About the Index

The Nifty 50 Index is the most important index of the Indian Stock Exchange.

It is the primary indicator of the state of the country's economy.

It was launched on April 22, 1996.

The index is managed by NES.

The index symbol is NIFTY 50 or NESI.

The index comprises the 50 largest companies listed on the Indian Stock Exchange

in terms of liquidity and market capitalization.

These companies represent more than 65% of the total market capitalization of the Indian stock market.

Key Sectors

The index comprises approximately 16 different sectors.

The most important sectors include:

Energy

Information Technology

Financial & Banking

Telecommunications

Pharmaceuticals & Healthcare

Consumer & Consumer Goods

Major Companies Listed in the Index

Adani Enterprises

Axis Bank

Bajaj Auto

Apollo Hospitals

Cipla

Eternal

ICICI Bank

Titan Company

State Bank of India

Power Grid

Trading Hours

Main Session: 9:15 AM - 3:30 PM

Pre-Opening Session: 9:00 AM - 9:15 AM

Closed: Saturday & Sunday

All times are in Indian Standard Time (IST).

How to Trade the Index

1. You can trade through Exchange Traded Funds (ETFs)

such as the Nifty BeES or Sensex ETF.

2. You can trade through futures and options contracts.

3. Buying shares of companies listed on the index.

4. Through Contracts for Difference (CFDs)

Such as through various brokerage firms that offer the index.

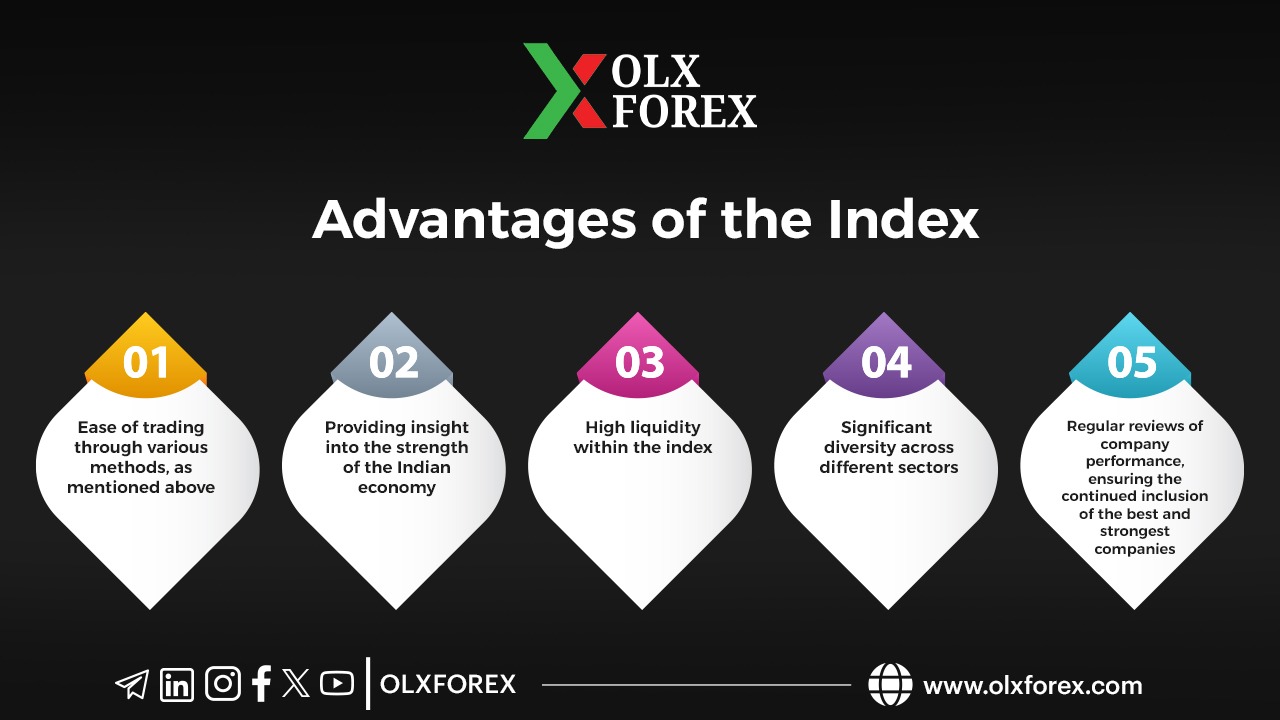

Advantages of the Index

1. Ease of trading through various methods, as mentioned above.

2. Providing insight into the strength of the Indian economy.

3. High liquidity within the index.

4. Significant diversity across different sectors.

5. Regular reviews of company performance, ensuring the continued inclusion of the best and strongest companies.

Disadvantages of Trading the Index

1. The index is easily affected by political and economic news in the country.

2. The influence of some large companies on the index's movement, such as Reliance and HDFC Bank.

3. Some restrictions on foreign investors in certain sectors.

4. Influence from global markets, especially decisions by the US Federal Reserve and oil price crises.

5. A concentration on certain sectors, such as banking and information technology.

Important Tips Before Trading

1. Closely monitor the index's movement and update your technical analysis daily.

2. Follow news related to both India and the United States.

3. Monitor the performance of investment funds specializing in India.

4. Closely follow central bank news, as it has a very strong and direct impact on the index.

5. Exercise caution while trading and ensure you have a robust money management system in place.