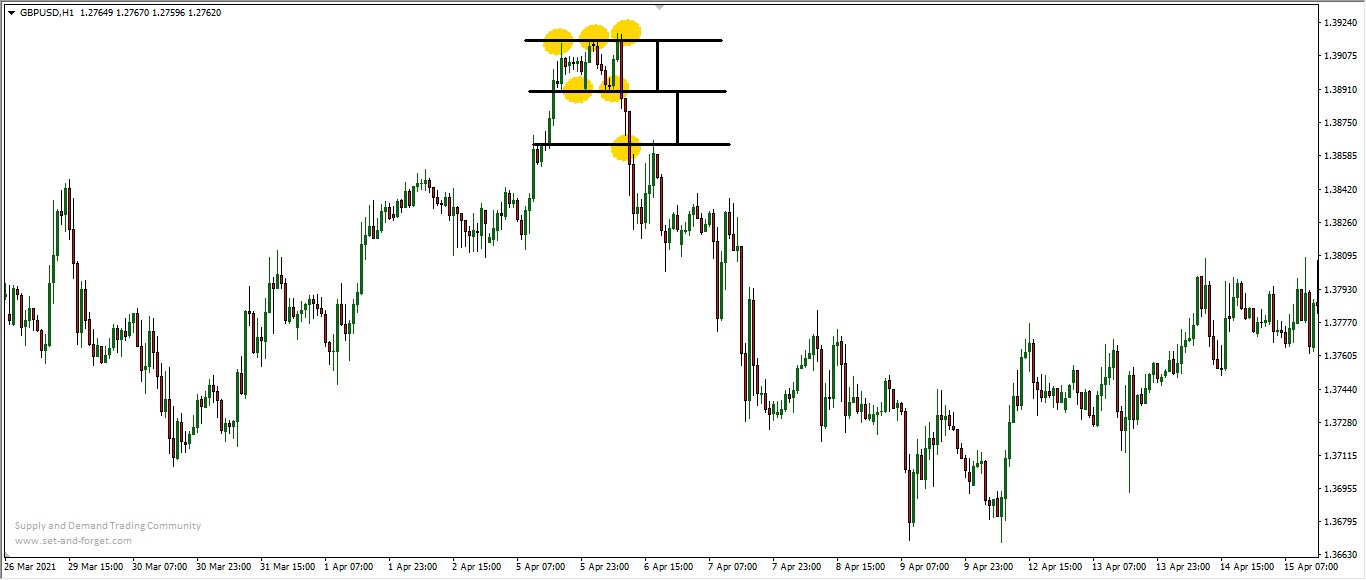

The triple top pattern is one of the classic reversal patterns.

A strong model that changes the trend from up to down The pattern comes at the end of an uptrend and changes direction to a downtrend Or it comes at the end of the upward corrective wave in a downward trend.

The pattern consists of three peaks, the second and third peaks may be at the same level as the first peak Or slightly above or slightly below the first peak. In all cases, it is considered a second peak and the model is considered correct.

How is the model formed?

Buyers rise in prices to form a new high and then sellers appear To push prices down to form a bottom or what is called a neckline Then buyers reappear and prices rise to form the second peak Then sellers reappear and prices fall to test the previous low Then buyers rise in prices again to form the third peak.

Explanation of the Triple Top model How to benefit from the form

As we mentioned, the model is one of the important classical reversal models There are two ways to enter based on the form..

The first method: is to enter after breaking the bottom, or the so-called neckline

The second method: is to wait for the bottom or neckline to break, and then wait Return to retest the broken bottom and then enter.

How is the goal determined?

The distance between the peaks and the neckline is measured The same distance is taken as a target for sales operations.

To learn more models from here ⬇️

The most important harmonic models and how to use them

Reflexive candles (hammer candle - inverted hammer candle)

What are the price gaps, their types and how do we use them in trading?

Support and resistance levels what they are and how they are extracted

Explanation of the Double Bottom model

Explanation of the Double Top model