How to Profit from Financial Markets?

This question often arises in the minds of investors looking to enter financial markets, especially in forex or currency trading. It is known that trading in this field is relatively easy, as it does not require a large capital unlike other markets. You can start investing in currency trading with a very small capital, even less than $100.

Here are some key factors that can help you profit from financial markets:

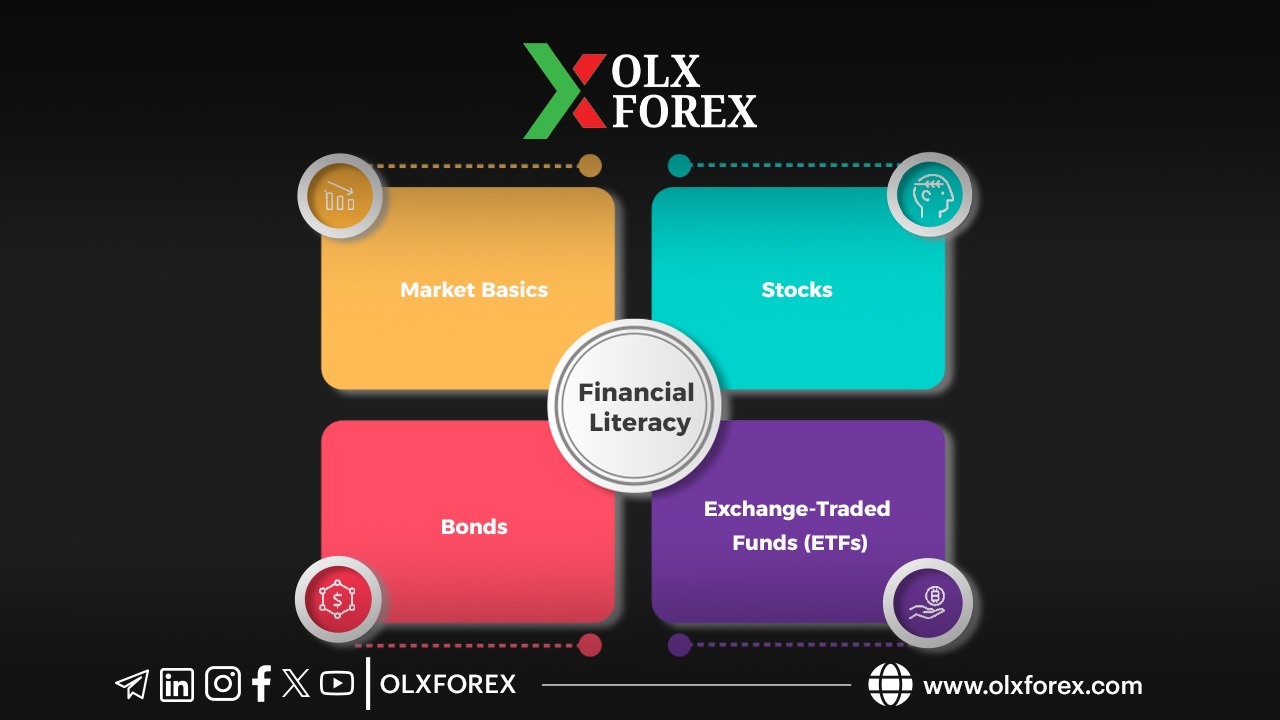

Education and Knowledge:

Start by learning and understanding the fundamentals of financial markets, such as stocks, bonds, and exchange-traded funds.

Experience:

Experienced traders with a good understanding of the market and trading strategies may achieve higher profits. On the other hand, inexperienced traders may find it difficult to achieve sustainable profits or even any profits at all. To avoid this, spend time learning and training to build your own strategy until you gain experience and can profit from financial markets sustainably.

Capital Size:

Traders with larger amounts can potentially achieve higher profits compared to those trading smaller amounts, as they can better withstand volatility and use leverage more effectively. However, this also depends on your market experience and the learning period you initially spent. Thus, having a large capital means nothing if you trade without knowledge, resulting in losses regardless of the amount.

Choosing a Broker:

Always look for a licensed and reputable broker. The broker should provide user-friendly trading platforms, customer support, and the ability to conduct technical and fundamental analysis. Make sure to understand the types of accounts available and trading conditions such as spreads and margins.

