Best Trading Strategies Across Different Markets

There are several trading strategies that can be used across various markets, including currencies, commodities, stocks, and cryptocurrencies. Below are some of the most popular strategies:

1. Day Trading

Day trading is a trading strategy that involves opening and closing positions within the same day to take advantage of short-term market movements. Day traders rarely hold positions overnight, making their trading strategies heavily reliant on short-term price fluctuations. The most common timeframes used for day trading are the 1-hour, 30-minute, and 15-minute charts, with the 4-hour chart also being an option.

Many traders are attracted to day trading because it offers the potential to make multiple profitable trades in a single day. However, it is considered one of the most difficult forms of trading, as it requires high skill and significant experience to avoid large losses. Making frequent, quick financial decisions within short timeframes is no easy task and requires intensive training and continuous adaptation to data.

How to Create a Successful Day Trading Strategy:

Despite the challenges, day trading can be learned and practiced to master the art. Whether you're trading stocks, forex, or even cryptocurrencies, here are some key elements to consider when developing a successful day trading strategy:

Select the Right Market:

Day trading strategies can be applied in various markets, but since day trading relies on making small profits from short-term price movements, it is essential to choose markets that offer low trading costs, such as low commissions and tight spreads.

Choose the Appropriate Timeframe:

The choice of timeframe depends on how much time you can dedicate to monitoring the market. You should pick timeframes that allow you to effectively track market movements, whether it’s shorter timeframes like 15 minutes or longer ones like 4 hours.

Use the Right Tools for Entry and Exit:

There are many technical indicators that can help in day trading, such as moving averages, Relative Strength Index (RSI), MACD, and Stochastic Oscillator.

Risk Management and Position Sizing:

Risk management is crucial in day trading. Always define the risk for each trade in advance (it is recommended not to risk more than 1% of your capital per trade) to avoid large losses that could hinder your continuity in the market, especially if you face a series of losing trades.

2. Swing Trading

Swing trading is a strategy that involves buying and selling financial instruments to hold them for a period ranging from a few days to several weeks, and sometimes up to a month. Swing traders are also known as trend traders because their decisions are often based on daily charts.

Some swing trading strategies are primarily based on technical analysis of price charts to determine entry and exit points. Additionally, integrating fundamental analysis or using multi-timeframe analysis can provide a more comprehensive view to help traders make informed decisions and hold positions for a longer period.

Swing trading is one of the most active trading strategies.

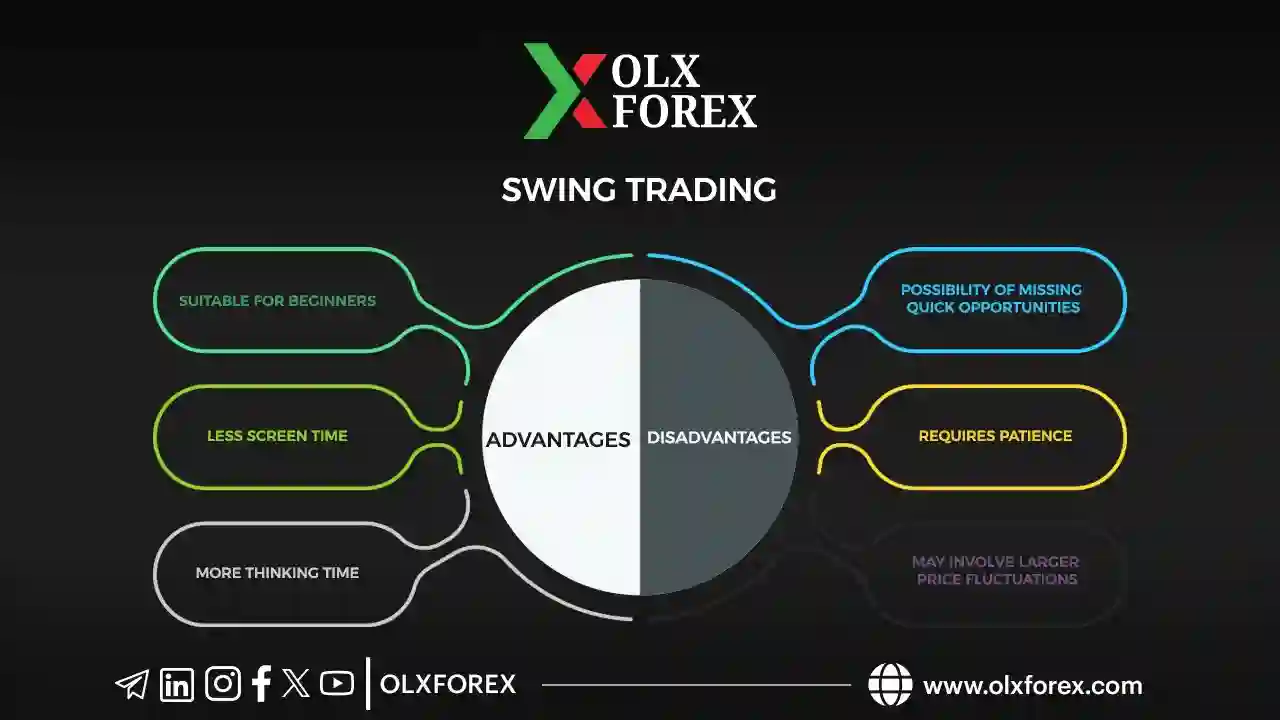

Benefits of Swing Trading:

Perfect for beginner traders.

