How to Build a Successful Trading Strategy

The field of trading in financial markets relies on many variables and influences that may leave you in a state of confusion when making the decision to buy or sell. Therefore, you must realize that it is not as easy as many amateurs think. At this point, you need to have a solid and effective method to answer your daily questions (Is the market available for selling now, or for buying?).

The only way to determine your decision is through your own trading strategy, which sets the conditions for entering buying or selling trades.

In this article, we will explain in detail how you can build a successful trading strategy based on important criteria that must be clearly defined, no matter which technical analysis school you follow.

The steps to building a successful trading strategy can be summarized in 4 key criteria as follows:

Type of Strategy (Trend-following or Reversal)

Tools (These are the tools from the technical analysis school you use)

Trading Style (This is your personal approach to trading) and it has several forms (Scalping, Day Trading, Swing Trading) which will be explained in detail.

Financial Assets (Here, it refers to defining the pairs you will trade)

The table below shows these four criteria, as mentioned, which you should consider when deciding to build your own effective trading strategy.

Here’s an explanation of each in detail:

First: Type of Strategy

In this step, you determine whether you will trade with the trend or with reversal zones. Based on this decision, the technical tools you use will be determined. For example, if you are working on trend-following trades, you should focus on classical continuation patterns and trade with them. Conversely, if you're trading reversal zones, you should focus on classical reversal patterns, the Harmonic trading school, or any other reversal-based methodology.

What's important here is that you can work with both types of strategies. In this case, the strategy is considered a hybrid, meaning it includes both trend-following and reversal trades. This requires you to combine analytical tools and demands broader experience using multiple technical schools simultaneously.

Second: Strategy Tools

The second important step is to determine which analytical tools you will rely on, or more generally, what type of analysis you will use: technical analysis or fundamental analysis, and which specific technical school you will follow. The following diagram illustrates how to choose between the different types of analysis methods.

As shown in the previous diagram, you determine whether you will rely on technical analysis or fundamental analysis, and which specific technical school you will follow. This will guide you in choosing the tools to use for identifying entry opportunities.

Third: Trading Style

The third step in building a strategy is to define your trading style or approach. In this step, you determine the type of trades you will execute, their objectives, and the appropriate time frame to work with. This is illustrated in the following diagram.

Fourth: Defining Financial Assets

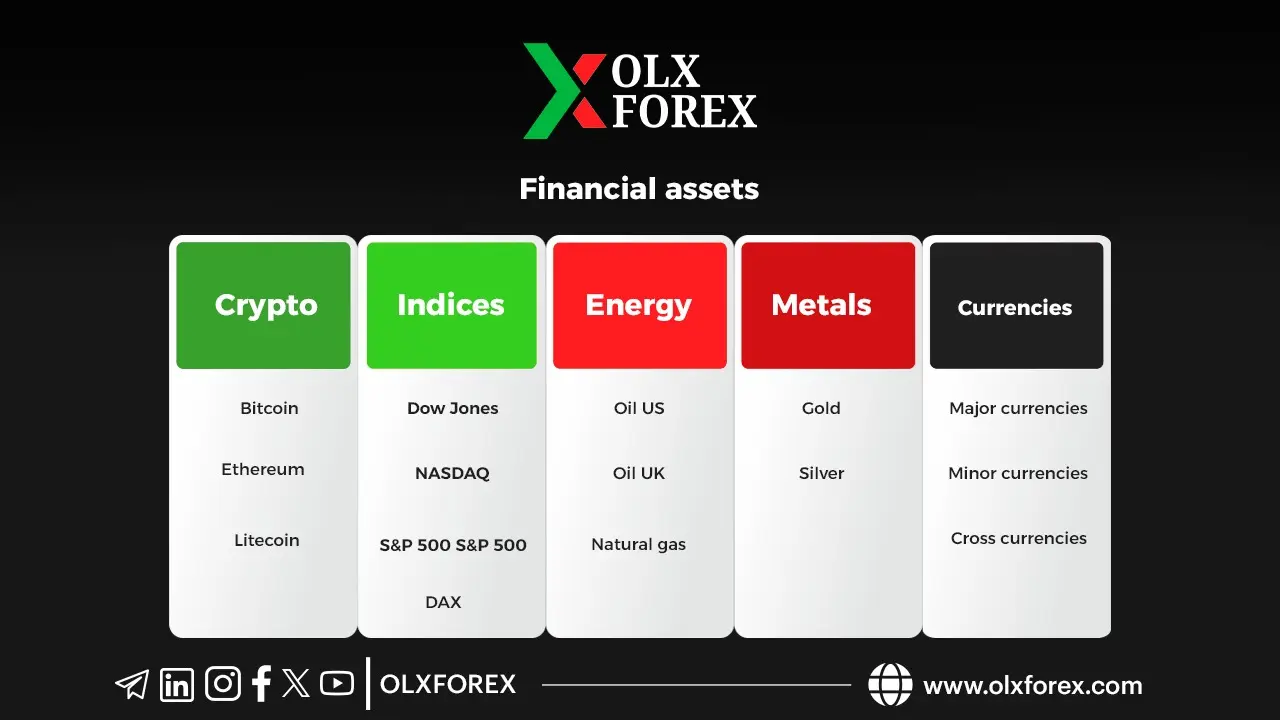

What is meant by defining financial assets here is determining the trading pairs that you will follow and identify entry opportunities for using the analysis tools of the technical school you rely on. This step is the fourth and final one in building a successful trading strategy. Through this step, you can choose the most suitable pairs for your specific trading style and approach.

The following chart illustrates the most important pairs you can trade, including various currency pairs, metal pairs with gold being the most significant, energy pairs with U.S. oil being key, major U.S. stock index pairs, and finally, cryptocurrency pairs, with Bitcoin leading the way.

For more to see the ready-made strategies and learn from them, you can watch these courses

The Divergence Strategy

Haiken Ashi's Strategy for Trading with the Trend

supply and demand with divergence

TDI strategy developed

False breach Strategy