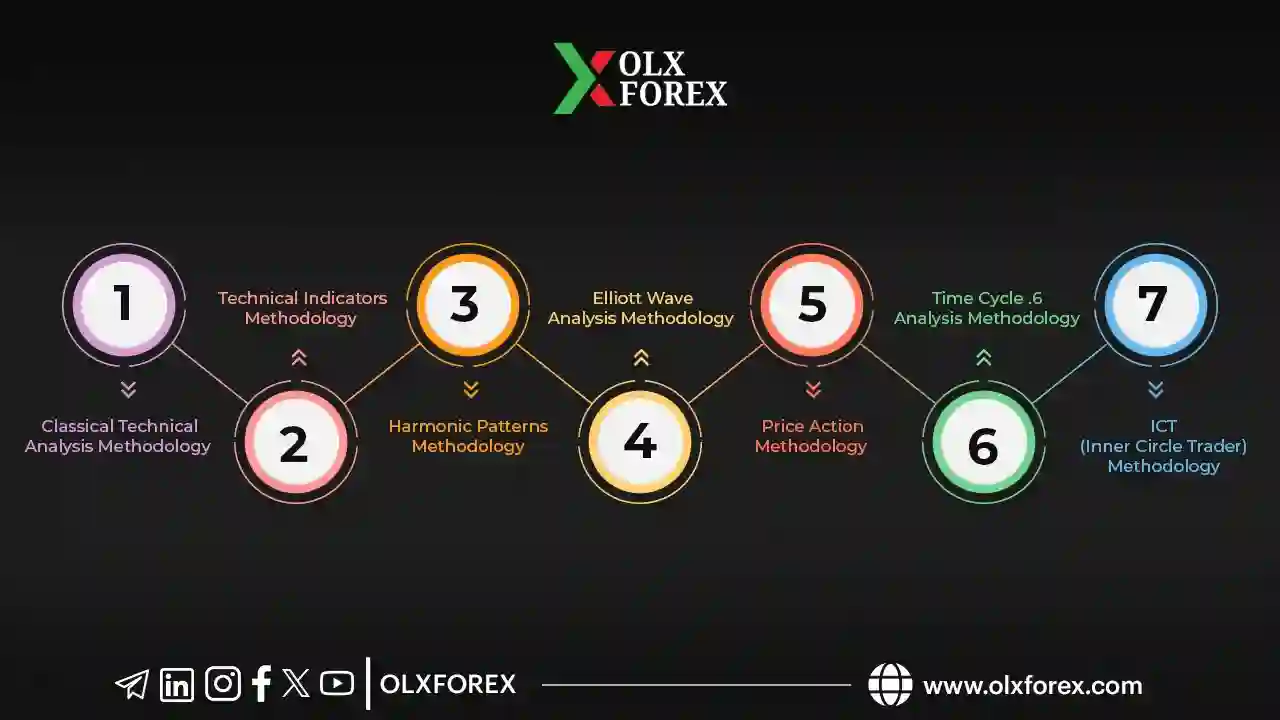

What are the Most Important Methodologies of Technical Analysis?

Technical analysis in the Forex market is divided into several methodologies, each with its own philosophy and tools.

Every methodology has its advantages and disadvantages, and your choice depends on your trading style. Some analysts even combine more than one school to gain a broader perspective.

Below are the most prominent methodologies of technical analysis in the financial markets:

1. Classical Technical Analysis Methodology

This methodology relies on Japanese candlesticks, support and resistance levels, trend lines, and price patterns such as Head and Shoulders and Divergence.

2. Technical Indicators Methodology

This methodology bases its entry and exit decisions on technical indicators such as Moving Averages, Relative Strength Index (RSI), MACD, Bollinger Bands, and others.

These tools are used to identify trends, momentum, and overbought/oversold conditions.

3. Harmonic Patterns Methodology

The Harmonic methodology, also known as the harmonic patterns school, uses Fibonacci ratios to identify price reversal zones.

It includes patterns like Gartley, Butterfly, Bat, and Shark.

This school requires precision in drawing patterns and determining entry and exit levels.

4. Elliott Wave Analysis Methodology

This methodology is based on Elliott Wave Theory, which assumes that the market moves in repetitive wave patterns that reflect traders’ psychology.

It includes impulsive and corrective waves, using Fibonacci ratios to determine targets.

5. Price Action Methodology

This methodology focuses on analyzing the price movement directly without using indicators, emphasizing Japanese candlesticks, price structures, and strong zones.

Some tools used include reversal candlestick patterns, break and retest setups, and ranging zones.

6. Time Cycle Analysis Methodology

This methodology relies on time cycles and their impact on prices, such as Gann cycles.

It aims to predict the timing of market reversals, not just the price levels.

7. ICT (Inner Circle Trader) Methodology

This methodology focuses on understanding market movements by analyzing Smart Money behavior and using advanced trading strategies.

ICT emphasizes concepts such as:

• Liquidity Pools: Identifying areas where large orders may flow.

• False Breakouts: Understanding how smart money exploits retail traders.

• Accumulation and Distribution Zones: Determining where smart money is buying or selling.

• Order Blocks: Identifying areas likely to cause price reversals.

Which Methodology is the Best?

Each methodology has its own strengths and weaknesses. The best choice depends on the trader’s style.

Some analysts combine more than one school to get a clearer and broader market view.

For courses on most of these schools, you can visit the educational section at OLX Forex Academy from here