Does not require being in front of the screen for long periods, allowing you to manage trades without fatigue.

Offers more time for thoughtful decision-making without the rush, unlike day trading, which demands quick thinking and decision-making.

3. Investment Trading Strategies

Investment trading is a long-term strategy where assets are bought with the intention of holding them for an extended period to benefit from market fluctuations. This strategy is typically used in long-term investment portfolios, where entry into the market is not as time-sensitive.

Investment trading primarily relies on fundamental analysis and does not require constant monitoring of the portfolio. Since the trader aims to hold positions for extended periods, it’s common to experience several small losing trades before achieving a significant profitable trade that compensates for losses and generates substantial returns.

For example, buying and holding cryptocurrencies like Bitcoin is a good example due to the significant growth potential of these assets. Likewise, purchasing stocks from companies that show strong growth potential, like tech companies, aims to generate long-term profits. It could also involve investing in stocks traded at low prices compared to their intrinsic value, where investors look for companies undergoing positive transformations after periods of mismanagement or negative news.

4. Scalping

Scalping is a fast-paced trading method that aims to exploit small price changes to make quick, frequent profits. Trades typically last from a few seconds to a few minutes, with multiple positions being opened and closed rapidly.

Scalping is done using very short timeframes, ranging from seconds to minutes, making it one of the fastest and most intensive trading strategies.

Scalping can be applied in several financial markets:

Cryptocurrencies: Trading on assets like Bitcoin.

Stocks: Trading stocks with small price fluctuations.

Forex: Trading currency pairs with low spreads or commissions for maximum profit.

5. Automated Trading Strategies

Automated trading, also known as algorithmic trading or quantitative trading, involves using computer programs to enter and exit trades based on a set of pre-programmed rules called "Expert Advisors" (EAs). Most automated trading strategies exploit small price movements in a high-frequency manner after analyzing data based on the programmed strategy.

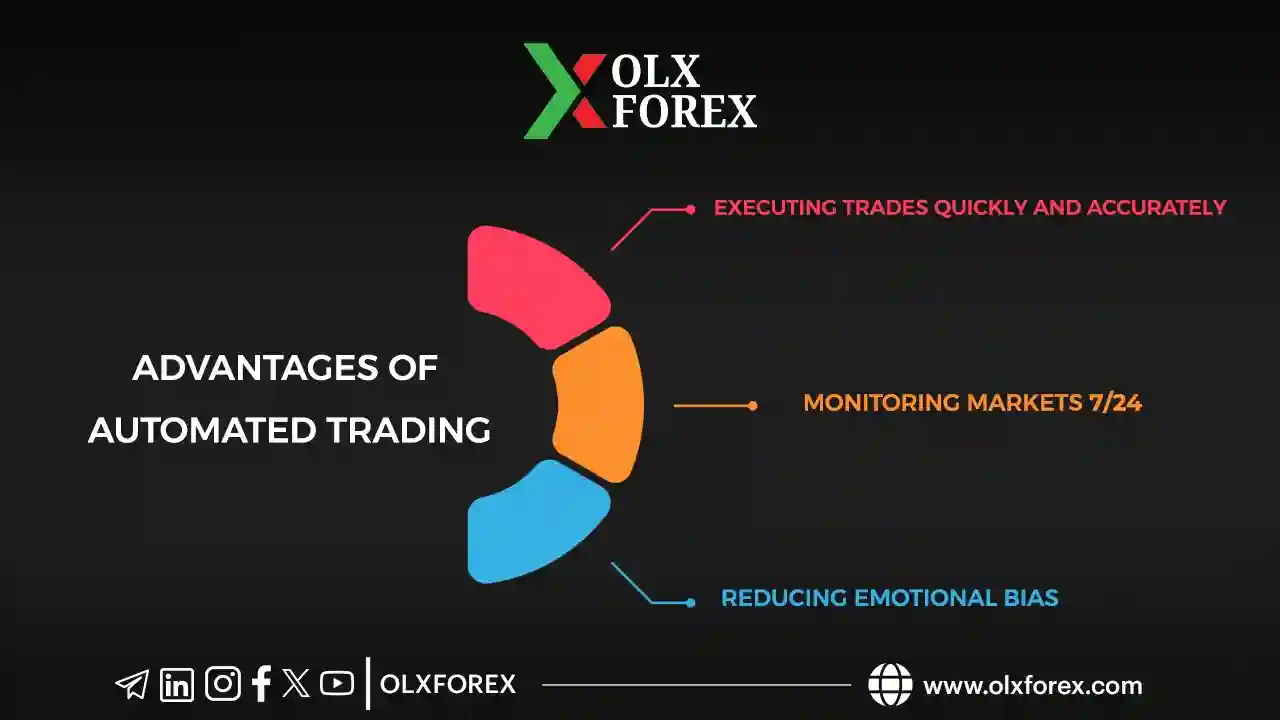

Benefits of Automated Trading:

Helps monitor the markets 24/7.

Allows for fast and highly accurate trade executions.

Reduces emotional bias when making trading decisions.

Although there are many failed strategies, combining algorithms with human analysis can yield optimal results.

Conclusion:

Each of these strategies offers a unique approach to trading, depending on your goals, risk tolerance, and market knowledge. Whether you’re a beginner or an experienced trader, it's important to choose the strategy that best fits your trading style. For tested strategies, both paid and free, you can visit the link below to get more strategies and insights:

Click here for trading strategies