Bitcoin Flows Decline Due to Jerome Powell.

Cash flows into Bitcoin exchange-traded funds (ETFs) have declined,

following hawkish remarks from Federal Reserve Chairman Jerome Powell.

Investors are becoming more cautious at this time.

Net cash flows reached $603.7 million this week,

compared to net cash flows last week of $934 million.

The IBIT Fund accounted for the largest share, with $841 million.

It's worth noting that this fund is owned by the giant asset

management company BlackRock.

It's also worth noting that Bitcoin ETFs in the United States

on the ETFS exchange have held more than 18,000 coins in recent weeks.

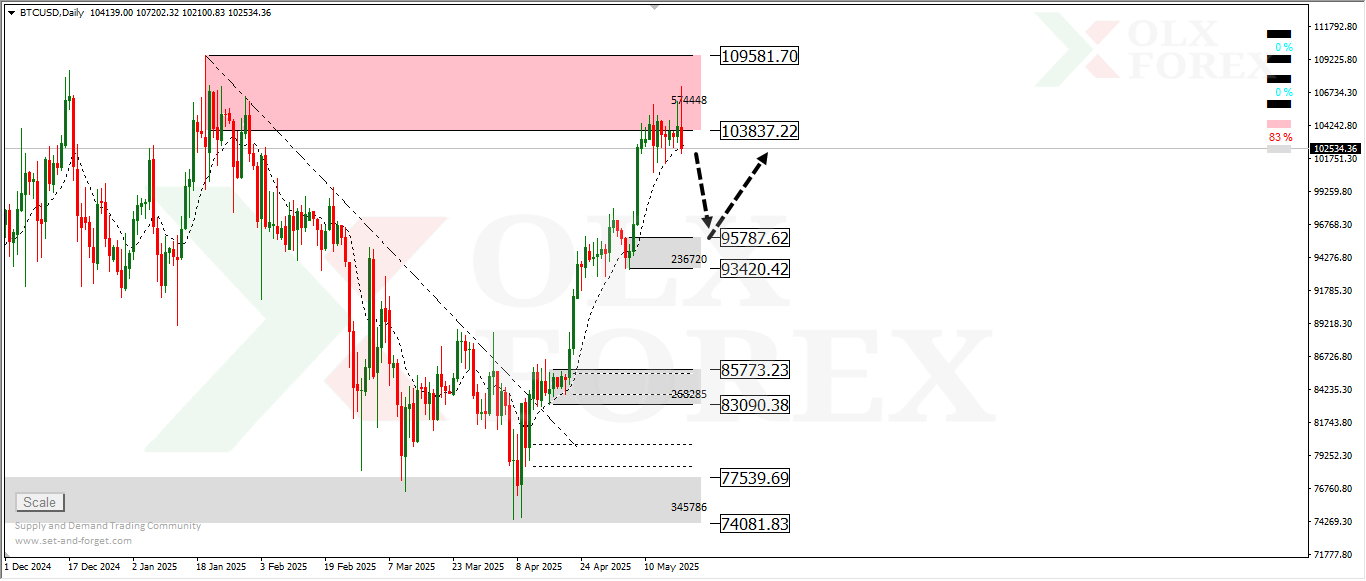

From a technical perspective, Bitcoin:

The currency has reached important and strong supply zones on the daily frame.

We are expected to see some corrections for the digital currency in the coming period.

These corrections may reach the demand zones below, near the 95,787 levels.

These are considered important buying demand zones at the present time,

and a return and rise from them is expected in the coming period.