Liquidity in the Forex Market

Liquidity is one of the fundamental concepts that directly affect price movement and trade execution.

Definition of Liquidity in Forex:

Liquidity refers to how easily a financial asset can be bought or sold without causing a significant change in its price. The higher the liquidity, the faster and more efficient trade execution becomes, with minimal price differences (spreads).

The Forex market is considered one of the most liquid markets globally, with a daily trading volume exceeding 7 trillion dollars.

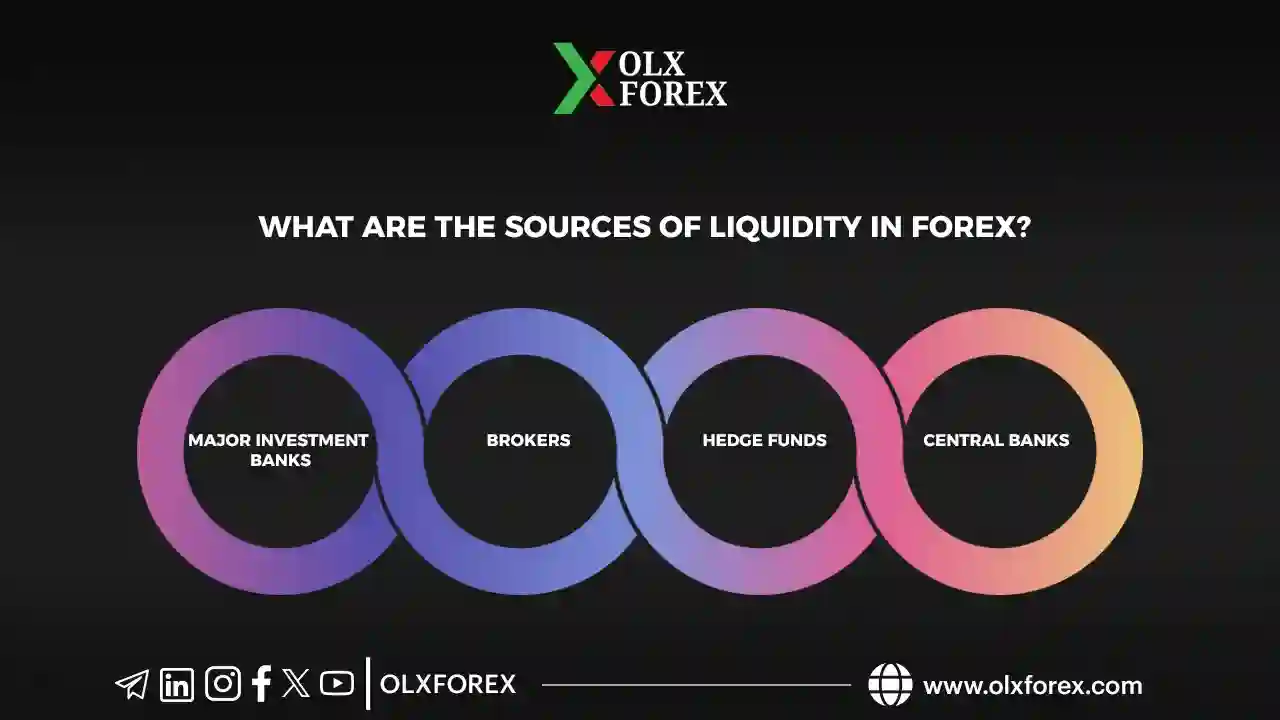

What Are the Sources of Liquidity in Forex?

Liquidity in the Forex market comes from several key sources:

1. Major Investment Banks:

• These banks provide liquidity through the Interbank Market, facilitating transactions between banks.

2. Brokers:

• Known as “brokers,” some connect their clients directly to the market, while others act as Market Makers, creating their own liquidity.

3. Hedge Funds:

• Managers of these funds trade large amounts, significantly impacting market liquidity.

4. Central Banks:

• These institutions sometimes intervene to regulate the liquidity of the local currency.

What Are the Most Liquid Currency Pairs?

Major pairs (Majors) have the highest liquidity due to their high trading volume, resulting in lower spreads. Examples include:

• EUR/USD (Euro/US Dollar)

• GBP/USD (British Pound/US Dollar)

• USD/JPY (US Dollar/Japanese Yen)

Minor pairs (Minors), such as EUR/CHF (Euro/Swiss Franc) or AUD/NZD (Australian Dollar/New Zealand Dollar), and Exotic pairs like USD/TRY (US Dollar/Turkish Lira), have lower liquidity and therefore higher spreads.

High and Low Liquidity Times:

High Liquidity Times:

• London + New York Overlap:

• From 1 PM to 5 PM GMT, the highest liquidity period during the trading day.

• Tokyo + London Overlap:

• From 7 AM to 9 AM GMT.

Low Liquidity Times:

• End of the week: During market closures.

• Major holidays.

• Outside main trading sessions: Such as midnight GMT.

Risks of Low Liquidity:

• Slippage: Price changes while executing orders.

• Widened Spreads: Especially during news events or off-peak hours.

• Difficulty in Closing Large Trades: Challenges in exiting large positions without incurring losses.

Tips for Managing Liquidity in Forex:

• Trade during peak hours: Especially during the London and New York sessions.

• Focus on highly liquid pairs: Like the major pairs if you prefer fast execution and lower costs.

• Avoid trading during news events: If unprepared for volatility.

• Avoid trading during low liquidity times: To reduce exposure to sudden price movements.

In Conclusion:

Liquidity is a crucial factor in your success in Forex trading. Understanding it helps you choose the right times and pairs to trade, minimizing unnecessary risks. Always focus on trading during high-liquidity times and with high-liquidity assets to achieve the best results.

Understanding liquidity isn't just a piece of information; it's a skill that distinguishes professionals from beginners.

Use what you've learned and start analyzing the market with fresh eyes. If you need a team of OLX Forex professionals at any time,you can contact them here as soon as possible.