Mastering Trading with the Wyckoff Method: Your Path to Success in Financial Markets

If you want to gain a deep understanding of the financial markets and implement precise entry strategies in the world of trading, the Wyckoff Method is one of the most important analytical frameworks that helps traders grasp market dynamics and make informed investment decisions. If you’re looking for tools to read the market accurately and achieve success, the OLX Forex course specialized in the Wyckoff Method is your best choice.

What is the Wyckoff Method?

The Wyckoff Method is a trading and market analysis methodology developed by the renowned analyst Richard Wyckoff in the early 20th century. This method focuses on studying price movements and trading volume to understand the behavior of major players (such as institutions and banks) and predict future market movements.

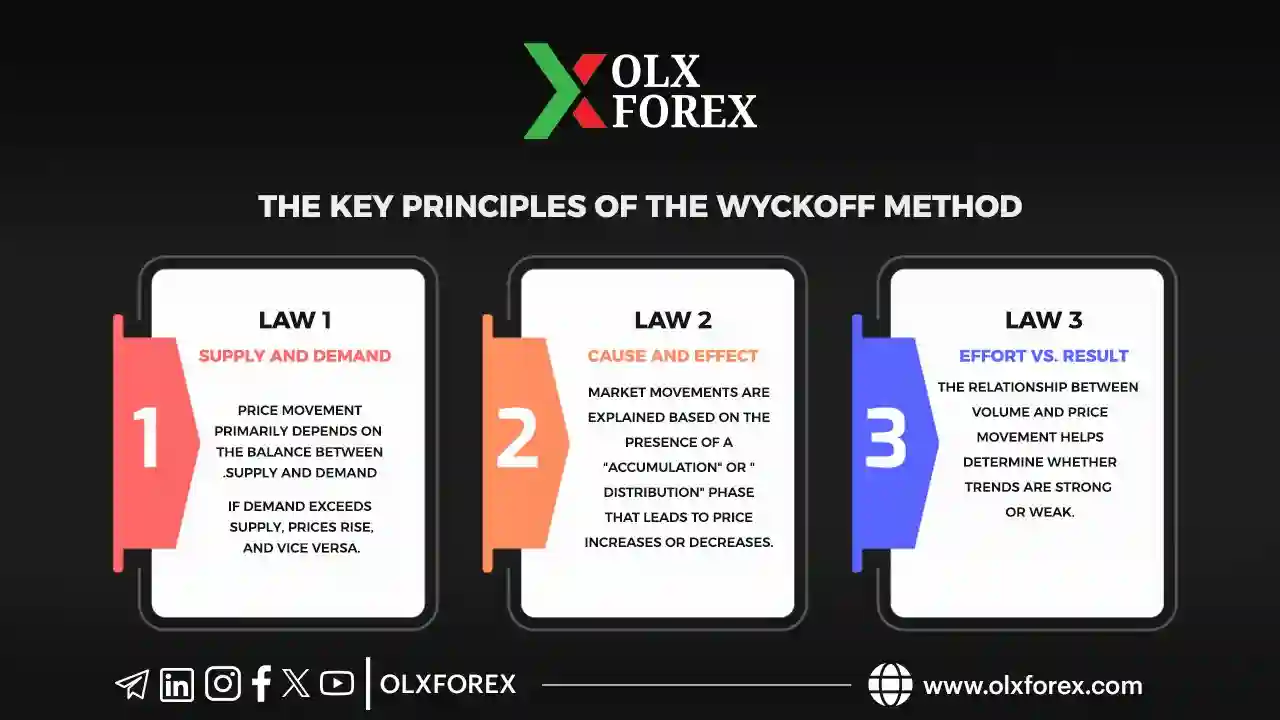

Key Principles of the Wyckoff Method:

The First Law :

Supply and Demand Price movement is primarily driven by the balance between supply and demand. If demand exceeds supply, prices rise, and the opposite is true when supply exceeds demand.

The Second Law :

Cause and Effect Market movements can be interpreted based on the existence of a “Accumulation” or “Distribution” phase that leads to price increases or decreases.

The Third Law :

Effort vs. Result The relationship between trading volume and price movement helps determine whether trends are strong or weak.

The Five Phases of the Market:

Accumulation: The beginning of an uptrend.

Markup: A significant rise in prices.

Distribution: Gradual selling of assets in preparation for a price drop.

Markdown: A decline in prices.

Re-Accumulation/Distribution: Sideways movements leading to a new trend.

