Forex or the stock market? A detailed comparison to help you choose the market that suits you best

The choice between currency trading (forex) and stock trading depends mainly on your risk tolerance, the time you are willing to invest, and your trading style.

First: What is each market?

Forex trading

is trading currencies against each other, for example, buying the euro against the dollar (EUR/USD), which means that you are buying the euro against the US dollar.

Stocks trading

is buying and selling shares in companies listed on global stock exchanges such as Apple or Tesla, or local stock exchanges such as CIB.

Second: The difference between Forex and stocks

Below, we will try to outline the basic differences between Forex and stocks to help you quickly understand

Which one should you choose based on your situation?

There is no one-size-fits-all option. You can determine the most suitable path for you by answering these questions:

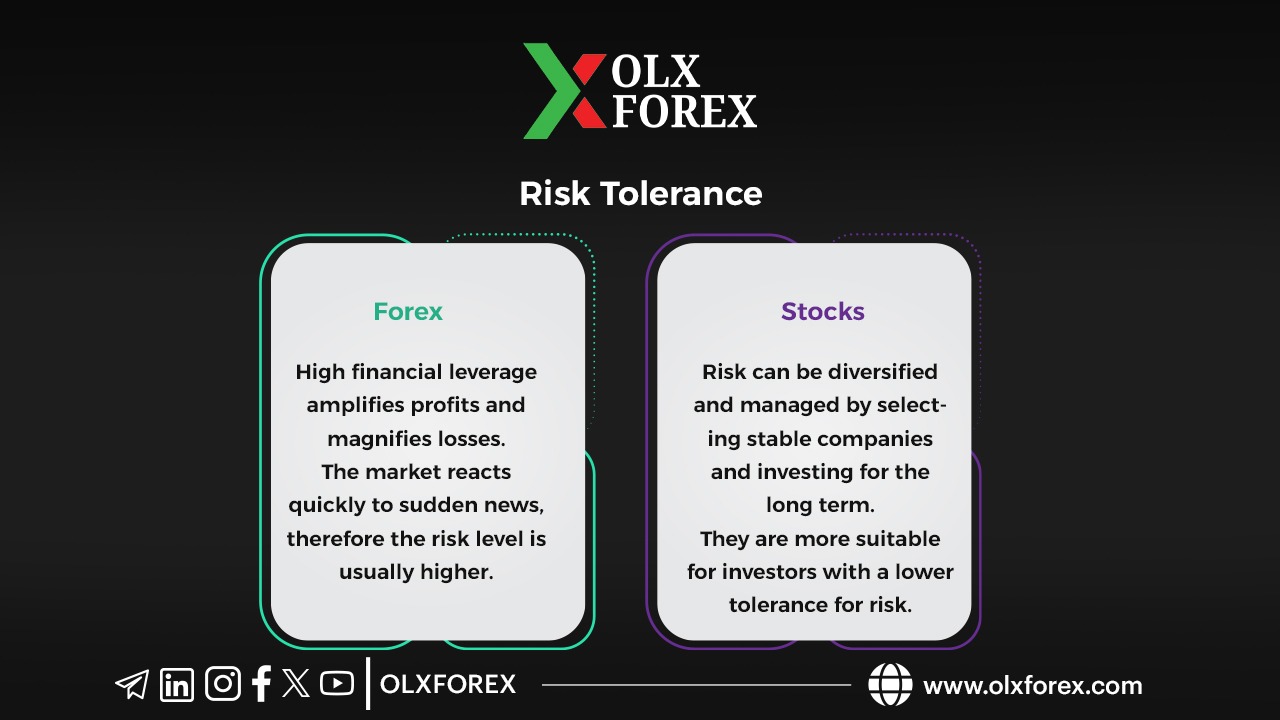

Your risk tolerance

Forex: High leverage magnifies profits and losses, and the market reacts quickly to sudden news, so the risks are usually higher.

Stocks: Risks can be diversified and managed by choosing stable companies and investing for the long term, which is more suitable for those with lower risk tolerance.

How long do you want to invest?

Forex: The market is open almost 24 hours a day, and is suitable for those who can continuously monitor the market and engage in short- and medium-term trading.

Stocks: Trading hours are more regular, and are suitable for those who cannot monitor the market throughout the day and tend to invest in the medium or long term.

What are you best at analyzing?

Forex: Requires a focus on the global economy, central bank policies, and interest rate differentials.

Stocks: Requires analysis of company earnings reports, business prospects, and competition within the sector.

How much initial capital do you have available?

Forex: The entry threshold is usually low, and high leverage allows you to control large positions with little capital.

Stocks: Especially high-priced stocks may require more capital to build a meaningful position.

What kind of return are you looking for?

Forex: The main profit comes from price differences (spreads), and is suitable for investors looking for short-term opportunities.

Stocks: Returns can come from stock price growth and corporate earnings (dividends), and are suitable for those looking for long-term capital growth and cash flow.

Important tips before you start trading

Before you start, pay attention to the following points:

- Leverage is a double-edged sword: it can amplify profits, but it also quickly amplifies losses, and should be used with a strict risk management strategy.

- Start with a demo account: Most reputable platforms offer free demo accounts. It is highly recommended to practice sufficiently and test your strategy with virtual money first.

- Continuous learning is crucial: Regardless of which market you choose, you need to set aside time to learn the basics, technical analysis, and risk management.