Digital Analysis An Innovative Tool for Understanding Financial Markets

In the modern trading world, digital analysis has become one of the most effective tools for predicting financial market movements. This type of analysis relies on studying historical numerical data to identify patterns and forecast future trends. Digital analysis is an ideal method for traders seeking a precise, data-driven approach to making successful investment decisions.

What is Digital Analysis?

Digital analysis is an approach based on numbers and quantitative data to analyze financial markets. Unlike technical analysis, which focuses on charts, or fundamental analysis, which considers economic factors, digital analysis utilizes mathematical algorithms and statistical models to analyze price movements and predict future trends.

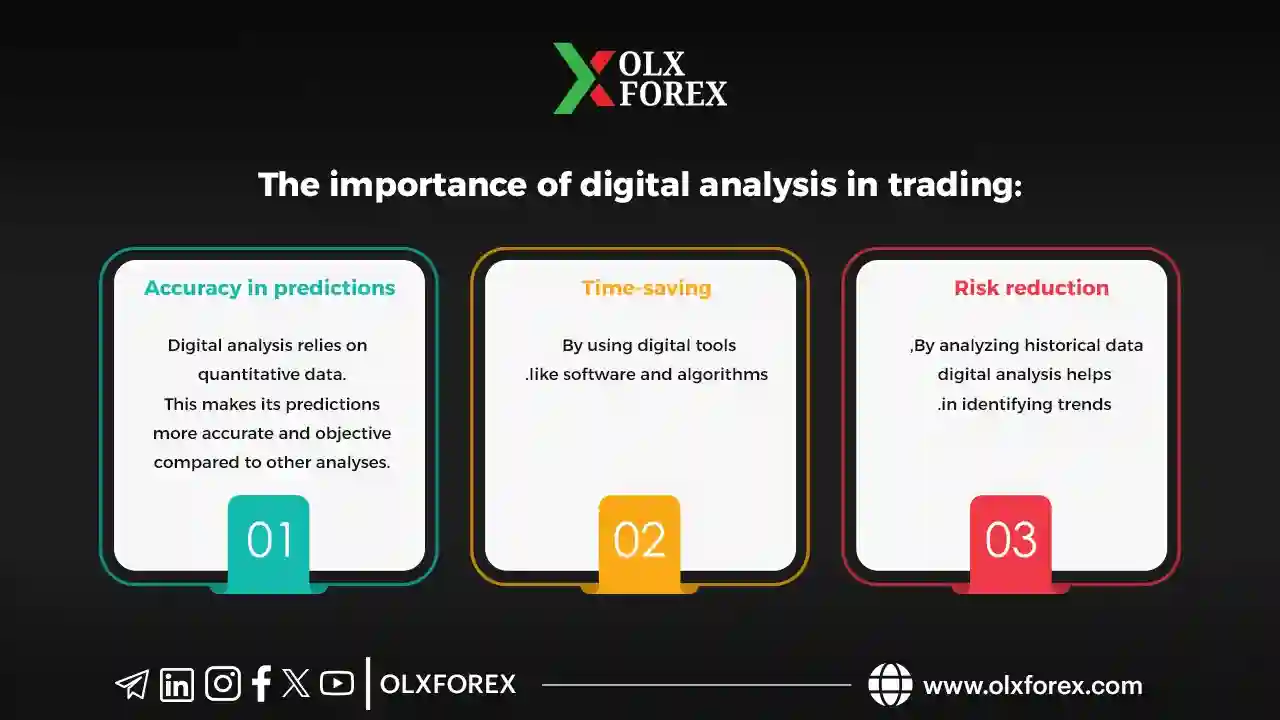

The Importance of Digital Analysis in Trading:

1. Accuracy in Predictions: Digital analysis relies on quantitative data, making its forecasts more precise and objective compared to other forms of analysis.

2. Time Efficiency: By using digital tools such as software and algorithms, traders can analyze vast amounts of data in a short time, allowing them to make quick and effective decisions.

3. Risk Reduction: By analyzing historical data, digital analysis helps identify trends and critical levels, reducing the likelihood of making poor investment decisions.

How Digital Analysis Works:

1. Historical Data: Historical price movement data forms the foundation for analyzing future trends. This includes opening and closing prices, highest and lowest prices, and trading volumes.

2. Mathematical Algorithms: Algorithms are used to analyze data and identify patterns that may not be visible to the naked eye. These include moving averages, linear regression, and other statistical tools.

3. Advanced Software: Specialized software is used for digital data analysis, such as Gannzilla, which is one of the leading tools in this field.