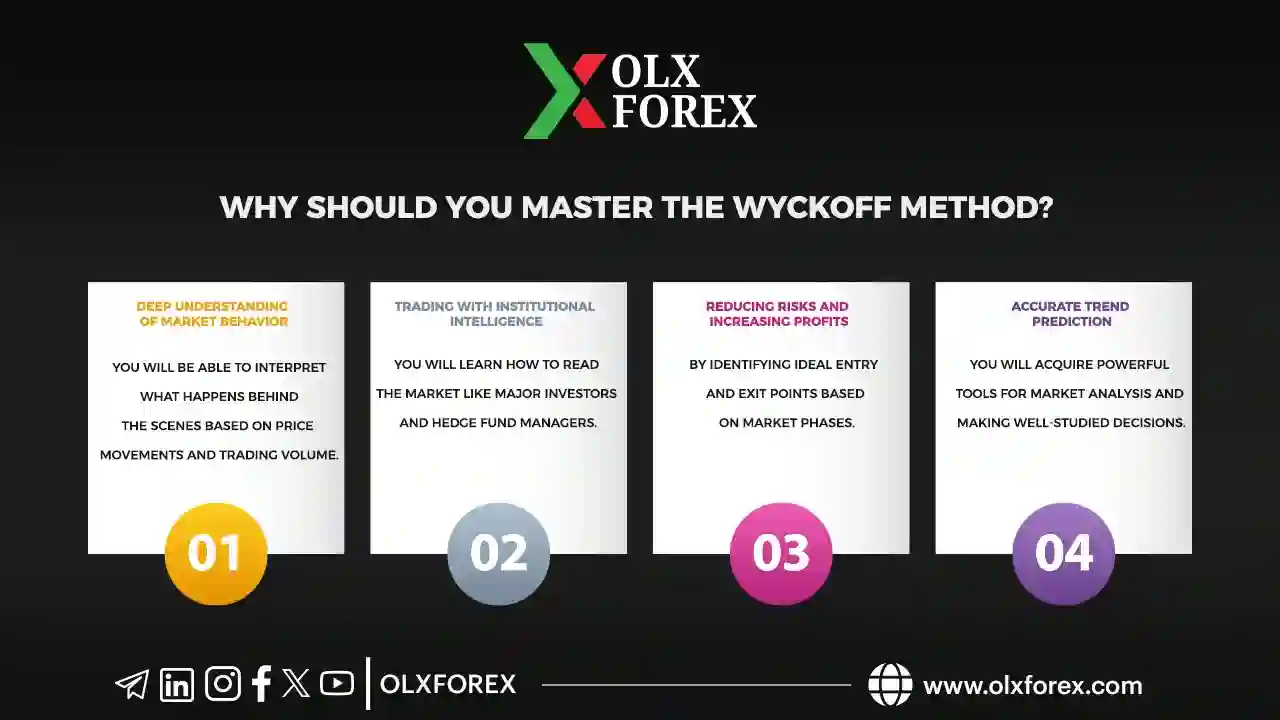

Why Should You Master the Wyckoff Method?

Deep Understanding of Market Behavior

You will learn to interpret what’s happening behind the scenes based on price movements and trading volume.

Trading Like Institutions

You will learn how to read the market as large investors and hedge funds do.

Risk Reduction and Profit Maximization

By identifying ideal entry and exit points based on market phases, you can minimize risks and maximize potential profits.

Accurate Trend Prediction

You will gain powerful tools for market analysis, enabling you to make well-informed decisions.

What Does the OLX Forex Course Offer?

Comprehensive Explanation of the Wyckoff Method

You will learn all the foundational principles of the Wyckoff Method and how to apply them in financial markets.

Practical Tools for Application

Hands-on training on how to identify market phases, accumulation, and distribution on charts.

Professional Trading Plans

Learn how to develop trading strategies based on Wyckoff’s principles to achieve consistent results.

Direct Support from the Instructor

You can ask questions and get clarification on your application of the course material, ensuring that you fully understand the concepts.

Benefits of the Wyckoff Method Course:

A comprehensive understanding of market structure.

Enhanced ability to accurately identify entry and exit zones.

Learn trading secrets as seen by professionals.

Trading strategies applicable across all types of markets (stocks, forex, cryptocurrencies).

Your Future in Trading Starts Here!

If you're serious about developing your skills and gaining a deep understanding of the markets, don’t miss the opportunity to join this comprehensive course. Discover the secrets to success with the Wyckoff Method and start your journey towards professional trading today.