How to Evaluate Companies and Stocks for Long-Term Investment

Investing in stocks is one of the best ways to grow wealth over the long term. Many investors look for the best stocks to invest in, aiming for high returns with minimal risk. Stock evaluation helps determine whether a stock is overvalued or undervalued, which is crucial for making informed investment decisions. For example, Tesla's stock is currently considered one of the most overvalued stocks.

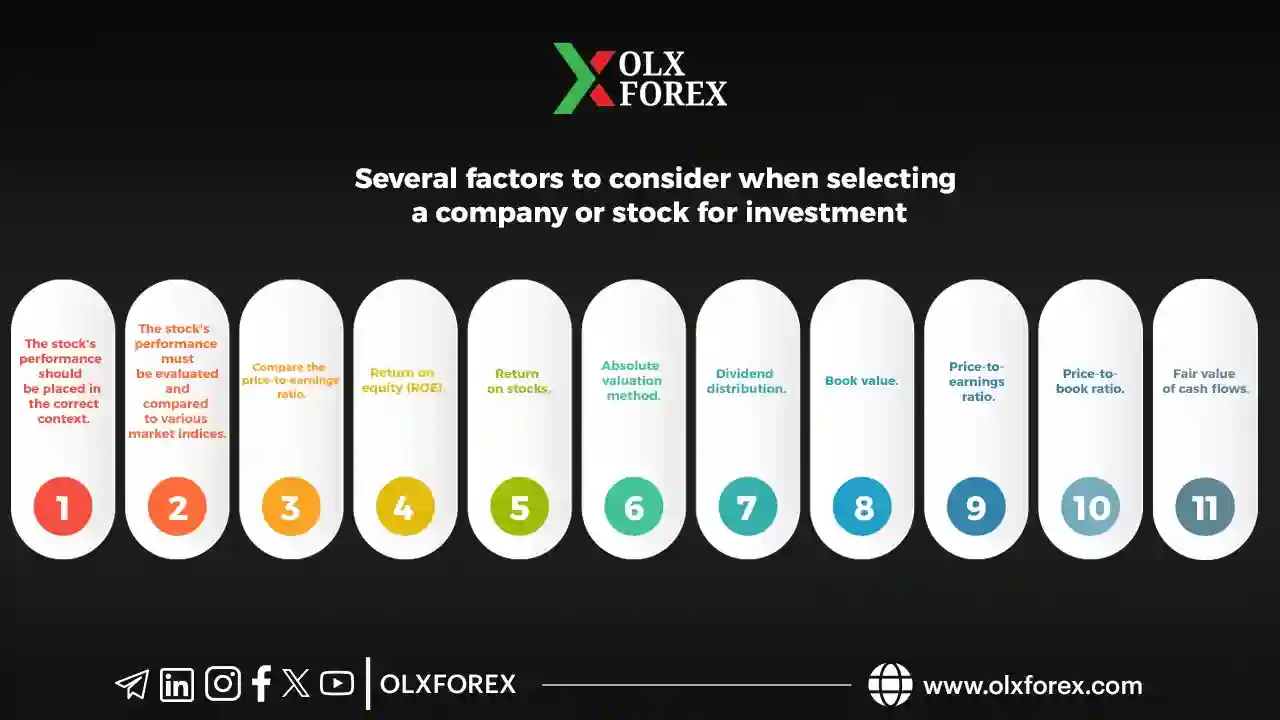

Factors to Consider When Evaluating Companies and Stocks for Investment

How to choose the right stock to invest

1. Assess Long-Term Stock Performance

Evaluate the actual performance of the stock over a long period, at least two years, to put its performance into the proper context.

2. Compare Stock Performance with Market Indices

Analyze the stock’s performance against various market indices. Choose an index that includes multiple stocks as a benchmark for comparison.

3. Price-to-Earnings Ratio (P/E Ratio)

Use the formula:

Stock Price ÷ Earnings Per Share (EPS)

This ratio indicates whether investors expect future growth or if the stock price is overvalued, which might lead to a potential decline.

4. Return on Equity (ROE)

ROE reflects the company’s profitability relative to shareholders' investments. A higher ROE indicates better returns for investors.

5. Earnings Yield

This metric compares a company’s earnings to its financial results. It’s one of the most critical indicators of a company’s financial health.

6. Absolute Valuation

Evaluate the stock based on the company’s financial statements. This helps determine spending patterns, debt levels, repayment capabilities, and profit margins.

7. Dividend Distribution

Check whether the company distributes a portion of its profits to shareholders. Dividends can be distributed quarterly, semi-annually, annually, or irregularly, depending on the company’s policy.

8. Book Value

Calculate the company’s actual value by subtracting liabilities from its total assets. This gives a clear picture of the company’s worth to shareholders.

9. Price-to-Earnings Growth (PEG Ratio)

This ratio measures the stock price relative to earnings. A high PEG ratio indicates expectations of future growth but might also suggest overvaluation.

10. Price-to-Book Ratio (P/B Ratio)

This compares the stock’s market value to its book value. If the P/B ratio is high compared to other companies in the same sector, the stock may be overvalued.

11. Fair Value of Cash Flows

Evaluate the stock based on its cash flow value. If the cash flow value exceeds the stock’s market price, it indicates a good investment. Conversely, if it’s lower, the stock may be overvalued.

Final Thoughts

Take your time to thoroughly research stocks and assess their financial conditions. Monitor the company’s news and overall performance before making investment decisions. Patience and proper analysis are key to successful long-term investing.