Steps to Conduct Digital Analysis in Trading:

1. Data Collection: The first step is gathering historical data for the financial markets of interest. This data can be obtained from various trading platforms.

2.Data Analysis: Using the appropriate software, the data is analyzed to identify patterns and trends. This can include determining support and resistance levels and calculating technical indicators.

3.Decision-Making: Based on the results of the analysis, traders can make informed investment decisions, such as when to enter or exit a trade.

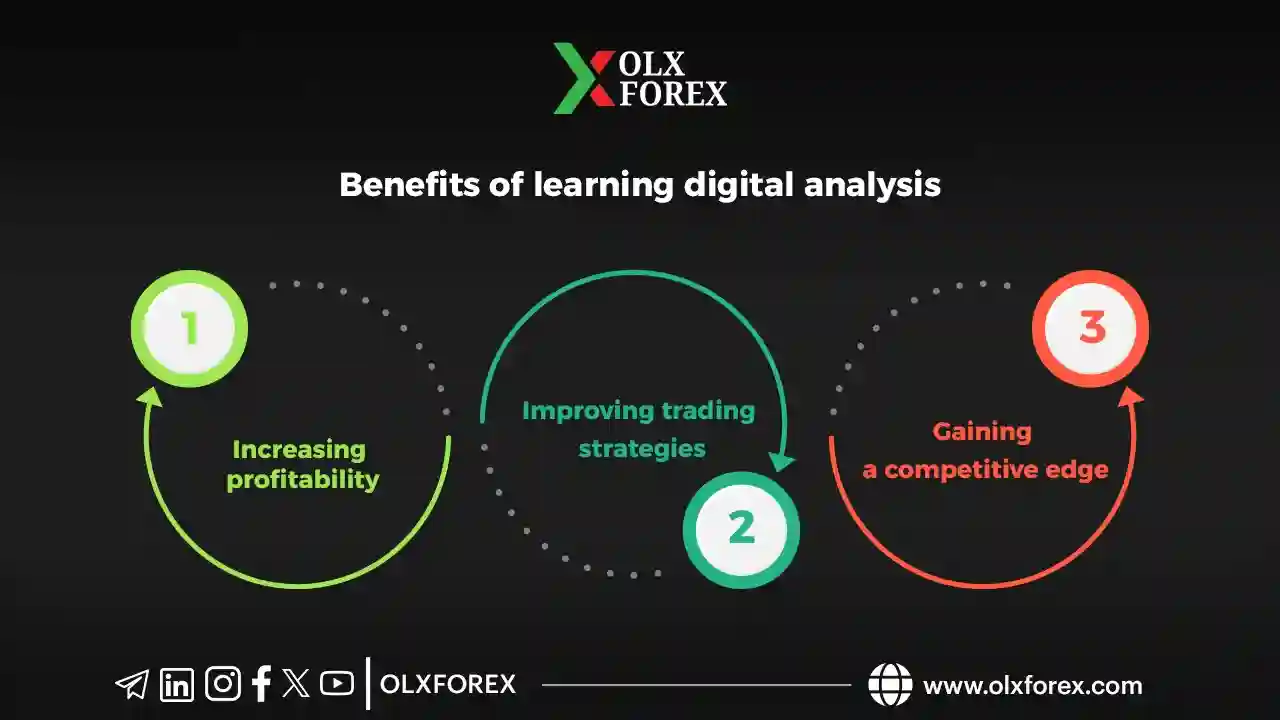

Benefits of Learning Digital Analysis:

1. Increased Profitability: By making investment decisions based on accurate data, traders can enhance their performance and increase their profits.

2. Improved Trading Strategies: Digital analysis provides traders with a deeper understanding of market movements, helping them develop more efficient trading strategies.

3. Gaining a Competitive Edge: Digital analysis is an advanced tool not used by all traders, giving those who master it a competitive advantage in financial markets.

If you're looking to develop your trading skills and increase your chances of success in financial markets, learning digital analysis is your next step. Digital analysis gives you the ability to understand markets from a new perspective and helps you make precise and effective investment decisions.

Through the "Digital Analysis" course, you'll learn how to use digital tools to analyze data and identify profitable investment opportunities.

Invest in your skills and achieve success in trading by studying "Digital Analysis" through our comprehensive course, which offers detailed training on using this advanced tool. For more information about the course, you can watch the introductory video and view the course contents here:

Related topics

Wolfy Wave in trading and how to learn it professionally

Trading strategies on the news and making a quick profit

Reflexive models and trading them and how to learn them