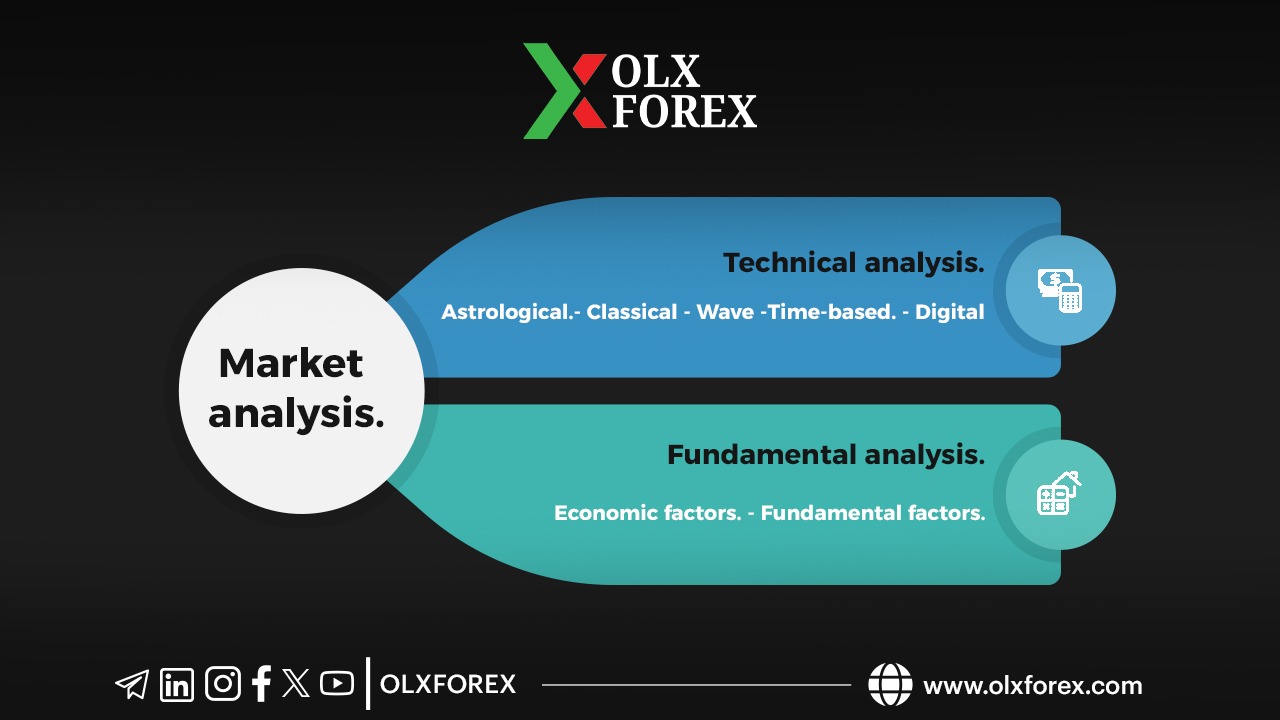

Market Analysis:

Analysis is divided into technical analysis and fundamental analysis. Technical analysis relies on studying charts and historical patterns to predict future price movements, encompassing various schools of thought (classical, wave, time, numerical, astronomical). Fundamental analysis considers economic and political factors that affect currency prices, such as central bank decisions, interest rates, employment data, and inflation.

Trading Strategy:

Different trading strategies yield different levels of profit. You need to determine whether you are a long-term trader willing to wait for long periods and endure market fluctuations, or a short-term trader who closes positions before the trading day ends. Once you settle on your trading style, you can develop your strategy based on your market experience.

Risk Management:

Traders who follow strict risk management policies can maintain capital and achieve sustainable profits. Failing to manage risks can lead to significant losses. While profits may not be large, preserving your capital and achieving modest, sustainable monthly profits is the true success in forex markets. Always determine how much money you are willing to risk on each trade and use stop-loss orders to limit losses if the market moves against you. Set a risk-to-reward ratio for each trade to ensure potential profits outweigh possible losses.

Psychology:

A trader's psychology is one of the most critical factors influencing their trading. It is often said, "Do not trade with money you do not have." This means that any investment should come from your own funds, not borrowed from anyone or any institution. Preferably, these funds should be surplus to your needs, so you can trade comfortably and maintain a balanced mindset without stress. This way, you can patiently wait for profits and cut losses without fear.

It is also important to remember that trading in financial markets can lead to significant losses, so risk management and your mental state are key to success in this challenging market.

You can read more important ⬅️ articles here ➡️ before you start taking any steps you will find everything that goes on in your mind.