Strong demand for Ethereum.

The percentage of Ethereum coins on centralized exchanges has declined.

More than 15 million coins have been withdrawn from the exchange.

For long-term holdings rather than trading, these coins have been withdrawn.

This reflects investor optimism about the future price of the currency.

And the expectation is that we will see a strong price increase.

Institutional investment funds have begun increasing cash flows to buy Ethereum.

Ethereum spot funds in the US have recorded

net inflows of more than $30 million over the past month.

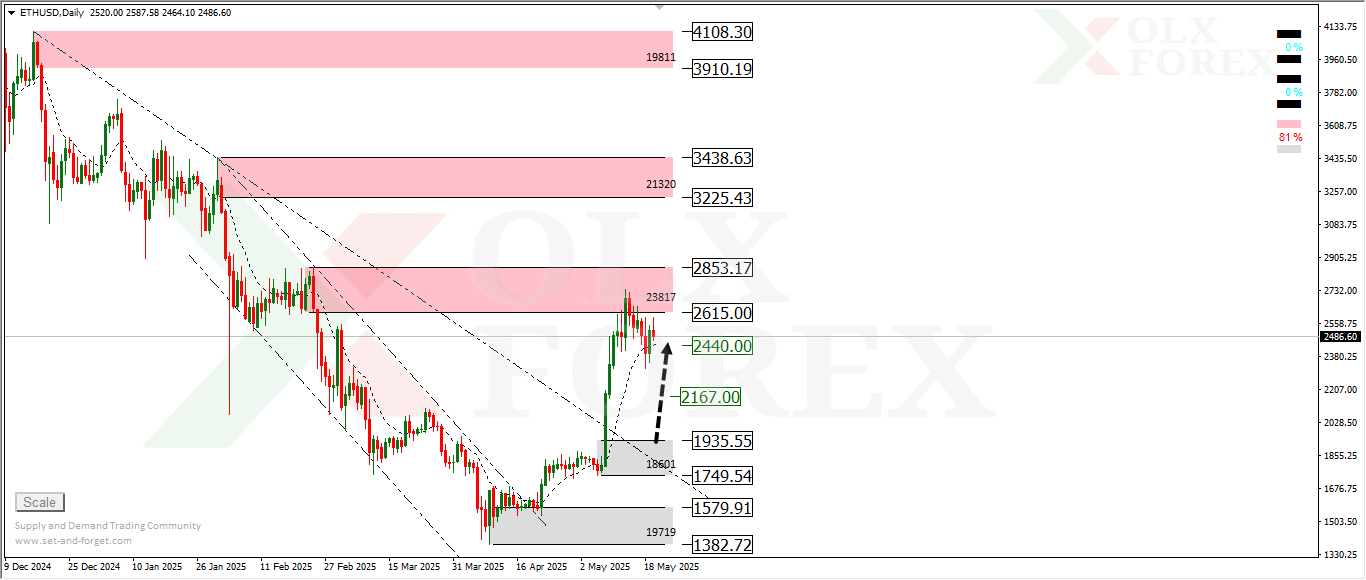

Technically :

The currency is facing significant supply areas, from which we may see some corrections.

In the event of a decline, demand areas at the 1935 level are considered.

The best areas to buy the currency again, targeting 2167 and 2440, respectively.

If the current supply zones, which constitute strong resistance areas,

are breached, the currency is expected to continue rising to the 3225 level.