An opportunity to buy NVIDIA stock with a new outlook from Barclays.

Barclays has raised its forecast for the tech giant NVIDIA stock,

now targeting $200 per share. The bank also maintained its "Overweight"

rating for the stock unchanged.

The bank also sees a strong upside potential of approximately 38%.

This forecast stems from increased demand for the company's supplies.

The company also raised its computing revenue estimate, now exceeding $37 billion.

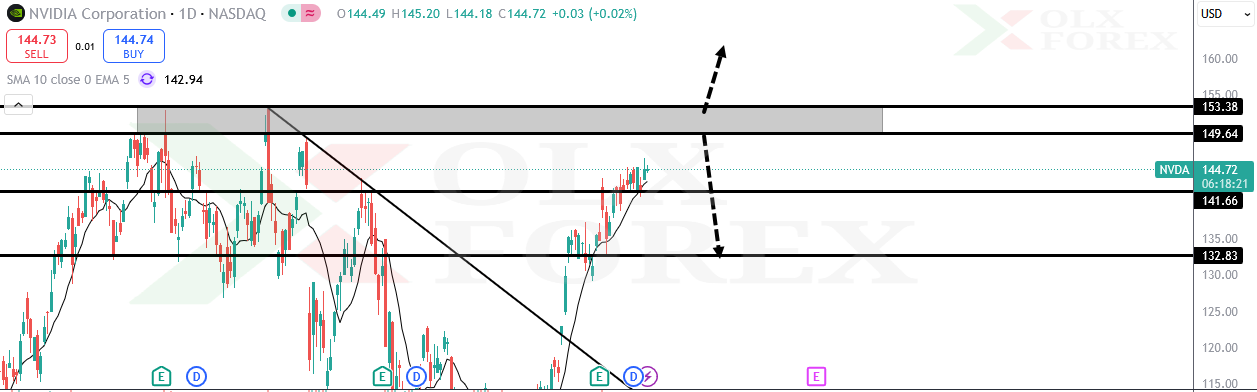

As for technical analysis:

The stock is still moving in a general uptrend.

Signs of weak demand and weak momentum are beginning to emerge,

indicating a possible medium-term correction.

The stock is still facing significant and strong resistance, as shown on the chart.

This resistance is located at 149.64, which could cause the stock to correct

toward targets of 141.66 and 132.83, respectively.

For the stock to continue rising, it must break through these resistance areas

and close above them with a full-day candle.

An opportunity to buy Nvidia shares with a new vision of Barclays Bank . Barclays bank raised its forecast for Nvidia stock