Apple shares likely to decline ahead of earnings announcement.

MoffettNathanson warned that Apple's upcoming report will be difficult

to understand and warned that there is a possibility of a stock decline

before the third-quarter results announcement.

MoffettNathanson maintained its "sell" rating on Apple's stock with a target price of $139 per share.

Apple also appears to be facing some different problems.

After the tariffs, the company has now significantly reduced the price

of its iPhone Pro models in China to accommodate local government subsidies.

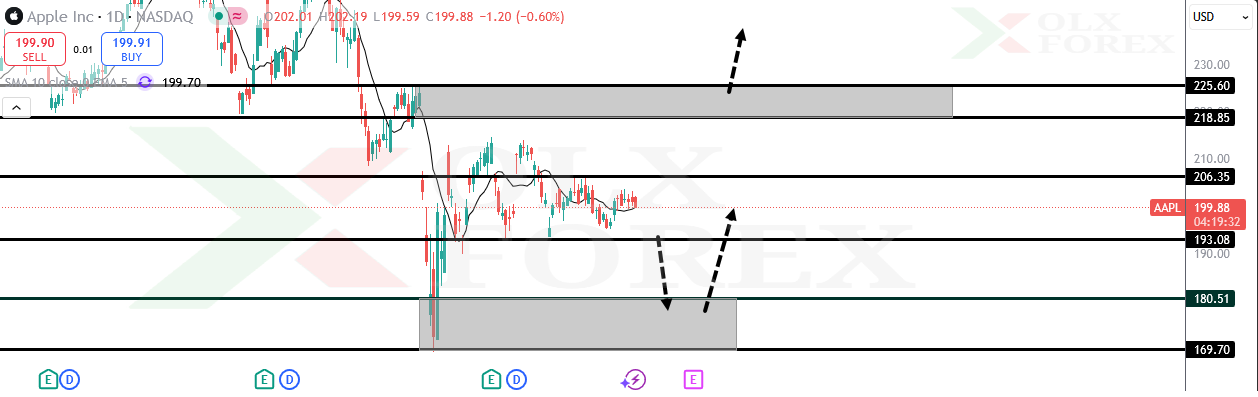

Technically speaking:

The stock is moving sideways, as we can see.

The decline may continue if the support levels are broken

and a close is reached below them, specifically below the $193 level.

The decline may continue until it reaches the demand zones at the $180.51 level.

From there, we may see the stock rise again.

However, if Q3 results are positive and there is other positive news

regarding tariffs, we may see the stock rise

to resistance levels above, near the $218 level.