A technical analysis of silver, outlining expected long-term price movements.

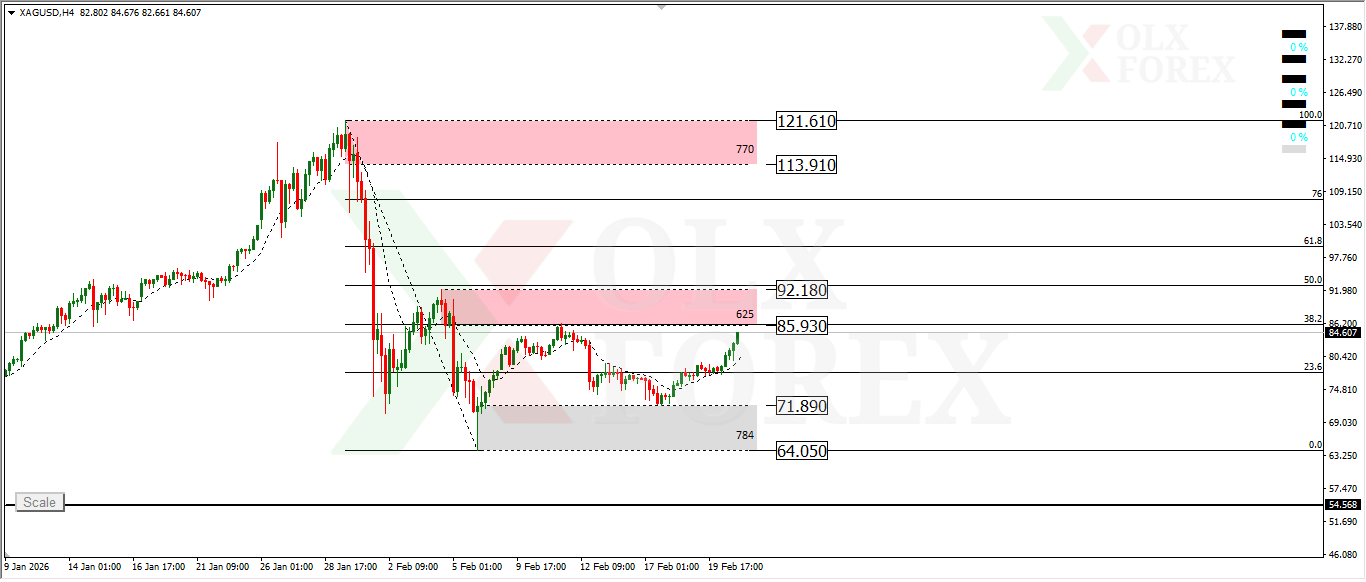

Silver retreated after its strong rally and record highs near $121.611, experiencing a sharp corrective move that targeted the $64.05 level.

Currently, silver is moving sideways on the 4-hour timeframe, confined between supply and demand zones, as illustrated in the chart.

Expected Scenarios

Buy Scenario

Currently, as we can see, silver is facing very strong supply levels around $85.93. These levels have broken through strong support levels and coincide with the 38% and 50% Fibonacci retracement levels, representing a resistance barrier to a renewed upward move in silver.

Certainly, if these strong zones are broken and closed above them, and also above the 50% Fibonacci retracement level, this will allow silver to resume its upward movement. This presents a buying opportunity targeting the 61% and 76% Fibonacci levels, and the rally could extend to 113.91 as the final target for the upward movement, which represents key supply zones near historical silver levels.

Another buying opportunity can be found in the demand zones below, near 71.89, which represents the lower boundary of the sideways movement. Strong buy signals could push silver higher again.

Selling Scenario

On the other hand, we also have a potential selling scenario for silver. This scenario hinges on a bounce from the supply zone near the $85.93 level, which, as mentioned, coincides with the 38% and 50% Fibonacci retracement levels. These are considered very strong areas, and if sell signals emerge, we will have a strong selling opportunity targeting the demand zones below, near the $71.89 level.

Another selling opportunity arises if the price breaks below the buying demand zones and closes below them with a strong 4-hour candle. In this case, we can consider selling on any corrective upward movement to target the next support zones near the $54.56 level, which is a significant level for silver.

In any case, please pay close attention to money management, monitor silver's price movements, and avoid rushing into any trades.